Bitcoin’s long-running debate over anonymity erupted again after a prominent privacy advocate disclosed an unexpected disagreement with one of the sector’s most influential figures.

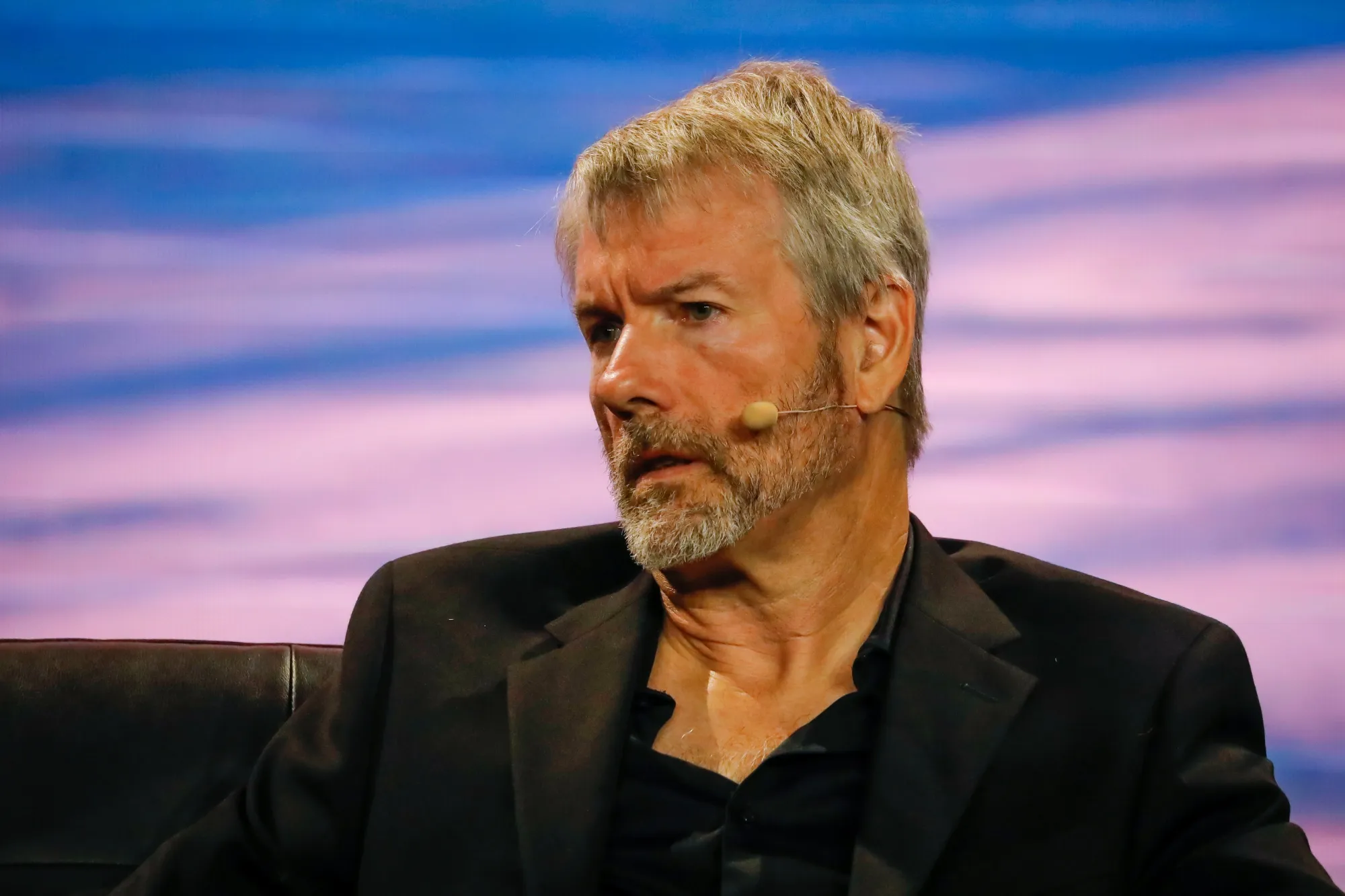

According to Zcash co-founder Eli Ben-Sasson, a private discussion with Strategy’s Michael Saylor revealed deep philosophical differences about where crypto should go next. Saylor, whose firm sits on the world’s largest corporate Bitcoin treasury, reportedly argued that Bitcoin should not pursue full financial opacity, warning that excessive privacy could provoke governments into suffocating the asset.

Key Takeaways

Saylor opposes Zcash-style privacy for Bitcoin, warning it could trigger government crackdowns.

Privacy advocates argue selective encryption is essential as adoption grows and surveillance risks rise.

Demand for confidential transactions is increasing, with networks like Solana and XRP Ledger already integrating privacy features.

Ben-Sasson says the disagreement isn’t about whether privacy matters — but about how it can be implemented. He claims cryptographic tools allow Bitcoin to provide shielding while still offering compliance mechanisms such as selective disclosure, meaning the network doesn’t have to choose between transparency and self-sovereignty.

Rising Interest in Privacy Coins Suggests the Argument Isn’t Going Away

The exchange resurfaced just as major figures in finance and crypto begin to browse outside Bitcoin for stronger privacy guarantees. VanEck chief Jan van Eck recently remarked that early Bitcoin believers are turning their gaze toward Zcash because of mounting concerns over transaction traceability and future quantum threats.

Arthur Hayes, co-founder of BitMEX, cast an even brighter spotlight on the debate, calling Zcash “Bitcoin with full privacy” and speculating that its value could reach up to one-fifth of Bitcoin’s market cap if privacy becomes a dominant market narrative.

That shift in sentiment is already creeping into institutions. Grayscale, one of the world’s largest digital asset managers, highlighted Zcash’s roots in Bitcoin’s code but with encryption that obscures amounts and participants. Its recent filing for a spot ZEC ETF has accelerated attention toward the asset and revived scrutiny over whether Bitcoin’s transparency model remains sustainable.

Privacy Advocates Warn That Bitcoin’s Openness Could Backfire

For privacy campaigner Mert, the pushback to Saylor’s position was immediate. He framed the debate in broader terms: society encrypts almost everything — personal messages, cloud files, photos — yet suddenly money is treated differently, and that inconsistency could expose users to state overreach.

Mert argues that the cypherpunk ethos behind Bitcoin risks being forgotten as adoption grows. Public blockchains, he says, unintentionally turn spending habits into evidence trails. As more institutions wake up to this problem, demand for stealth features is rising: Solana has rolled out confidential transfers at the request of enterprise users, while Ripple has been designing privacy add-ons for the XRP Ledger.

The debate is also widening beyond crypto. Europe’s early experiments with central bank digital currencies include proposals for spending limits — precisely the kind of system privacy developers warn against. Mert believes that tighter controls are almost inevitable, and that the next generation of cryptocurrencies must be ready to prevent financial surveillance.

Whether Bitcoin evolves to meet that demand or cedes the role to privacy-enhanced competitors remains one of the most consequential ideological battles the crypto space faces today.