The search for the best altcoins to buy now is intensifying as top-tier coins like Ethereum and Polkadot continue to lose ground in today’s trading session. With Ethereum sliding below $3,150 and Polkadot under $2.30, the broader altcoin market is flashing red.

Meanwhile, presale-stage tokens such as Bitcoin Hyper and Maxi Doge are attracting new capital at a rapid pace, positioning themselves as breakout opportunities with real-time price momentum and visible upside catalysts.

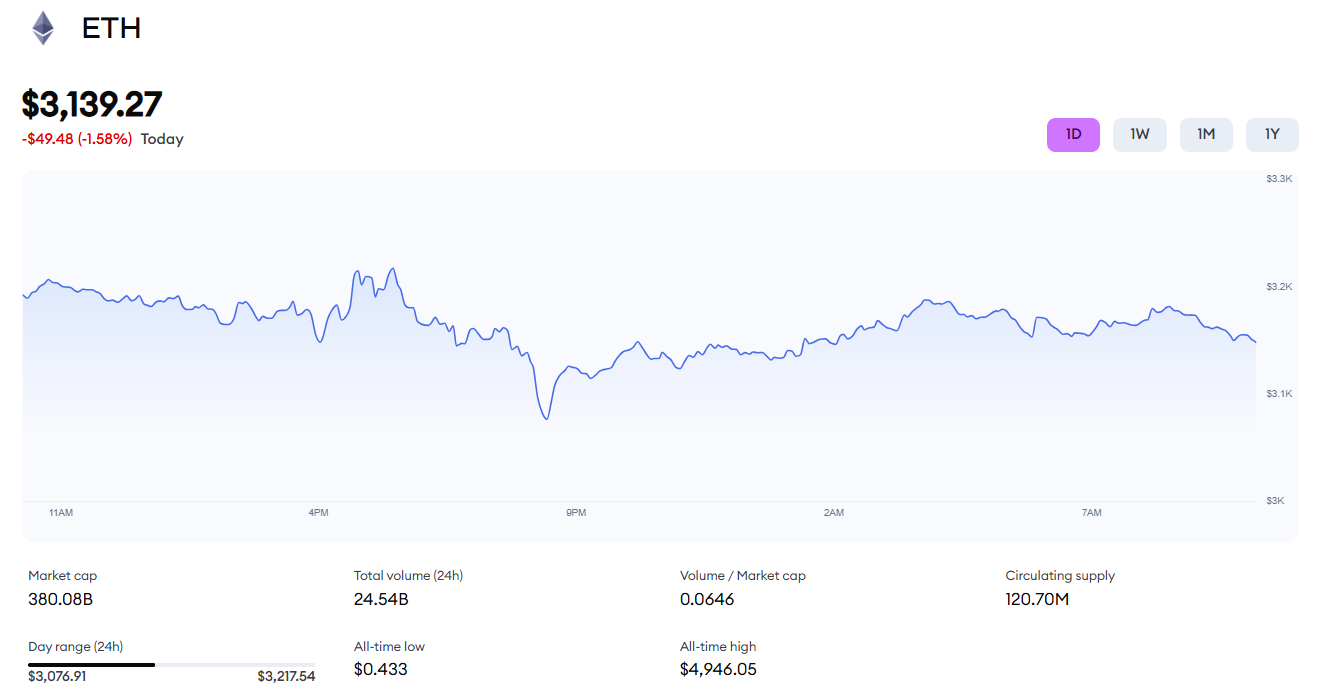

Ethereum Stalls at $3,143 as Daily Volume Drops by Nearly 24%

Ethereum (ETH) is now trading at $3,143.01, down 1.64% in the past 24 hours, according to the latest market snapshot. The sharpest signal of weakness isn’t just the price decline, but the drop in daily trading volume – down 23.95% to $23.91 billion.

Ethereum’s market cap currently sits at $379.34 billion, and its fully diluted valuation (FDV) is just slightly above that at $379.99 billion, indicating no immediate growth premium priced in.

From a supply perspective, ETH remains stable. The total supply and circulating supply are identical at 120.69 million ETH, with no inflationary triggers or deflationary burns currently active on-chain.

The Volume-to-Market Cap ratio is now just 6.21%, showing a moderate level of market activity but certainly not a signal of breakout momentum.

Traders are watching closely to see if Ethereum can reclaim any of its recent highs, but the absence of clear catalysts has left ETH range-bound.

Polkadot Falls Below $2.30 as Speculative Capital Exits

Polkadot (DOT) is now trading at $2.26, reflecting a 3.48% drop in the past 24 hours. Market capitalization is down to $3.71 billion, and the FDV sits just above at $3.71 billion, showing little differentiation between circulating and unlocked supply.

Today’s volume has also contracted significantly, with a 19.75% decline down to $155.43 million. The Vol/Mkt Cap ratio sits at 4.18%, which is notably lower than Ethereum’s.

Polkadot’s total and circulating supply are both at 1.64 billion DOT, with no upcoming halving events or network burns to alter the tokenomics in the short term.

The price compression and lack of trading activity highlight the challenge many Layer-1 protocols are facing in Q4 – namely, holding investor attention in a presale-heavy market cycle.

With no strong retail narrative and limited upside movement, Polkadot appears vulnerable to further consolidation.

Bitcoin Hyper Builds Massive Traction as $29M Target Gets Hit

In sharp contrast to the cooling metrics of Ethereum and Polkadot, Bitcoin Hyper ($HYPER) is experiencing a surge in buyer activity.

The presale dashboard shows $29,032,662.90 raised out of a $29,346,698.75 cap – meaning over 99% of the current stage has already sold out. With the price currently at $0.013375 per HYPER, a timer shows just 9 hours left until the next price increase.

The token’s interface supports crypto, SOL, and card payments, signaling strong UX focus and mainstream accessibility.

What’s driving the urgency is the visible countdown and capped raise limit. Investors know that once the target is hit, the price rises automatically – creating a built-in demand surge for those tracking the best altcoins to buy now before they become overbought.

With nearly $30 million already committed and the price locked to increase in hours, Bitcoin Hyper is now positioning itself as a top short-term speculative play.