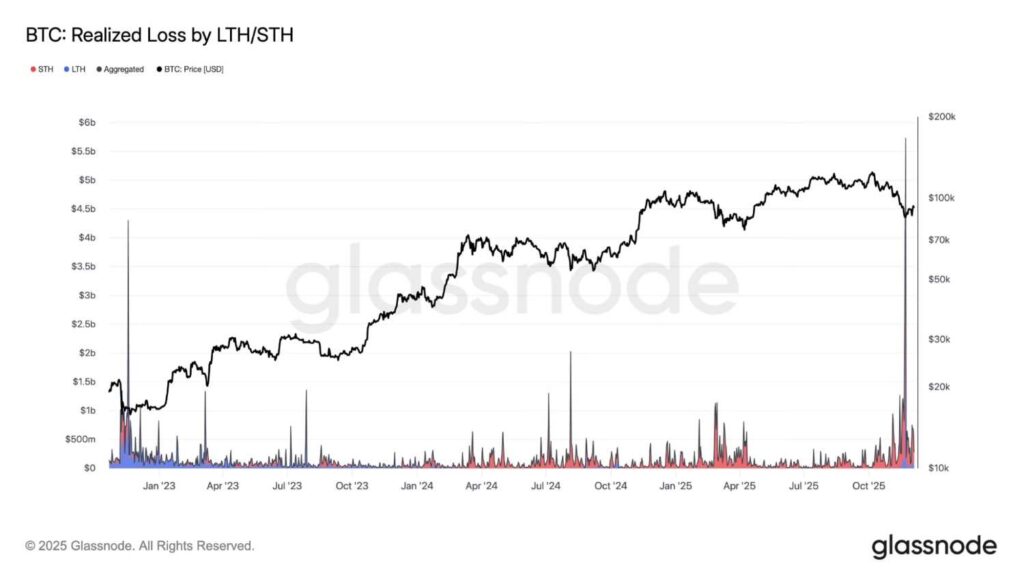

Bitcoin’s weekly slide has escalated into a deeper stress signal, with blockchain data revealing that realized losses have spiked to levels not seen since the aftermath of the FTX disaster.

This time, however, the selling seems to be concentrated in a much narrower cohort — traders who chased recent highs and are now being forced out of positions.

Key Takeaways

Bitcoin’s realized losses are at their highest since the FTX wipeout.

Short-term traders are capitulating, while long-term holders remain stable.

BTC is moving closely with tech equities, with a 0.82 Nasdaq correlation.

Bitcoin ETFs are seeing deep withdrawals — nearly $3 billion over 30 days.

The market turbulence has stirred memories of late 2022, when the collapse of FTX triggered one of the fastest evaporations of value in crypto history.

Back then, more than $100 billion vanished in a single day, as the exposure of Alameda Research’s shaky balance sheet and Binance’s decision to exit its FTT holdings sent Sam Bankman-Fried’s token — and confidence — plummeting.

Today’s losses are not tied to a single scandal, but the magnitude of realized pain rivals that moment, according to data reviewed via Glassnode.

Macro Tensions Are Amplifying the Damage

Bitcoin’s weakness is being intensified by an unfriendly macro backdrop rather than purely crypto-driven news.

Labor numbers showing unexpectedly strong employment — jobless claims falling to multi-year lows — are pressuring risk assets by suggesting rate cuts may not arrive quickly.

The market’s sensitivity to this shift is stark: Bitcoin is moving almost in lockstep with tech equities, posting a 0.82 correlation with the Nasdaq, making it highly vulnerable whenever sentiment deteriorates.

Traders now await fresh Core PCE inflation readings, aware that a disappointing print could push rate relief further away and extend Bitcoin’s downturn.

BTC trades around $90,750, sliding more than 2% over the day.

ETF Interest Is Drying Up Fast

Where institutional flows once acted as a stabilizing force, they are now turning into an additional drag.

U.S. spot ETFs collectively saw $196 million in net withdrawals on December 5 — their worst outflow streak in two weeks.

BlackRock’s flagship product, which had previously dominated inflows, shed $114.7 million, followed by $54.2 million exiting Fidelity’s fund, while VanEck recorded $14.3 million in selling.

Across the rolling week, funds are $73 million in the red, and over a 30-day window, ETF investors have yanked nearly $2.9 billion from Bitcoin exposure, according to HeyApollo data.

What Makes This Drawdown Different?

Long-term holders appear remarkably calm; their entry prices are so low that this correction barely registers for them.

The stress is primarily visible among newer market participants — the same group most likely to capitulate when volatility accelerates.

That divergence, alongside weakening ETF flows and heightened macro sensitivity, paints a picture of a market under pressure but not universally panicked.