KEY TAKEAWAYS

AVNT bounced 15%, signaling rising bullish sentiment after its post-launch dip.

Positive AO and CMF confirm growing buyer control and strong accumulation.

A breakout above $0.82 could lift AVNT’s price toward $1.15 in the short term.

Avantis (AVNT) made a striking market entrance, quickly surging in price and capturing the market’s attention some weeks back.

In the days following its launch on major exchanges, the token soared to an all-time high of $2.68.

After the initial spike, the Avantis token faced a pullback as early holders took profits and trading interest waned, resulting in a short-term dip.

However, over the past 24 hours, the token has rebounded roughly 15%, reflecting rising bullish sentiment.

Is AVNT gearing up for another rally? The current technical setup seems to suggest so.

Avantis Finds Its Footing

On the 4-hour chart, the Awesome Oscillator (AO) reads 0.0929, displaying deep green histogram bars that signal strengthening bullish momentum.

Buyers appear to be regaining control, with upward momentum accelerating after the Avantis token faced a consolidation phase.

At the same time, the Chaikin Money Flow (CMF) stands at 0.05, showing that capital inflows outweigh outflows. This trend points to growing investor optimism, as accumulation dominates selling pressure.

A confirmed break above the $0.96 to $1.00 zone could validate a bullish continuation.

AVNT Price Outlook: Bullish

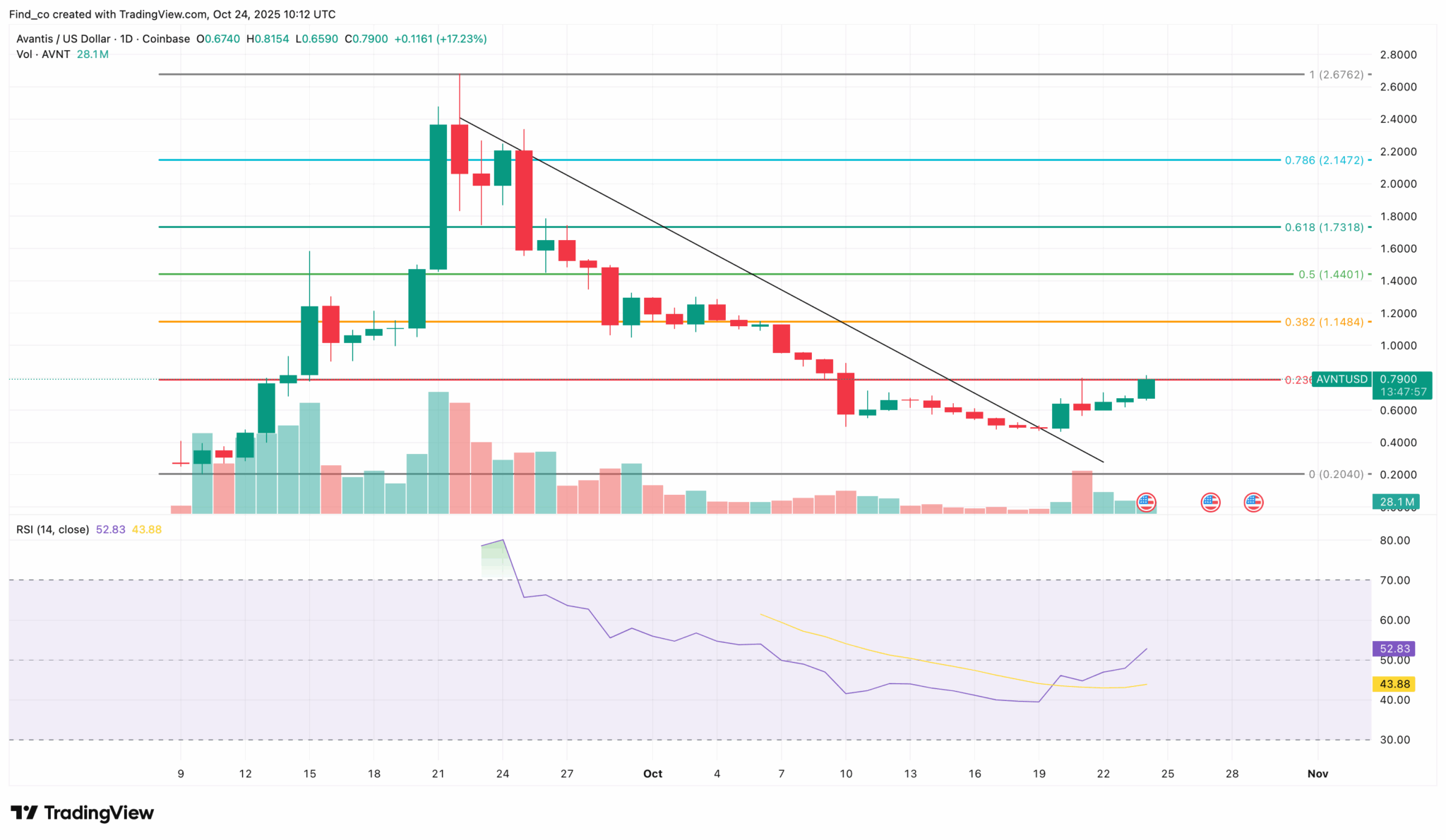

On the daily chart, AVNT’s Relative Strength Index (RSI) is 52.83 and trending upward, signaling buyers are gradually taking command.

This upward movement hints that AVNT’s price may be entering the early phase of another rally, with the potential to test key resistance zones.

The Bull Bear Power (BBP) indicator reinforces this outlook. It has begun printing green bars at 0.12 within the positive range, suggesting bullish momentum is steadily overpowering bearish pressure.

Further examination of the price action supports this thesis. For instance, AVNT’s price continues to form higher lows, indicating growing buyer interest.

This contradicts the Avantis token price performance when it declined from $2.36 on Sept. 22.

Also, AVNT’s price has broken above the key resistance line that has kept it trapped for weeks.

Although the token currently trades around $0.70, sustained momentum could push it toward the $1 mark.

A deeper look at the Fibonacci retracement levels outlines AVNT’s price outlook.

The token is trending upward, hovering near the 0.236 Fib level at $0.79. A move above the $0.82 resistance could drive AVNT toward the 0.382 Fib level around $1.15, signaling a strong uptrend continuation.

On the other hand, failure to hold support at this critical zone may trigger a trend reversal, sending the token back toward the Fib level at $0.21.

At the same time, traders need to watch out for the short-term movement. This is because it could determine whether AVNT maintains its upward momentum or slides into a corrective phase.