The latest BTC bull cycle showed a shift in trading composition. More new capital from institutions flowed in compared to all other cycles, bringing down the year’s average volatility.

BTC attracted $732B in new liquidity, according to the most recent Digital Asset Report by Glassnode and Fasanara Digital. The review revealed BTC saw more inflows from institutions, but unlike previous cycles, the liquidity stayed within the confines of the BTC market, not flowing into altcoins.

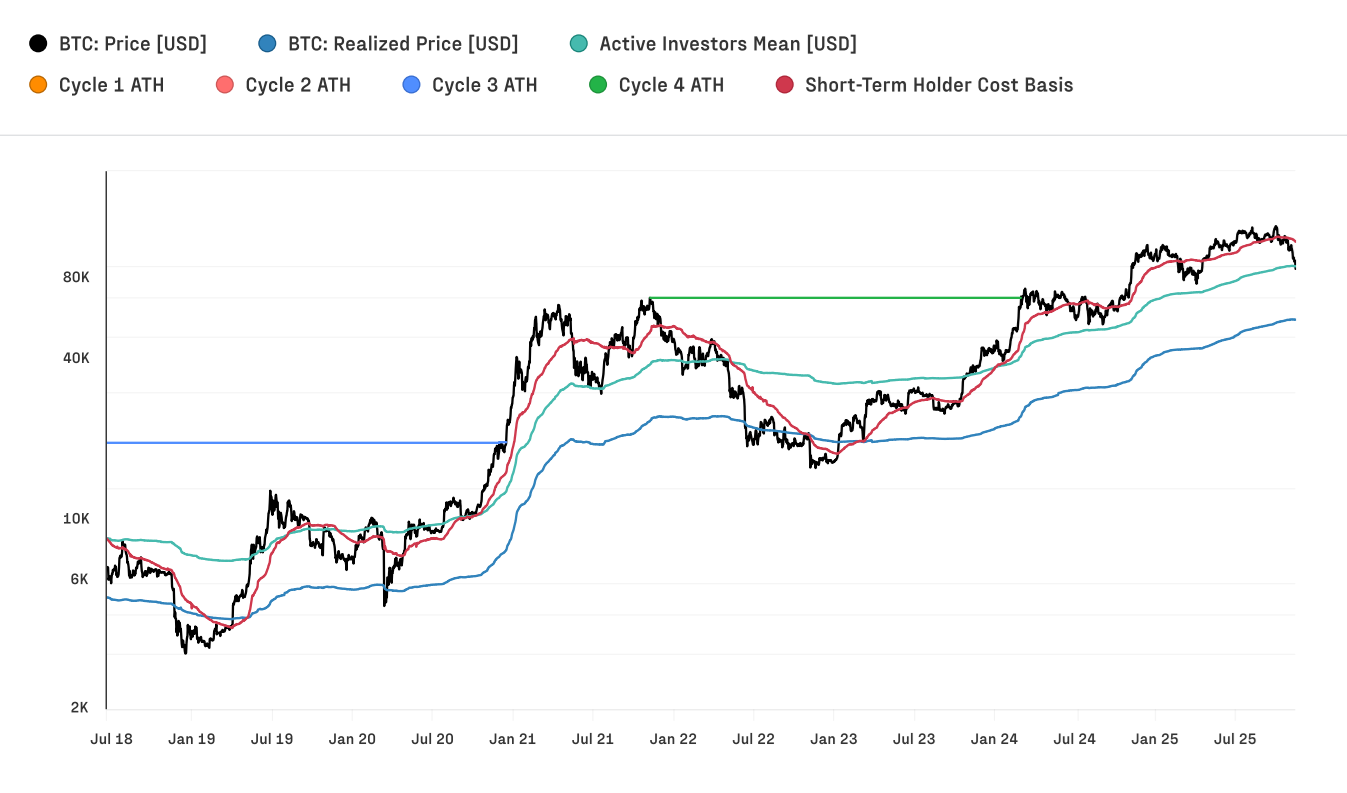

The latest market cycle attracted more inflows than all other bull markets combined, up from $388B during the 2018-2022 bull market.

The biggest wave of institutional capital came after the launch of regulated ETF, most directed at the US market. In 2025, the crypto market finally overcame the worst effects of the 2022 crash, returning to growth as a mix of spot and derivative trading.

BTC completed three major rallies since the crash in November 2022, with the latest climb in 2025 bringing a new all-time peak above $126,000. Over the bear market period, BTC achieved a net gain of 715%, while ETH and the altcoin market had average 350% gains.

Unlike previous cycles, altcoins underperformed against BTC, with only extremely brief altcoin seasons. Liquidity quickly ran out, or shifted to the hottest trends, only lifting several large-cap altcoins, and causing a meme token season.

The stablecoin market was a major source of liquidity, up by 89% since November 2022, leaving the crypto economy almost fully dollarized.

BTC was the main target of fresh capital

The altcoin market showed signs of internal turnover, while BTC was the only digital coin to attract regular inflows of capital. The crypto market showed a different approach to liquidity distribution.

Glassnode on-chain data showed previous cycles had a predictable flow from BTC and ETH to a wider selection of altcoins. Increased risk, rug pulls and VC-backed low-FDV assets made traders more skeptical of new altcoins.

BTC experienced multiple waves of active inflows, ranging between $40B and $190B per month. For ETH, the inflows remained much smaller, and buying depended on internal stablecoin-based rotation from whales.

Stablecoins remained an internal factor, but the US dollar increased its share through regulated buying platforms, including ETF, brokerages, Robinhood trading, and other regulated exchanges. Stablecoins also shifted into DeFi, instead of being used for altcoin trading.

BTC dipped under the short-term holder basis

In Q4, BTC dipped under the cost basis for short-term buyers. The basis price increased after a series of local price peaks, where both retail and whales kept buying.

In the past few months, BTC showed signs of short-term pressure and even capitulation, especially at levels below $90,000. However, the presence of institutional buying was a factor to dampen volatility.

The BTC volatility index remained under 2% for most of the year. The 2025 cycle differed from the 2021 rally, with a 50% lower volatility level. The price action reflected the presence of institutions, which protected the market from the panic-selling of native whales or retail traders.

In the short term, BTC still had relatively volatile periods, but lower in comparison to previous cycles.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.