Hyperlane (HYPER) is a platform that connects disparate blockchain platforms into a unified network with enhanced liquidity and security. Its developers are building a permissionless interoperability layer to address the blockchain fragmentation that has plagued the industry for years.

Hyperlane enables seamless cross-chain communication, allowing dApps on Ethereum, for example, to connect with those on Arbitrum. The platform supports various virtual machines, including Ethereum, Solana, and Cosmos. A key feature of Hyperlane is the absence of centralized bridges. Instead, it uses a modular Interchain Security Module (ISM) that allows dApp developers to customize security. Additionally, Hyperlane offers Warp Routes for flexible and secure token bridging.

The HYPER governance token powers this protocol and is the subject of this price prediction.

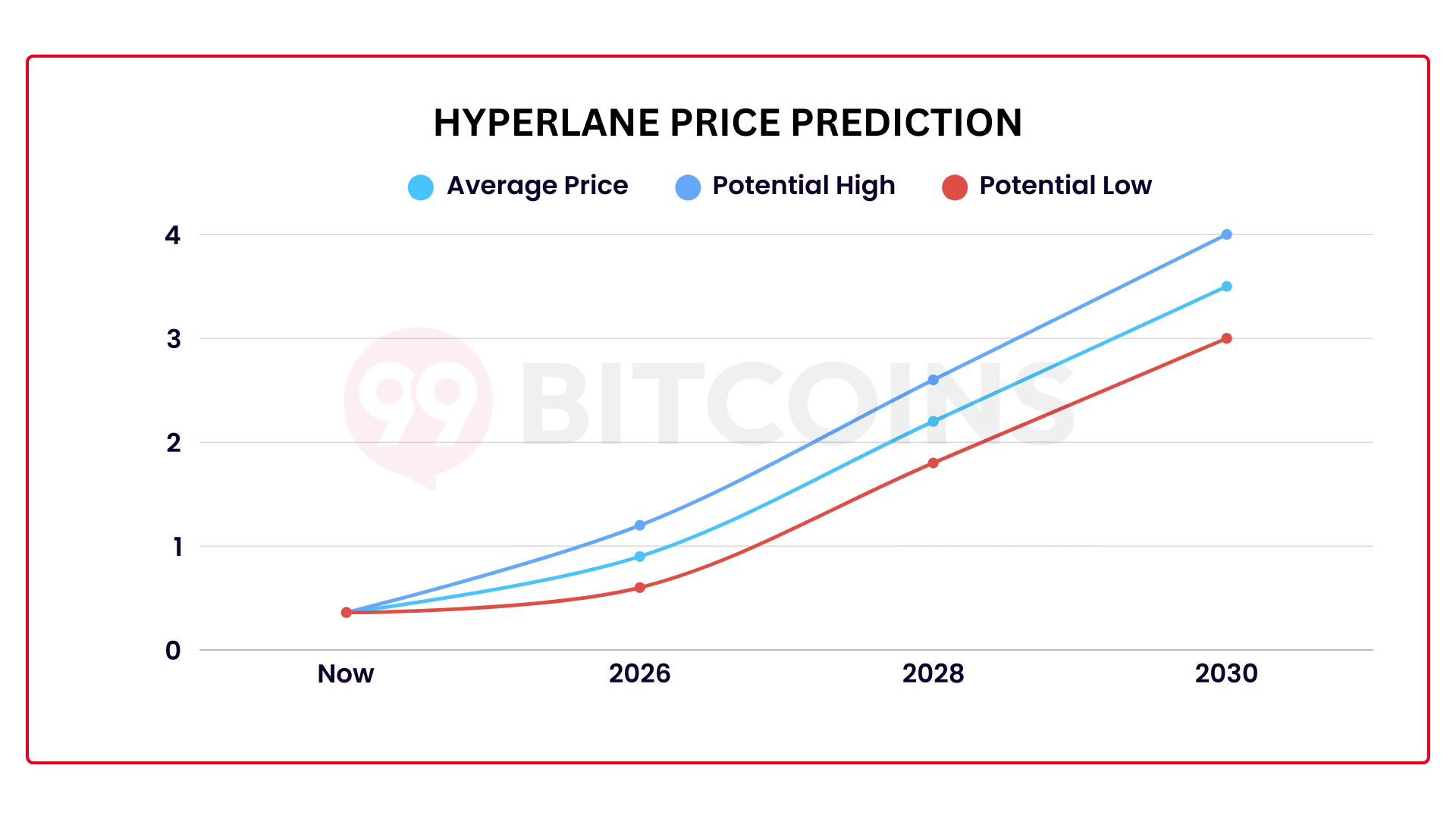

Hyperlane (HYPER) Price Prediction 2026–2030

In this Hyperlane price prediction, we explore the price potential, the platform’s technological edge, and its role in a multichain future where developers can deploy on any chain while accessing all chains.

End of 2025: As of mid-Q3 2025, HYPER crypto is stable. Since listing on top crypto exchanges in early May, HYPER has trended upward, boosted by rising crypto prices, continuous development, and more dApps connecting via Hyperlane. We project HYPER to range between $0.20 and $0.70 by year-end.

End of 2026: If buyers dominate and crypto prices continue to rise in 2026, HYPER is expected to climb higher. In this scenario, HYPER could close above $1.20, with yearly lows around $0.60. This uptrend will likely be supported by Hyperlane’s active development, blockchain expansion, and growing dApp adoption.

End of 2030: If the future is multichain, Hyperlane could be a leading protocol driving this growth. Assuming Hyperlane expands its market share against competitors like LayerZero, HYPER could trade above $4 by the end of the decade, with lows around $3.

HYPER Price Prediction 2025–2026: Short-Term Drivers

Our analysts are confident that HYPER will trend higher in the coming years. If HYPER builds on its solid gains from early May 2025, it could be among the next cryptos to explode.

As of 2025, Hyperlane powers over 140 networks, including layer-1 blockchains, rollups, and app chains, primarily built on Ethereum. Developers are drawn to the network’s unique features, such as customizable security models via the ISM.

Warp Routes 2.0

The release of Warp Routes 2.0 in July 2025 was a major milestone, enhancing Hyperlane’s interoperability capabilities. On launch, HYPER rallied to a high of $0.70. Warp Routes 2.0 introduced native liquidity rebalancing through a collateral-agnostic bridging system, eliminating the need for centralized hubs, custodial liquidity pools, or wrapped tokens. It integrates features from Everclear and uses Circle’s CCTP for automatic rebalancing.

Virtual Machine Expansion and Successful Audits

In July 2025, Hyperlane also integrated Celestia, enabling native TIA transfers across multiple chains, such as Ethereum and Solana.

To bolster trust in its smart contracts, Hyperlane completed multiple security audits from established blockchain security firms, including Trail of Bits, Hacken, Zellic, and Sec3.

Adoption

In 2026, we expect Hyperlane to expand Warp Routes adoption, driving HYPER prices higher. Additionally, improvements to Warp Routes and Rebalancer systems are anticipated to scale the platform and reduce transaction costs. If Hyperlane integrates more virtual machines and blockchains, HYPER is likely to rise, potentially reaching $1.20 by the end of 2026, with lows around $0.60.

HYPER Price Forecast: Long-Term Outlook 2027–2030

We expect HYPER to trade above $4 by 2030, though the pace of growth will depend on several factors.

A primary factor is Hyperlane becoming an Interchain Standard. Hyperlane aims to be a global network for value transfer. As a decentralized layer for digital payments, it must support numerous virtual machines while remaining secure, user-friendly, and cost-effective. Rapid adoption of Warp Routes 2.0 is critical to achieving this goal, requiring developers to actively improve the product to attract institutions.

Failure to enhance product offerings, innovate, or strengthen its core value proposition of trustless cross-chain transfers could allow competitors like LayerZero, currently the dominant interoperability layer, to expand their market share.

For bullish investors, challenges include HYPER’s tokenomics and market cycles. If Solana and Ethereum prices fall, HYPER could post sharp losses because it is less liquid.

As of early August 2025, only 19.2% of HYPER tokens have been released, with more tokens scheduled for release through 2050. As supply increases, rising token circulation could slow bullish momentum, especially if adoption falters or fewer projects choose Hyperlane as their interoperability solution.

Our HYPER Price Prediction Methodology

Our Hyperlane price prediction draws on a combination of technical and fundamental analysis to provide a well-rounded outlook.

From a technical perspective, we examine historical price movements, trading volumes, and chart patterns to identify potential trends and key support or resistance levels.

However, we believe long-term value is more accurately gauged through fundamental factors. This includes closely tracking adoption metrics such as user growth and network activity, assessing the tokenomics model to understand supply dynamics and incentives, evaluating Hyperlane’s competitive advantages over similar projects in the market, and analyzing the speed at which the platform is evolving and delivering on its roadmap.

By integrating these insights, we have aimed to create a price forecast that reflects both current market sentiment and Hyperlane’s underlying growth potential.

HYPER Price History

The maximum supply of the coin is 1 billion HYPER tokens. Hyperlane raised $19.1 million during its seed round and IDO. HYPER was sold for $0.03 during the IDO, raising $600,000 from the community via Binance.

Investors include Galaxy, CoinFund, Variant, and Circle Ventures.

After listing in early May 2025, HYPER prices soared to an all-time high of $0.652, up from an all-time low of $0.0873 in June 2025. Currently, as of , HYPER is trading at , which is a change over the past 24 hours. It has a market cap of .

What Is Hyperlane (HYPER)?

Hyperlane is a permissionless interoperability platform that allows dApps to connect to any supported virtual machine without approval. Through Hyperlane, dApps can securely and cost-effectively send data or tokens via smart contracts.

Hyperlane’s three core products are:

Cross-Chain Messenger: Enables dApps to send messages across supported virtual machines and chains without centralized bridges.

Warp Routes 2.0: Allows direct asset transfers between chains without wrapping or using centralized hubs.

Interchain Security Modules (ISMs): Enable developers to build dApps with customizable security settings.

HYPER is the utility and governance token. Holders can stake HYPER for yields or participate in governance, shaping the platform’s evolution.

Is HYPER a Buy?

HYPER powers Hyperlane, a platform that connects all blockchains and layers built on networks like Solana and Ethereum.

While HYPER is strong in 2025, there is no guarantee of continued rallies. Price movements will depend on internal and external factors, including market cycles and policies, particularly in the United States and Europe.

As a volatile asset, HYPER carries risks. The Department of Banking in the State of Connecticut warns that governments and central banks do not back cryptos. At the same time, they add that cryptos are highly volatile and there are no guarantees that prices will continue rallying in the future.

Accordingly, investors are encouraged to conduct thorough research and due diligence before purchasing.

Note that storing HYPER on custodial exchanges carries risks. For added security, consider transferring tokens to non-custodial wallets like the Best Wallet. It stores your private keys securely and offers top-level protection with 2FA and biometric authentication. With this mobile wallet, you can buy, sell, store, and stake thousands of cryptocurrencies.

It also includes features like the Upcoming Token section, where you can discover and invest in trending crypto presales. For more details, check out our full Best Wallet review.

Conclusion: Hyperlane Price Prediction

HYPER is a high-conviction investment for those who believe in a multichain, permissionless future. If this vision materializes, HYPER could deliver significant returns. However, risks remain, including competition and uncertain adoption. If you believe in HYPER’s potential, conduct thorough due diligence before investing.