Hyperlane is a permissionless, modular interoperability protocol designed to facilitate secure cross-chain messaging and asset transfers without relying on centralized intermediaries. It empowers developers to build custom bridges and interchain applications with unparalleled flexibility.

This article explores Hyperlane’s core features, growing ecosystem, the upcoming HYPER token’s airdrop and HYPER’s tokenomics.

Key Takeaways:

With support for over 140 blockchains, Hyperlane delivers decentralized messaging without relying on any central authority.

The HYPER airdrop is set for April 20, 2025, with over 340,000 wallets eligible.

Hyperlane’s customizable interchain security modules offer developer-defined verification models.

What is Hyperlane?

Hyperlane is a permissionless interoperability protocol for cross-chain communication across blockchain ecosystems. It allows decentralized applications (DApps) to exchange arbitrary messages and transfer assets across chains seamlessly — without centralized relayers or approvals.

What sets Hyperlane apart is its Interchain Security Modules (ISMs) — part of a modular system that lets developers define the way that cross-chain messages are verified, offering unmatched flexibility. It supports cross-VM communication, including EVM, SVM (Solana), and CosmWasm, making it ideal for today’s multichain and modular blockchain environments.

Hyperlane’s architecture eliminates lock-in and promotes composability, laying the groundwork for a truly interconnected web3.

Hyperlane founders and investors

Hyperlane was co-founded by Jon Kol, Asa Oines and Nam Chu Hoai, all seasoned innovators with experience at corporations such as Morgan Stanley, Galaxy Digital, Celo and Google. In 2022, the protocol secured $18.5 million in seed funding, led by Variant Fund, with notable participation from Galaxy Ventures, CoinFund, Circle and Figment Capital.

The funding underscored growing institutional confidence in permissionless interoperability infrastructure. Hyperlane hasn’t conducted a public ICO, but early community contributors and developers are expected to receive token rewards.

The project’s approach mirrors LayerZero and Wormhole in incentivizing both users and integrators, with a focus on long-term decentralization.

Hyperlane Foundation

Launched in August 2024, the Hyperlane Foundation governs the protocol as a decentralized autonomous organization (DAO). It manages treasury grants and protocol upgrades, and ensures decentralization in the governance process.

The foundation also introduced the Hyperlane Alliance, a collective aimed at expanding adoption and standards for intent-based messaging and cross-chain interoperability.

Governance will be powered by the HYPER token, with voting rights extended to developers and users shaping Hyperlane’s future.

Key features of Hyperlane

Interchain Accounts (ICAs) enable smart contract calls across chains from a single wallet interface.

Warp Routes allow seamless asset bridging with support for native, yield-bearing and NFT transfers.

Modular security: Developers choose or compose ISMs (e.g., multisig, aggregation) tailored to specific use cases.

Gas abstraction allows you to pay gas fees on the origin chain using its native token.

Multi-VM support allows cross-chain communication with EVM, Solana (SVM), CosmWasm and Starknet.

Permissionless deployment: Any rollup or appchain (application-specific blockchain) can integrate Hyperlane without approval.

Hyperlane combines security, flexibility and scalability in a single messaging layer.

Hyperlane ecosystem

Hyperlane currently supports over 140 blockchain networks, including Ethereum, Arbitrum, Solana, Celestia, Base and Blast. Its messaging framework is used for:

rollup-to-rollup communication

NFT transfers and DeFi coordination

liquidity routing and cross-chain staking

Key integrations include:

Renzo Protocol for ezETH bridging across at least 14 EVM chains

Eclipse for Ethereum L2 using Solana VM

Karak, a restaking platform

OpenUSDT, a cross-chain stablecoin on the OP Superchain

Nexus Bridge, a native Hyperlane bridge connecting Eclipse, Ethereum and Solana

Hyperlane’s integration with ABC Stack allows sovereign rollups to maintain control, while gaining seamless access to the broader blockchain ecosystem.

HYPER airdrop and tokenomics

Hyperlane’s native token, HYPER, will officially launch on Apr 20, 2025, with an airdrop targeting over 340,000 eligible wallets. To claim tokens, users must register by April 13 on the official website.

HYPER will play a central role in the Hyperlane ecosystem, as follows:

Governance through the Hyperlane DAO

Staking rewards for securing the protocol

Economic alignment, including validator incentives and subsidized gas fees

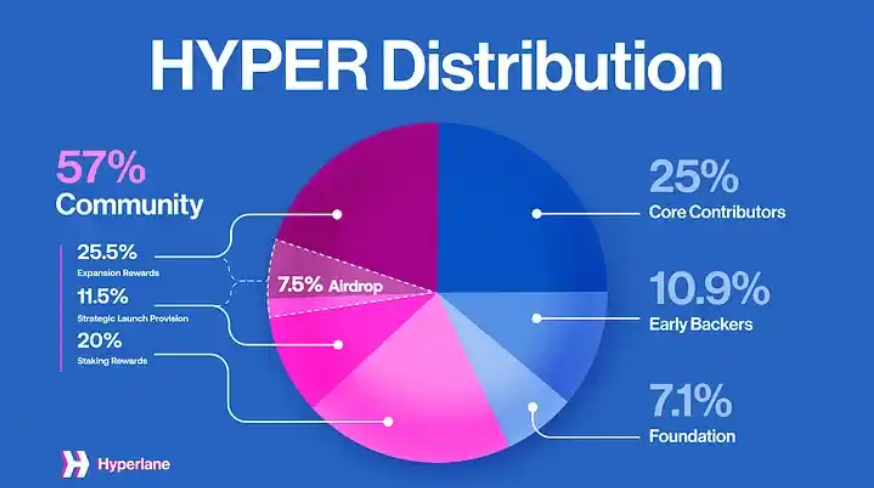

Based on official documentation, the total HYPER supply will be allocated as follows:

Source: Hyperlane

The community will receive 57%, broken down into 25.5% for expansion rewards, 20% for staking rewards and 11.5% for strategic launch provisions. Meanwhile, 25% will be allocated to core contributors, 10.9% to early backers and 7.1% to the Hyperlane Foundation.

Hyperlane’s distribution strategy prioritizes general message passing (GMP) activity over short-term engagement. To prevent airdrop farming, anti-sybil mechanisms assign trust scores based on historical interaction, wallet behavior and transaction quality in order to ensure rewards go to real users who contribute meaningful value to the ecosystem.

Trade HYPER on Bybit

Bybit recently listed HYPER on Bybit Spot, allowing users to buy and sell HYPER on the Bybit platform with ease.

To trade HYPER, simply sign up or login to your Bybit account. Fund your Unified Trading Account with fiat or crypto, and head to the HYPERUSDT page to start trading!

For new and existing users, stand a chance at winning from a prize pool of 2,500,000 HYPER by trading and depositing HYPER. Head to the announcement page for more details.