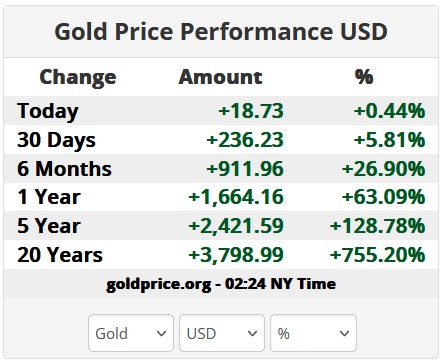

Gold has been surging at an exponential rate, gaining nearly 70% since the start of the year. Crypto investors are speculating on whether the Bitcoin price will follow the rare metal’s performance.

Gold and Bitcoin are often compared because one is the oldest commodity, which has remained a store of value for thousands of years, and the other is the oldest decentralized asset. Prominent economists often highlight Bitcoin’s potential as a decentralized alternative to gold, as its capped supply and widespread adoption mirror those of the precious metal.

The question “Why is gold surging?” is on every trader’s mind lately due to its remarkable performance. The gold price has been closing higher for four consecutive months, currently up 2.8% in December. Gold touched an all-time high of $4,381 per ounce in October, only to crash to $3,900 per ounce.

However, it has stayed resilient compared to other leading assets and is again attempting to create new highs, currently trading at $4,331 per ounce. On the other hand, the Bitcoin price has declined by over 30% in the past two months and is struggling to hold above $86K.

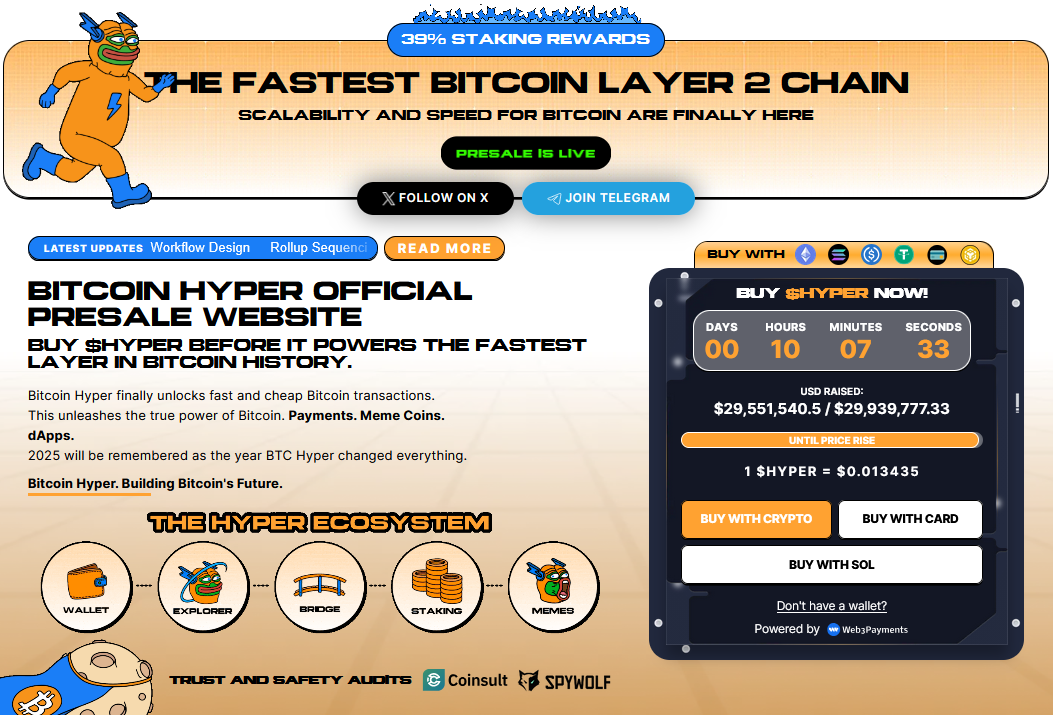

With the broader crypto market reset, seasoned investors are now expecting a rebound by the end of 2025, suggesting Bitcoin could surge similar to gold in the months ahead. Keeping this in mind, smart money is moving to Bitcoin Hyper, an emerging Bitcoin-based layer-2 that could surge exponentially when BTC starts to rally.

Gold Surges on Safe-Haven Demand and Macro Uncertainty

This year has seen considerable macroeconomic uncertainty. Rising geopolitical tensions, global debt, and inflation concerns have led most investors to turn to safer assets to preserve their wealth for the long term. As a result, the world’s oldest hedge asset, gold, has seen significant inflows.

Another reason is the Federal Reserve’s three consecutive rate cuts in 2025, which brought lending rates to their lowest level in recent years. This dovish policy led to a significant decrease in the opportunity cost of holding non-yielding gold. This made gold and other similar assets more attractive than yield-bearing assets, inducing capital inflows.

It reached overbought territory with RSI surging to 85 in October, and after a quick correction, it is back to overbought levels. Despite this, Goldman Sachs predicts gold will rise further, forecasting $4,900 per ounce by the end of 2026.

Bitcoin Price Outlook: Can BTC Mirror Gold’s Performance?

The Bitcoin price plunged to $85K support over three weeks ago, declining in a channel since October. It has since struggled to break above or below the $85K-$94K range, extending its consolidation streak amid uncertain market sentiment.

BTC has faced multiple rejections from the upper boundary of the sideways range, despite the MACD oscillator highlighting increasing bullish pressure over the past few weeks. As a result, the MACD has now dipped below the signal line, indicating bearish pressure has taken over.

The RSI is approaching oversold territory, dropping from 50 last week to 39 today. Additionally, volumes have been drying up as trading activity has diminished. All technical indicators are pointing to a market bottom, suggesting Bitcoin may rebound and enter a recovery phase towards the $100K psychological level.Historically, the crypto market has seen positive moves at year-end, which is why investors are expecting Bitcoin to regain its bullish bias and follow gold’s price performance in 2026.

Bitcoin Hyper Targets Bitcoin’s Next Growth Phase

While Bitcoin maintains its image as digital gold amid the crypto downturn, Bitcoin Hyper is emerging with its layer-2 solution for the oldest blockchain network. As investors no longer seek only Bitcoin’s holding value and adopt innovative DeFi ecosystems, the infrastructure project has gained immense investor backing.

Bitcoin is known for its secure but slow transfers, but DeFi users now require lightning-fast processing speeds for general trading and large-volume asset transfers. That is why Bitcoin Hyper is bringing the next-gen Bitcoin ecosystem with Solana Virtual Machine (SVM) integration.

What makes Bitcoin Hyper stand out is that, instead of changing the Bitcoin network, the project introduces a virtual layer to unlock higher throughput and low-latency smart contract execution.

Why investors are adopting Bitcoin Hyper:

Massive infrastructure upgrade: Enabling fast payments with over 1,000 TPS

Presale pricing advantage: Available at $0.013435, offering a discounted presale entry

Presale performance: Over $29.5 million raised within months of presale debut

Token listing: HYPER is scheduled to list on major DEXs in Q1 2026 after presale

Attractive staking rewards: Early presale buyers get better yields, currently 39% APY

Trust and Security audits: Coinsult and SpyWolf certified

The project is attracting investors toward its presale with solutions that expand Bitcoin’s real-world utility for the first time. During a period when large-cap tokens are slowing down, the HYPER presale offers exposure to its Bitcoin-backed growth, offering explosive ROI to early-stage backers.