Once again, Bitcoin price prediction is trending in searches as traders grow increasingly uncertain about future price movements. Contrasting institutional plays fuel uncertainty as spot BTC ETFs experience outflows while corporate accumulation rises.

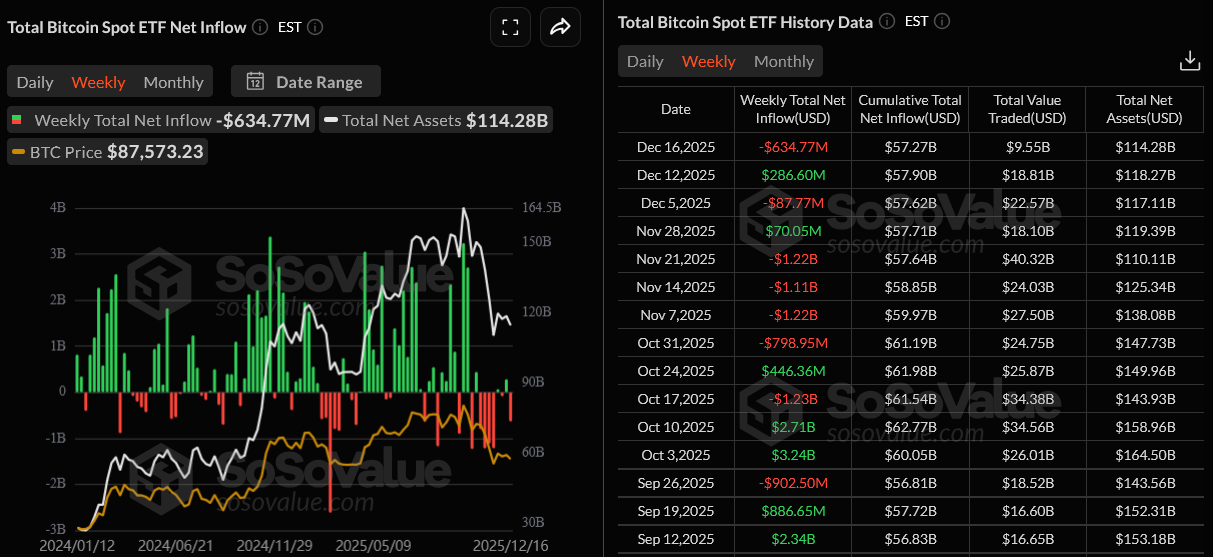

Over the past few weeks, ETF inflows have been fluctuating significantly. Last week, US-based Bitcoin ETFs recorded $286.60 million in inflows, breaking the trend of outflows and marking the most significant addition since October. However, approximately $634.77 million has exited in just the first two sessions this week.

The renewed selling pressure on Monday triggered approximately $200 million in long liquidations in under an hour, according to data from CoinGlass. As a result, Bitcoin plunged below the $87K support, dropping to $85K.

Meanwhile, Strategy, formerly known as MicroStrategy, continues to purchase BTC as part of its accumulation strategy, despite poor price performance. This shows the firm’s confidence in Bitcoin’s long-term value growth, ignoring short-term price fluctuations.

While institutions continue to accumulate BTC, ETF outflows, and on-chain data indicate that investors are shifting funds to more promising altcoins. The leading investment choice of long-term Bitcoin holders is the rapidly rising layer-2 project, Bitcoin Hyper, which has recently surpassed the $29.5 million presale milestone.

Strategy Continues Aggressive Bitcoin Accumulation

The publicly traded firm, Strategy Inc., has made back-to-back Bitcoin accumulations worth billions over the past two weeks.

On December 8, executive chairman and co-founder of Strategy, Michael Saylor, announced that the firm “has acquired 10,624 BTC for ~$962.7 million at ~$90,615 per bitcoin” and that the firm holds “660,624 BTC acquired for ~$49.35 billion at ~$74,696 per bitcoin.”

Strategy has acquired 10,645 BTC for ~$980.3 million at ~$92,098 per bitcoin and has achieved BTC Yield of 24.9% YTD 2025. As of 12/14/2025, we hodl 671,268 $BTC acquired for ~$50.33 billion at ~$74,972 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/VdAz7pqce1

— Michael Saylor (@saylor) December 15, 2025

Following this purchase, on December 15, Saylor posted another update on X, sharing that Strategy has acquired another “10,645 BTC for ~$980.3 million at ~$92,098 per bitcoin”, taking the total holding amount to 671,268 BTC.

After these purchases, Strategy now holds ~3.2% of the total BTC supply. It could continue to accumulate over the coming weeks, as Saylor has previously mentioned that the firm could theoretically hold up to 7% of Bitcoin’s fixed supply. However, it’s not a formal target.

Bitcoin Price Prediction: BTC Trades Range Bound Near Multi-Month Lows

Bitcoin has faced significant corrections over the past few months, trading over 30% below its all-time high of $126,000 in October. The BTC price remains weak despite the Federal Reserve’s third rate cut of the year, as the Fed’s stance on further rate cuts weighs in on market sentiment.

It is consolidating near multi-month lows at $85K, and the long-term moving averages are declining, suggesting bears currently have the advantage over bulls. Still, the selling pressure remains low, which means if buying pressure rises, a recovery leg could take Bitcoin back above $100,000.

However, prominent analysts are adjusting their Bitcoin price prediction ranges amid recent sell-offs and market uncertainty. The multinational investment bank, Standard Chartered, has slashed its Bitcoin targets in half, now citing $100,000 by the end of this year and $150,000 by the end of 2026.

As Bitcoin struggles to regain momentum and break above $94K, near-term downside risks have increased. Institutional interest remains intact as corporates continue to grow Bitcoin Treasuries. But rising ETF outflows show traders have become cautious and are moving funds to better-performing altcoins amid high volatility.

Bitcoin Hyper Emerges as an Early-Stage Infrastructure Play

While Bitcoin struggles to find a decisive move, Bitcoin Hyper is outperforming, with its ongoing presale raising nearly $30 million. Bitcoin’s limitations have kept it from competing with newer smart contract platforms, and Bitcoin Hyper is built to close that exact gap by introducing Solana-like speed and scalability directly to the Bitcoin ecosystem.

Instead of positioning itself as a rival to Bitcoin, the project aims to be an extension of the network. It exists as a virtual layer that breaks Bitcoin’s DeFi bottlenecks and enhances transactional throughput.

A Solana Virtual Machine integration enables users to participate in DeFi and Web3 activities such as staking and executing decentralized applications. The native token, HYPER, is essential for paying transaction fees, interacting with smart contracts, and accessing decentralized applications.

How Bitcoin Hyper stands out:

Nearly $30 million raised, with over 650 million HYPER tokens sold so far

By staking HYPER in presale, ICO participants can earn up to 39% APY

Presale offers a discounted price of $0.013415, much lower than the listing price

Price increases every 72 hours with new presale stages

Powered by zk-rollups, enabling faster, cheaper transactions secured by Bitcoin

Early buyers have strong ROI potential when HYPER lists on major DEXs in Q1 2026

As more users adopt the platform and activity grows across DeFi, gaming, and high-speed payments, the demand for HYPER is expected to rise accordingly. This means the token’s growth is utility-driven rather than speculative hype.

With the Bitcoin price forecast to reclaim $100K this year and surge to $150K in 2026, HYPER could unlock exponential growth alongside it. This means early presale investors who acquired at low prices can realize massive returns after the token listing.