KEY TAKEAWAYS

Ravencoin surged 70% in one hour after South Korean exchange Upbit announced its listing.

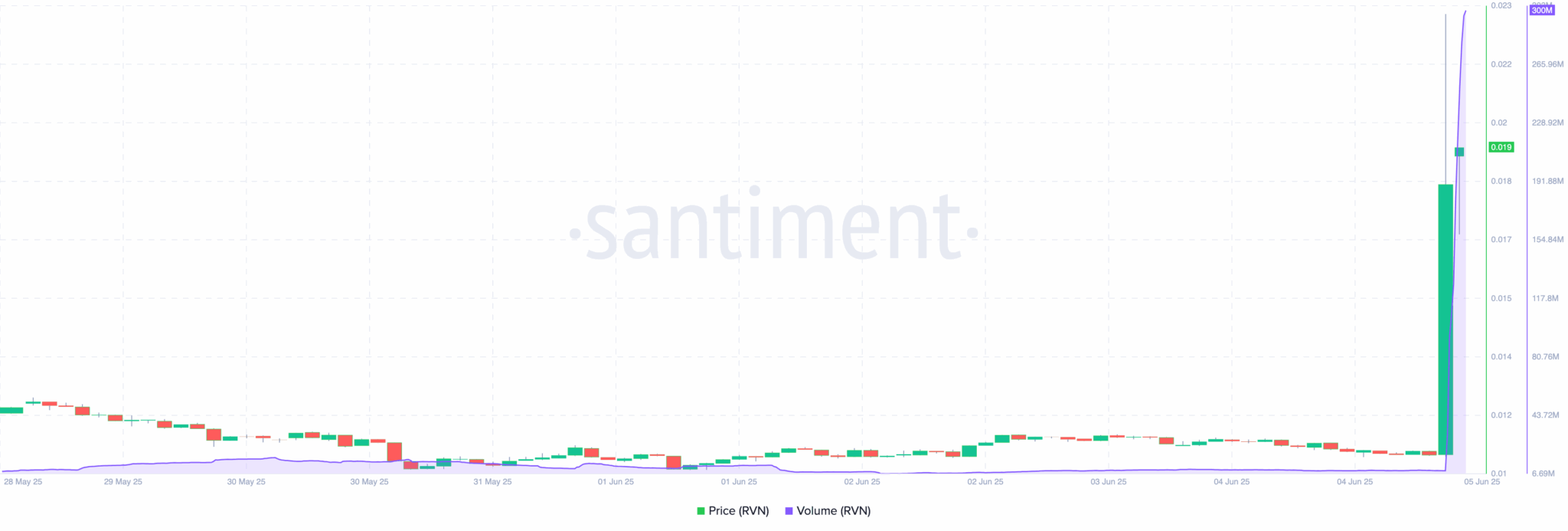

Trading volume skyrocketed 3,000%, climbing from under $10 million to over $300 million.

Funding rate flipped negative, indicating a short squeeze that could add fuel to RVN’s rally.

RVN, the native cryptocurrency of the digital peer-to-peer (P2P) network Ravencoin, surged by 70% within an hour today. This development comes after top South Korean exchange Upbit announced that it will list the token.

Earlier in the day, Ravencoin’s price was $0.011. As of this writing, the market value has rocketed to $0.018.

Accompanying the rally is a staggering 3,000% spike in trading volume. Here is what could be next for the cryptocurrency.

Upbit Fuels Ravencoin Rally

According to Upbit, Ravencoin went live for trading at 17:00 KST today. It mentioned that the cryptocurrency was only paired with the Korean Won (KRW).

This move opens RVN to one of Asia’s most active retail markets. And judging by the volume surge, Korean traders are already piling in.

Based on Santiment’s data, the trading volume before the listing was less than $10 million. At press time, the same metric has increased 30x and has hit $300 million.

Besides showing how interested the market is in a cryptocurrency, trading volume also hints at where the price might go next. From a price perspective, falling volume alongside rising price indicates a weak trend. In that case, the rally begins to fade.

But in this instance, the rise in the trading volume alongside the increase in Ravencoin’s price could open the doors to a higher value. So, if the trend continues. RVN’s price is also likely to move higher.

Short Squeeze Hits Traders

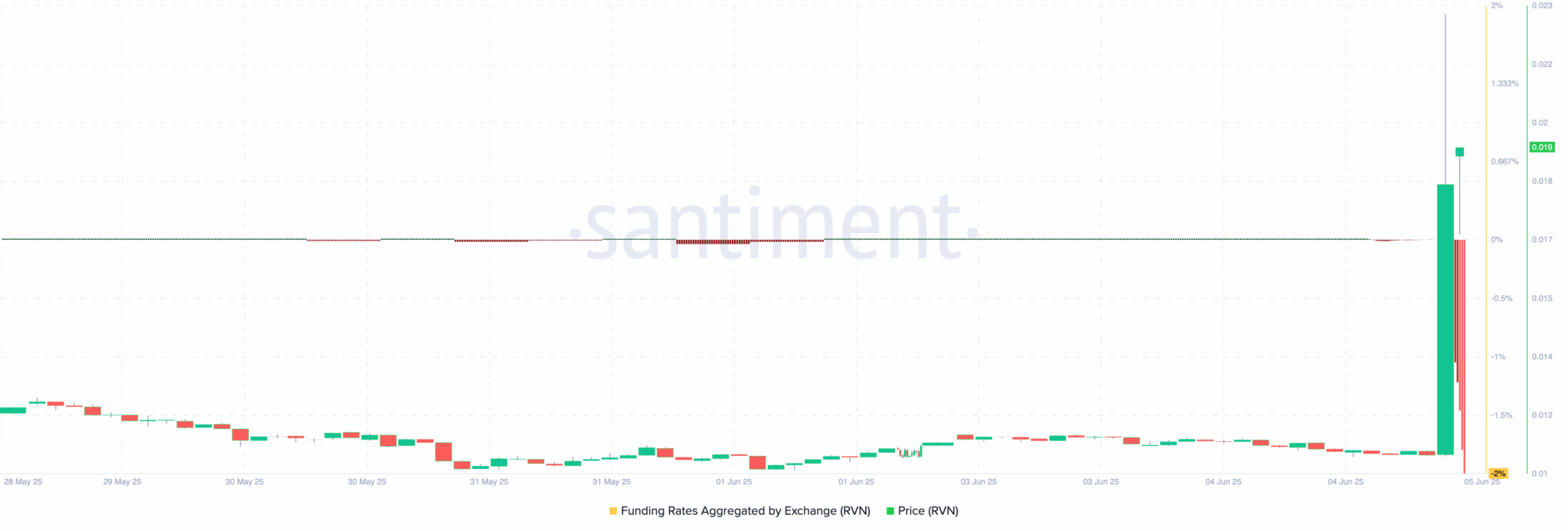

Meanwhile, data reviewed by CCN revealed a plunge in Ravencoin’s funding rate. Typically, a positive funding rate suggests that long traders are in control, paying shorts to maintain their positions, which indicates a bullish outlook.

In contrast, the current deeply negative funding rate implies that short sellers are dominating the market. But despite this aggressive bearish positioning, Ravencoin’s price has been rising — a divergence that suggests shorts are getting squeezed and not profiting from their trades.

This mismatch between sentiment and price action could signal underlying strength for RVN’s price, making the outlook potentially bullish.

RVN Price Prediction: Uptrend Still Strong

From a technical point of view, the Ravencoin Upbit listing helped the price break out of a descending triangle. Amid the price increase, the Relative Strength Index (RSI) reading has also jumped, indicating bullish momentum.

Adding weight to Ravencoin’s uptrend, the Average Directional Index (ADX) has begun to rise. The upward shift in the ADX suggests that the ongoing price movement is not just a blip, but a potentially sustained rally with solid directional conviction behind it.

Should this remain the same, Ravencoin price could breach the resistance at $0.022.

If that happens, the potential target for the cryptocurrency could be a rise to $0.026 near the 0.382 Fibonacci level.

On the contrary, if selling pressure increases, this prediction might not come to pass. In that case, RVN might decline below $0.010.