Monero price prediction models are turning sharply lower this week as XMR trades just above $400, threatening a breakdown toward the $390 range. The current downtrend has raised concerns across technical charts, even as sentiment remains broadly bullish.

XMR has now failed to reclaim $450 for the third time in two months, with weakening volume and declining RSI pointing to deeper near-term losses. While long-term projections for 2026 still show strong upside potential, short-term holders face pressure to exit before further capitulation.

As this unfolds, momentum is clearly shifting toward Bitcoin Hyper, a fast-growing presale that has already attracted more than $29.5 million in early funding.

Short-Term Monero Forecast Signals Weakness

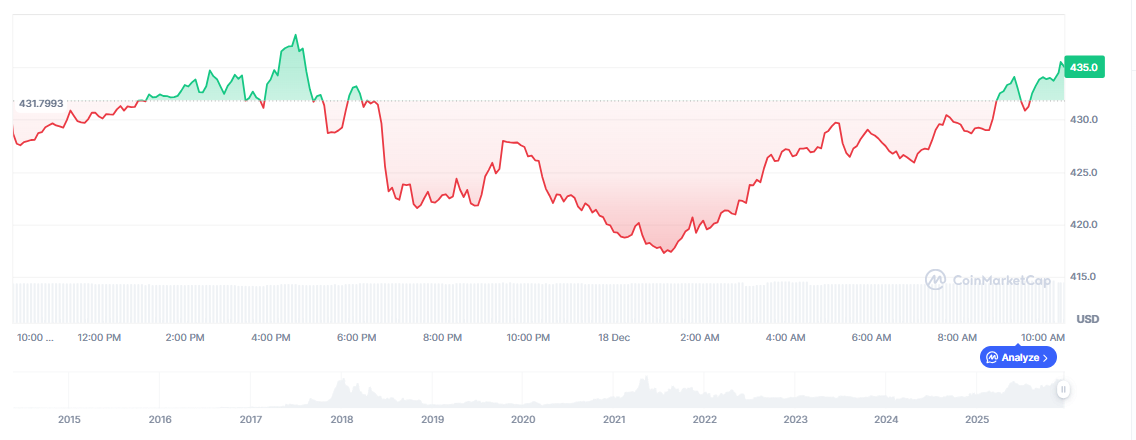

The Monero price prediction for the rest of December indicates consistent downside. From December 19 through December 23, XMR is forecasted to fall from $423.18 to $404.91, a weekly loss of 6.83%.

These projections follow a sharp rejection at $420 and failure to hold the $450 resistance, leading to increased selling across short-term traders. Technical data confirms this shift: RSI has dropped below 50, while On-Balance Volume shows continued decline.

Sentiment remains misleadingly positive. Of 30 key indicators, 87% are still flashing bullish signals, with only four showing bearish divergence. But on-chain demand is eroding.

Trading volume has stagnated under $200 million, and Monero’s inability to break above recent resistance suggests the market is running out of momentum. If the $400 level breaks cleanly, analysts expect XMR to fall rapidly toward $395, $380, or even $360, where a more stable demand zone exists.

Long-Term Price Outlook Remains Bullish for 2026

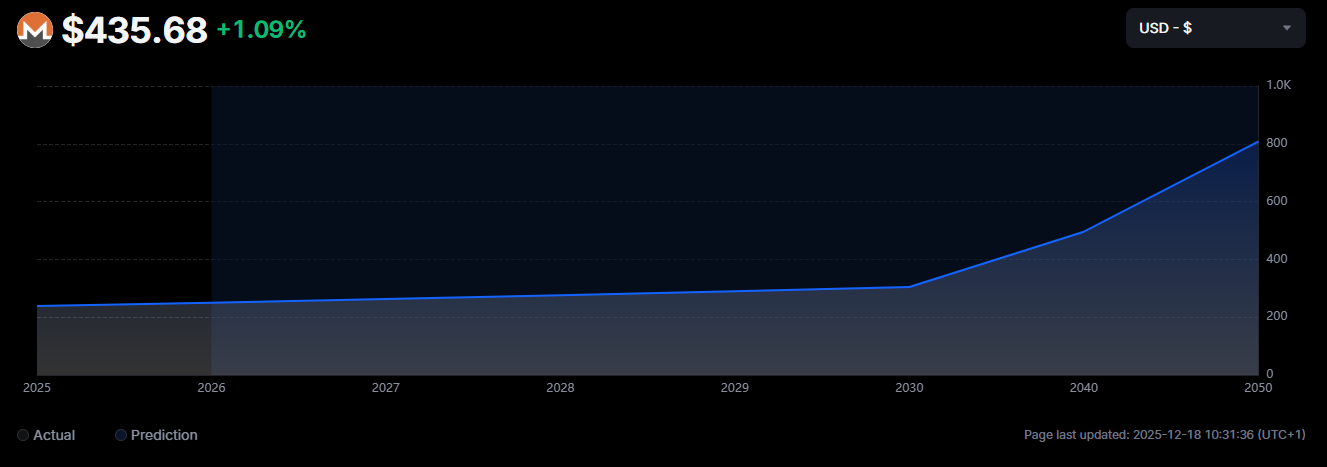

Despite short-term concerns, the broader Monero price prediction for 2026 remains highly optimistic. Forecasts suggest Monero could reach an average annual price of $551.76, with projected highs at $671.88 by year-end. That would represent a potential return of over 54% from current levels.

The early part of 2026 already looks promising. In March alone, XMR is forecasted to average $587.82, with peak values hitting $619.50.

Analysts expect renewed privacy debates and macroeconomic shifts to fuel renewed demand for privacy-preserving assets like Monero, especially if institutional attention increases. Even if current support levels fail, long-term projections remain intact – but recovery timing is now more uncertain.

Technical Indicators Point to Divergence

Charts show a clear disconnect between price action and underlying sentiment. The 50-day SMA continues trending above the 200-day SMA, but daily price movement is testing these trendlines. The RSI remains neutral across higher timeframes, but bearish divergence in the On-Balance Volume is a growing concern.

This divergence has lasted over seven months, creating an unstable foundation. Despite upward price movement during October and November, demand metrics have failed to keep pace.

This suggests recent price strength may have been speculative and not supported by fresh accumulation. As a result, the risk of a sharp correction has increased, even if long-term averages remain in an uptrend.

Key Level to Watch: $400

Everything now hinges on the $400 support level. This psychological floor has been tested multiple times since October, but never broken decisively. A breakdown below this area could reset the bullish outlook, potentially delaying 2026 targets and damaging technical momentum.

If bulls can reclaim $420 and regain volume strength, a rebound toward $450 is possible. But for now, the focus is survival. The Monero price prediction into year-end remains bearish unless a strong reversal occurs – and traders are watching closely for confirmation.

Bitcoin Hyper Gains Attention as Monero Stalls

As traders look for alternatives, Bitcoin Hyper is emerging as a major presale event. With $29.5 million raised and less than $500,000 remaining before the next price increase, momentum is clearly accelerating. The token is currently priced at $0.013445, with thousands of buyers entering the presale across crypto, card, and SOL payment options.

For traders seeking near-term upside, Bitcoin Hyper presents a different risk profile. Unlike Monero’s slow price action and regulatory pressure, this early-stage token is benefiting from high visibility, fast-paced growth, and a clear supply model. While Monero’s fundamentals remain solid, the short-term opportunity cost is drawing capital elsewhere.