KEY TAKEAWAYS

DEXE had a strong 2024.

The token is performing well despite an overall bearish crypto market movement.

Our DeXe price predictions suggest DEXE could reach $28 this year.

Interested in buying or selling DeXe DEXE coin? Read our review of the best exchanges to buy and sell DeXe DEXE.

The DEXE token rallied in 2024 and 2025, taking what, until that time, had been something of a crypto also-ran and putting it into the top 100 cryptos by market cap.

The Ethereum-based token did well in early February 2025, rallying when the market slumped due to US President Donald Trump’s proposal of tariffs on goods from Mexico, Canada, and China.

On Feb. 4, 2025, DEXE was worth about $21.45.

Let’s examine our DEXE price predictions, made on Feb. 4, 2025. We will also examine the DEXE price history and discuss what DEXE is and does.

DEXE Price Prediction

Let’s look at the DEXE predictions made by CCN on Feb. 4, 2025. While we take the utmost care with our price forecast, we do need to remind you that price predictions, especially for something as potentially volatile as cryptocurrency, can very often end up being wrong.

| Minimum DEXE Price Prediction | Average DEXE Price Prediction | Maximum DEXE Price Prediction | |

|---|---|---|---|

| 2025 | $13 | $20 | $28 |

| 2026 | $17 | $26 | $35 |

| 2030 | $96 | $120 | $144 |

DeXe Price Prediction 2025

For 2025, DEXE is projected to range between $13 and $28. This range reflects a recovery from the current correction phase, with potential bullish waves driven by renewed market sentiment and adoption yet tempered by periodic pullbacks.

DeXe Price Prediction 2026

Prices are expected to strengthen further by 2026, ranging from $17 to $35. This growth could be fueled by DEXE’s continued development and broader crypto market cycles entering a new bullish phase, with key Fibonacci extensions providing resistance and support targets.

DeXe Price Prediction 2030

Looking ahead to 2030, DEXE may reach between $25 and $60. This wide range considers long-term macroeconomic factors, technological advancements, and crypto market maturity, positioning DEXE for significant growth if adoption scales while acknowledging potential volatility.

DeXe Price Analysis

DeXe completed a five-wave Elliott Wave on the daily chart, peaking at $24.21 on Feb. 3 with a 22% surge. This high aligned with a rising wedge’s upper boundary, signaling a bearish reversal. The price then fell 13% to $21, marking the start of a corrective phase and returning to ascending support.

Daily RSI shows bearish divergence, with higher price highs but lower RSI highs, indicating fading bullish strength. The breach of the wedge’s support trendline suggests more downside.

Key support lies at $20.16, $17.66, and $15.63, with the latter matching prior consolidation, making it crucial.

Short-term DEXE Price Prediction

The one-hour chart outlines an ABC correction post-peak. Wave A may drop to $17.66. Meanwhile, a rebound in wave B could retest $20.16, forming a lower high.

Wave C might reach $15.63, a potential buy zone. If bearish momentum continues, it could dip to $13.61. The declining RSI supports near-term downside. Bullish divergence or oversold RSI at key supports may signal the correction’s end.

The DEXE price prediction for the next 24 hours hinges on when and where the correction finishes.

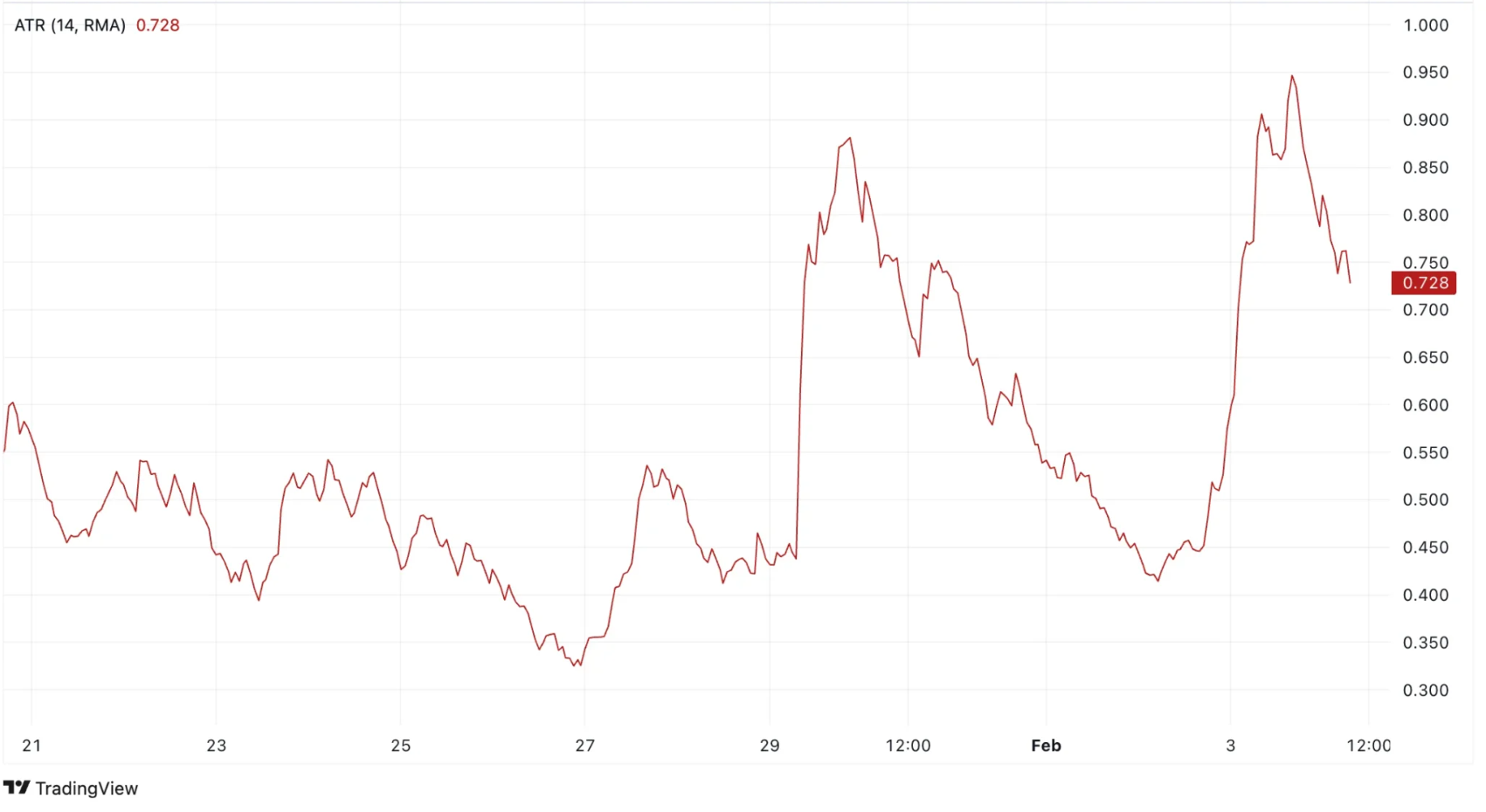

DEXE Average True Range (ATR): DEXE Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days. A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility.

Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On Feb. 4, 2025, DEXE’s ATR was 0.728, suggesting relatively low volatility.

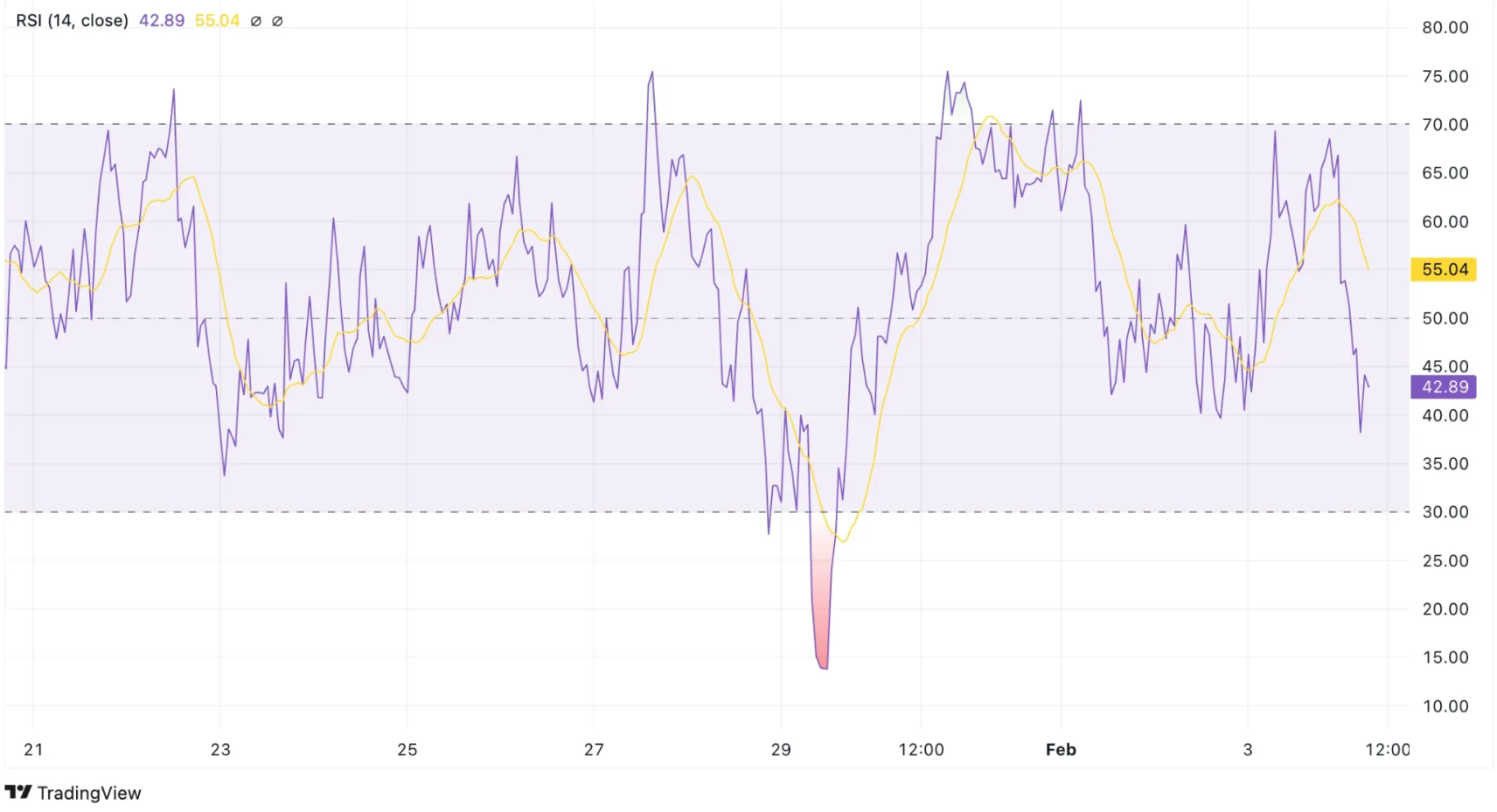

DEXE Relative Strength Index (RSI): Is DEXE Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold. Movements above 70 and below 30 show over and undervaluation, respectively.

Movements above and below the 50 line also indicate if the trend is bullish or bearish.

Looking for a safe place to buy and sell DeXe DEXE? See the leading platforms for buying and selling DeXe DEXE

On Feb. 4, 2025, the DEXE RSI was at 42, indicating bearish conditions.

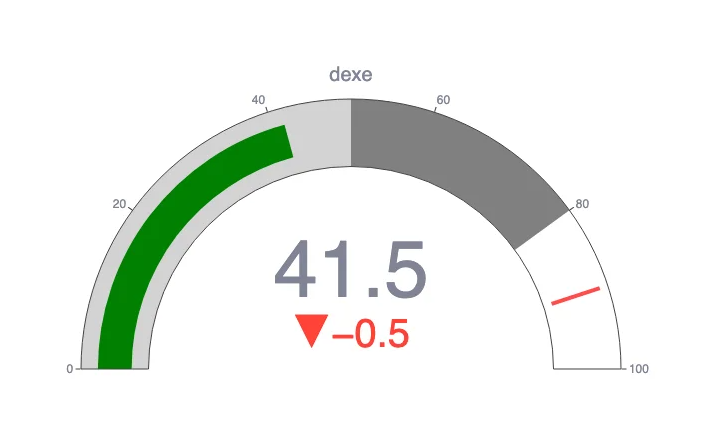

CCN Strength Index

The CCN Strength Index combines an array of advanced market signals to measure the strength of individual cryptocurrencies over the last 30 days.

Every day, it assigns a strength score, ranging from 0 to 100, to the top 500 assets by market capitalization on CoinMarketCap, focusing on both trend direction and the intensity of price movements.

0 to 24: Assets exhibit significant weakness, showing signs of sustained downtrend behavior.

25 to 35: The price tends to move within stable bounds with minimal volatility.

36 to 49: Assets begin a stable uptrend but without strong surges.

50 to 59: Consistent growth with moderate price advances, building momentum.

60+: Sharp price movements and high demand indicate stronger volatility and trend shifts.

The index dynamically adapts to rapid changes. For example, an asset experiencing a 100% increase within a short timeframe would see a sharp jump in its score to reflect the intensity of the rise.

However, should that asset stabilize at this new price level, the score will gradually taper down and align with the dampened momentum as the movement normalizes. The same principle applies to rapid declines: a sudden drop will spike the score downward, but as volatility decreases, the score will slowly adjust back up.

On Feb. 4, 2025, DEXE scored 41.5 on the CCN Index, suggesting moderate momentum.

DEXE Price Performance Comparisons

Let’s compare DEXE’s price performance over the last year with both ETH and other related tokens.

| Current price | One year ago | Change | |

|---|---|---|---|

| DEXE | $21.45 | $2.91 | +637% |

| ETH | $2,705 | $2,309 | +17.1% |

| VET | $0.0355 | $0.0287 | +23.6% |

| AIOZ | $0.5295 | $0.1419 | +273 |

Best Days and Months to Buy DEXE

We looked at the DEXE price history and found the best times to buy DEXE.

| Day of the Week | Thursday |

| Week | 30 |

| Month | March |

| Quarter | First |

DEXE Price History

Let’s take a look at some of the key dates in the DEXE price history. While past performance should never be taken as an indicator of future results, knowing what the token has done in the past can give us some useful context when it comes to either making or interpreting a DEXE price prediction.

| Time period | DEXE price |

|---|---|

| Last week (Jan. 28, 2025) | $21.78 |

| Last month (Jan. 4, 2025) | $19.67 |

| Three months ago (Nov. 4, 2024) | $7.51 |

| One year ago (Feb. 4, 2024) | $2.91 |

| Launch price (Oct. 7, 2020) | $1.56 |

| All-time high (March 8, 2021) | $33.54 |

| All-time low (Nov. 10, 2020) | $0.6535 |

DEXE Market Cap

The market capitalization, or market cap, is the sum of the total number of DEXE in circulation multiplied by its price.

On Feb. 4, 2025, DEXE’s market cap was $1.82 billion, making it the 52nd-largest crypto by that metric.

Who Owns the Most DEXE?

On Feb. 4, 2025, one wallet held nearly 50% of the DEXE supply.

DEXE Supply and Distribution

| Supply and distribution | Figures |

|---|---|

| Maximum Supply | 100,000,000 |

| Circulating supply (as of Feb. 4 2025) | 83,733,347 (83.73% of maximum supply) |

| Holder distribution | Top 10 holders owned 96.06% of supply as of Feb. 4 2025 |

From the DEXE Whitepaper

In its technical documentation, or whitepaper, DeXe says it is “an innovative open-source DAO constructor featuring a library of over 50 contracts continually developed and enhanced through the collaborative efforts of the community and contributors.”

What is DEXE?

Deze is a platform that allows people to create their own decentralized autonomous organizations (DAOs). It is powered by the DEXE token and is based on the Ethereum blockchain.

How DEXE Works

People who hold DEXE can vote on changes to the DeXe protocol. They can also buy, sell, and trade DEXE on exchanges.

Because DeXe is based on Ethereum, DEXE is a token, not a coin. You might see references to such things as a DEXE coin price prediction, but these are wrong.

Is DEXE a Good Investment?

It is hard to say. DEXE has been in an uptrend lately, but we don’t know for sure whether it can maintain its momentum. The high centralization of ownership, with the top three wallets owning more than 80% of the maximum supply, is also something of a worry.

As always with crypto, you must do your own research before investing in DEXE.

Will DEXE Go Up or Down?

No one can really tell right now. While the DEXE crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind that prices can and do go down and up.

Should I Invest in DEXE?

Before you decide whether or not to invest in DEXE, you will have to research DEXE and other related coins and tokens, such as BEAM or BTT. Either way, you will also need to ensure you never invest more money than you can afford to lose.