Riot Platforms recently detailed a shift away from its traditional Bitcoin mining focus toward building large-scale AI and high‑performance computing data centers, starting with core‑and‑shell development of two buildings at its Corsicana, Texas campus following land acquisition and campus design completion earlier this year.

This move recasts Riot as a power‑rich digital infrastructure developer rather than a pure crypto miner, raising fresh questions about execution, capital intensity, and how effectively it can monetize its low‑cost power and land assets in the competitive data center market.

Next, we’ll examine how Riot’s decision to prioritize AI‑focused data center development at Corsicana could reshape its previously mining‑centric investment narrative.

Riot Platforms Investment Narrative Recap

To own Riot today, you have to believe it can convert its power‑rich Texas footprint into profitable AI and high‑performance computing data centers, while still managing exposure to Bitcoin price swings. This week’s Corsicana pivot announcement directly affects the key near term catalyst, which is securing credible AI or HPC leases, and heightens the biggest current risk around capital intensity, financing needs, and potential underutilization of newly built capacity.

Among recent developments, the upsizing of Riot’s credit facility with Coinbase Credit to up to US$200,000,000 stands out, because it directly relates to how the company may fund its shift toward large scale data center infrastructure at Corsicana. How Riot balances this expanded access to debt against already high capital expenditure requirements will feed into both progress on AI leasing catalysts and investor concerns about returns on the build out.

Yet behind the appeal of AI powered growth, investors should be aware of the risk that large new data center capacity could remain underutilized if...

Riot Platforms’ narrative projects $992.8 million revenue and $125.7 million earnings by 2028.

Exploring Other Perspectives

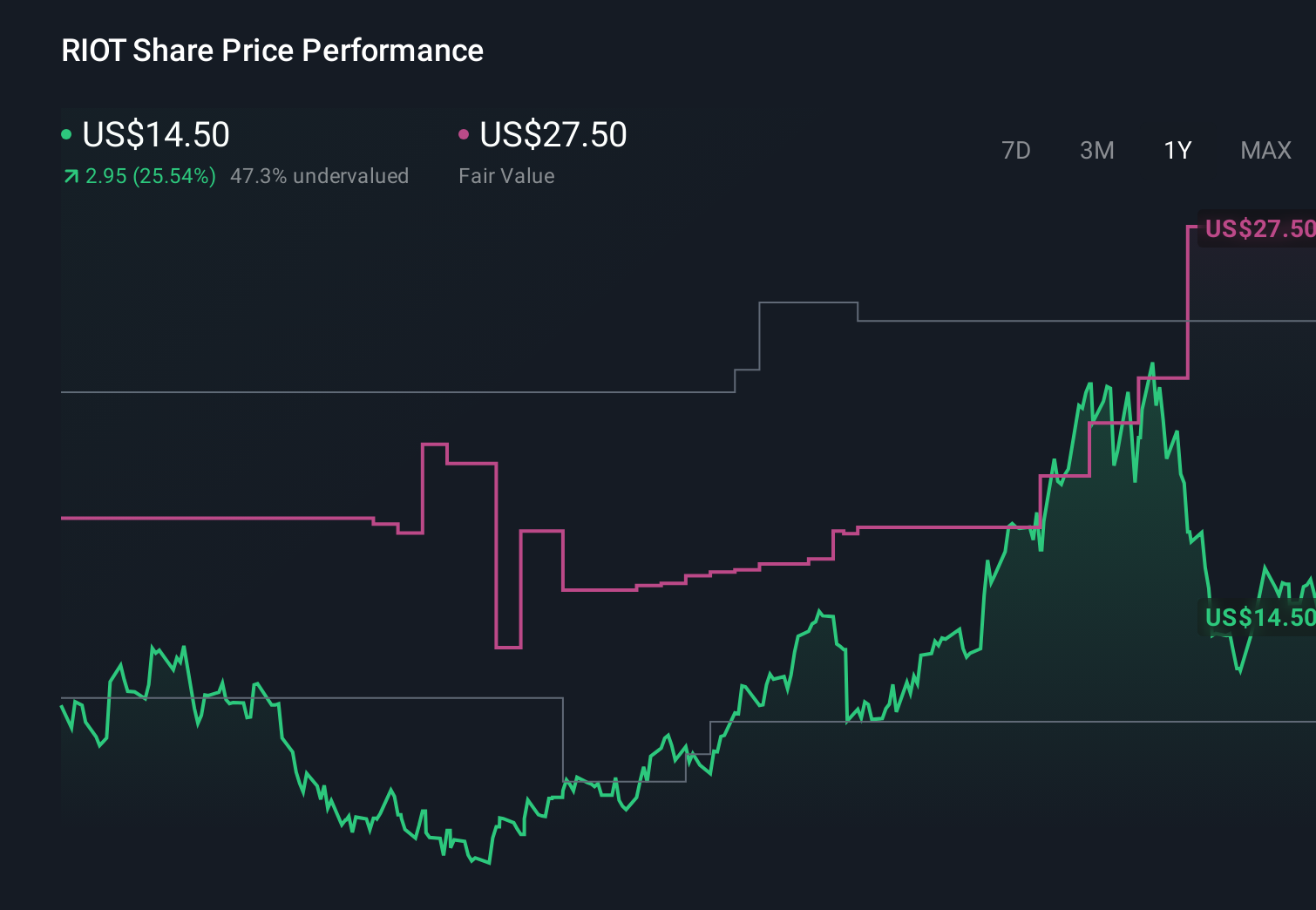

Five members of the Simply Wall St Community currently see Riot’s fair value between US$15 and US$27.50, underscoring how differently you can assess the same stock. Against that wide range, the recent pivot toward AI and HPC data centers puts even more weight on the risk that significant new capacity might not be fully leased, which could materially affect future returns and is worth comparing with several independent viewpoints.

Explore 5 other fair value estimates on Riot Platforms - why the stock might be worth just $15.00!

Build Your Own Riot Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Our free Riot Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Riot Platforms' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.