XRP trades under broader market pressure while BNB tests $840 support. DeepSnitch AI bonus codes offer up to 100% extra tokens before January 1.

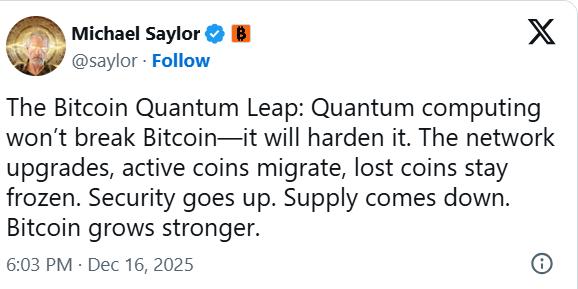

Quantum computing threats are pushing blockchain networks to upgrade their security infrastructure. Michael Saylor argued that quantum computing will actually strengthen Bitcoin, while many debate timelines for when the threat becomes real.

Meanwhile, VivoPower announced plans to acquire up to $300 million in Ripple Labs shares for indirect XRP exposure, and BNB Chain launched real-time AWS payment integration. But DeepSnitch AI bonus opportunity stands out. The presale has raised over $840,000 with prices climbing more than 90% from initial entry, and DeepSnitch AI bonus offer codes providing up to 100% extra tokens expire January 1.

Quantum computing forces blockchain security upgrades as threat timeline debated

Blockchain networks are preparing for quantum computing threats that could eventually break current cryptographic standards. The discussion intensified after recent advances in quantum processors, pushing protocols to explore quantum-resistant algorithms before the technology matures enough to pose a real danger. Bitcoin uses cryptography that quantum computers could theoretically compromise, though experts debate when this becomes practical.

Michael Saylor pushed back against quantum concerns, arguing that the technology will actually strengthen Bitcoin rather than weaken it. He suggested that quantum computing advances will drive better security implementations across the network.

As quantum preparation reshapes crypto development priorities, traders are watching how XRP’s institutional partnerships through VivoPower develop, how BNB’s AWS integration drives enterprise adoption, and whether early-stage opportunities like DeepSnitch AI bonus can deliver exponential returns before quantum computing even becomes a practical concern.

XRP institutional moves and BNB AWS payments can’t match DeepSnitch AI bonus potential

DeepSnitch AI price prediction: Live intelligence tools with 100% bonus codes expiring January 1

The presale has crossed $840,000 raised, with token prices jumping over 90% from the initial $0.01510 entry point to the current $0.02903. DeepSnitch AI bonus codes are changing how early investors position themselves before launch.

Code DSNTVIP100 doubles your token allocation on purchases $5,000 or more. Code DSNTVIP50 provides a 50% bonus on purchases of $2,000 or more. The bonus codes expire in January.

What separates DeepSnitch AI from the flood of presale projects is that the tools are live right now. SnitchGPT provides natural language queries for real-time crypto intelligence. Token Explorer delivers deep token intelligence with single-token alerts, risk scoring, time-series analytics, visual risk profiling with liquidity metrics, and holder concentration data.

SnitchFeed and SnitchScan integrate with SnitchGPT for unified monitoring, allowing traders to query any signal and explore any token.

DeepSnitch AI delivers tools traders use right now.

XRP price prediction: Indirect exposure through equity deals raises questions

XRP builds strength through corporate partnerships and institutional adoption, but VivoPower’s latest move highlights a complex problem. The company isn’t buying XRP directly but rather acquiring Ripple Labs equity as a proxy for token appreciation.

The structure targets South Korean investors seeking indirect crypto exposure through traditional financial instruments, yet any returns depend on Ripple’s corporate performance and balance sheet composition rather than XRP’s market price alone.

December 2025 forecasts show downside risk. Technical analysis reveals XRP trading below major moving averages, including the 50-day and 200-day EMAs, reinforcing a bearish short-term trend despite the VivoPower news.

XRP Price Action: 7-Day Technical Overview

Over the past seven days, XRP has declined approximately 4%, trading within a volatile but clearly defined range as sellers defended the $2.00 psychological resistance level. The chart shows a sharp mid-week capitulation toward the $1.78–$1.80 support zone, followed by a swift rebound, suggesting strong demand absorption and a short-term liquidity sweep rather than trend breakdown.

Price has since stabilized above $1.90, forming a tentative higher low that may indicate early consolidation. A sustained move above $1.95–$2.00 would be required to invalidate the corrective structure, while a loss of $1.88 could reopen downside risk.

BNB: AWS integration can’t overcome technical weakness

BNB Chain’s AWS integration represents a practical shift in how companies manage cloud payments, moving away from slow cross-border banking toward real-time blockchain settlement. Amazon Web Services customers can now send payments on-chain through the Better Payment Network using BNB, with transactions settling almost instantly while reducing fees and eliminating clearing delays.

Despite this enterprise-grade utility, BNB traded down roughly 2% as selling pressure built. Technical indicators show BNB failed to hold above $928 earlier in December and has since drifted below its 200-day SMA. BNB remains under key resistance zones, with rising volume alongside falling open interest suggesting position unwinding rather than confident buying.

BNB Price Action: 7-Day Technical Overview

Over the past seven days, BNB has posted a controlled pullback of just over 3%, remaining within a broader consolidation structure after failing to hold above the $890–$900 resistance zone. The chart shows a sharp mid-week sell-off toward the $820–$830 support area, followed by a steady recovery, suggesting a liquidity-driven correction rather than structural weakness.

Price has since reclaimed the $850 region and is forming higher lows, indicating short-term stabilization. A decisive break above $880 would signal renewed bullish momentum, while a loss of $840 could trigger another test of lower support.

The bottom line: Why DeepSnitch AI bonus codes lead December 2025 opportunities

The DeepSnitch AI bonus opportunity combines three elements that established coins can’t match: live intelligence tools working now, early-stage pricing with over 90% gains already realized in presale, and bonus codes offering up to 100% extra tokens before the January 1 deadline.

Code DSNTVIP100 doubles your token allocation on purchases $5,000 or more. Code DSNTVIP50 provides a 50% bonus on purchases of $2,000 or more.