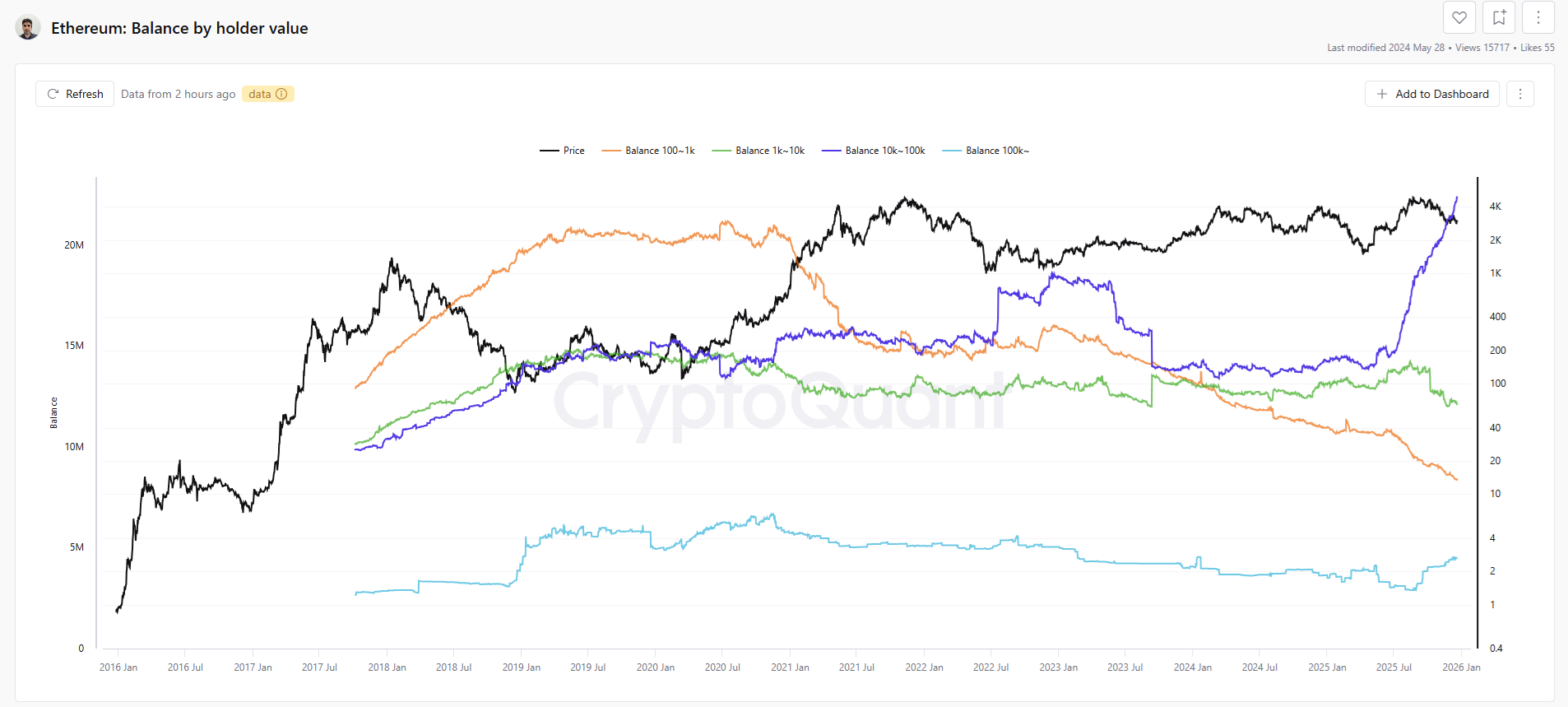

In 2025, ETH marked significant inflows into whale wallets. As retail gave up on the coin, large-scale holders kept accumulating.

ETH wallets with a balance of 10K to 100K ETH are the leading holders toward the end of 2025. ETH whales kept accumulating, especially in the second half of 2025.

ETH is going through a significant shift in holding structure, with tokens flowing out of exchanges and into new self-custodial wallets. In 2025, retail sentiment continued to sink, while whales used the available DeFi tools on Ethereum.

The holdings of smaller wallets, carrying 100-1K ETH, have continued their decline since 2024. The inflows into the wallets of large-scale whales expanded at a much more rapid pace, holding over 22M tokens.

The largest wallets, possibly belonging to exchanges or treasuries, carry around 4.47M ETH, and may not be as influential.

The recent cohort of whales kept buying close to their realized price, even without significant profits. The whale moves are seen as an indicator of an expected breakout, not a bear market for ETH.

Large-scale whales buy the dip on ETH

The collection of large-scale wallets also has a pattern of buying in 2025, avoiding market peaks. Whale accumulation happens at levels where ETH is considered undervalued.

The whale level of holdings also offers support for ETH at around $2,800. Whales become active on ETH at prices under $3,000, with notable buyers like the Seven Siblings wallets getting active in November.

The active pace of buying also signals whales may be more confident in the potential of ETH. The current whale buying did not occur during a hype cycle; instead, whales entered the market during periods of market panic and price weakness.

The whale buying happened as ETH retail sentiment was near all-time lows. At the same time, derivative traders also became more cautious. ETH sentiment shifted between neutral and fearful trading for the past months.

ETH whales extend silent accumulation with long-term confidence

Whales also accumulated ETH while ETF buyers were shedding their holdings. The storage of ETH in new whale wallets also signals long-term confidence from crypto insiders, staging one of the biggest events of building up a reserve.

ETH remains potentially important for DeFi activity and even mainstream finance. The ETH accumulation continued, despite the lack of an altcoin market. ETH may be key to the creation and usage of stablecoins, one of the fastest-growing sectors in 2025.

Ethereum remains a key network for some DeFi protocols, currently holding 95% of the liquidity on protocols like Sky (formerly MakerDAO).

ETH is also key for liquid staking, which is much more rewarding for whales. An ETH reserve can also be used to generate new crypto-backed stablecoins or as collateral in lending protocols. However, the usage of DeFi is also becoming the arena of whales and more experienced traders, leading to the creation of a new cohort of whale wallets.

If you're reading this, you’re already ahead. Stay there with our newsletter.