Bitcoin appears to be transitioning out of a prolonged period of undervaluation, according to fresh on-chain data, as several indicators suggest the market is moving toward a more balanced state rather than approaching a cycle peak.

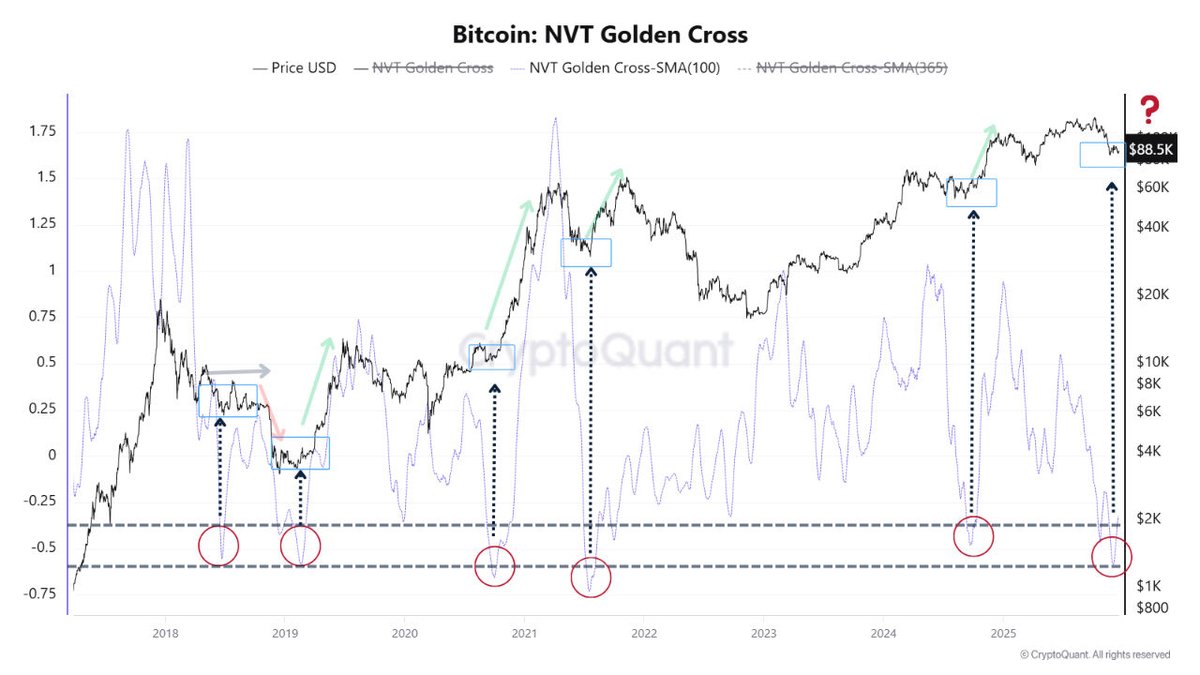

Recent charts tracking Bitcoin’s Network Value to Transactions (NVT) Golden Cross show a familiar historical pattern.

This phase has typically followed major capitulation events, where weaker market participants exit and longer-term capital begins to accumulate. Analysts interpret this shift not as a warning sign, but as a structural reset that often lays the groundwork for more sustainable trends.

Key Takeaways

Bitcoin’s NVT Golden Cross suggests a post-capitulation reset, not a market top

Gold’s new all-time high has revived rotation narratives, but evidence remains mixed

Historical data shows no consistent proof of direct capital flow from gold into Bitcoin

Historically, similar resets have occurred after periods of intense volatility, eventually preceding renewed upside rather than marking tops. Current readings imply Bitcoin is stabilizing after prior excesses, with valuation metrics slowly normalizing.

Gold Hits New Highs, Rotation Narrative Faces Scrutiny

At the same time, gold has surged to fresh all-time highs above $4,420 per ounce, reigniting speculation that capital could rotate from precious metals into Bitcoin. The idea has been widely discussed throughout the current cycle, often framed around Bitcoin reclaiming its role as “digital gold.”

However, this narrative is increasingly being questioned. Analyst Darkfost argues that while the timing may appear compelling, there is limited evidence proving that capital directly migrates from gold into Bitcoin in a consistent or measurable way.

To explore this relationship, Darkfost analyzed historical price behavior using a comparative framework that tracks Bitcoin and gold against their respective 180-day moving averages.

? As gold has just set a new all-time high above $4,420 per ounce, I wouldn’t be surprised to see the capital rotation toward Bitcoin narrative back in force.

This is one of the narratives we’ve heard a lot during this cycle, yet it isn’t really well grounded.

I built this… pic.twitter.com/d6kcKI2kLN

— Darkfost (@Darkfost_Coc) December 22, 2025

What the Data Actually Shows

The model identifies positive signals when Bitcoin trades above its 180-day average while gold remains below its own trend, and negative signals when both assets fall under their long-term averages. While this approach helps highlight periods where Bitcoin may outperform gold, the results are far from conclusive.

Data compiled using historical market cycles shows that outcomes have been mixed. Some rotation periods coincided with strong Bitcoin performance, while others produced little follow-through. This inconsistency suggests that broader macro forces, liquidity conditions, and risk sentiment play a much larger role than simple asset rotation narratives.

According to data visualizations shared from CryptoQuant, Bitcoin’s current positioning reflects normalization rather than speculative excess, even as gold continues to attract defensive capital.

Reset, Not a Top

Taken together, the signals suggest Bitcoin is undergoing a structural reset rather than flashing late-cycle warning signs. While gold’s rally has captured attention, the assumption that its gains will automatically fuel a Bitcoin surge remains unproven.

Instead, analysts emphasize that sustainable Bitcoin trends tend to emerge after periods of consolidation and valuation repair – conditions that appear increasingly present in the current market environment.