Chainlink’s LINK token is trading in a narrow range near the $12 to $12.50 level, a key support zone that has so far held amid broader weakness across the crypto market. While retail trading activity remains subdued, on-chain data suggests larger holders are quietly repositioning rather than exiting the asset.

? LINK is defending the $12.5 support zone even as market fear grips altcoins. On-chain data shows selling pressure stabilizing and buyers stepping in — a sign this could be consolidation rather than breakdown. Holding this level is key before any deeper slide. $LINK #Chainlink pic.twitter.com/3oi05vhiEi

— LEXY BERRY (@akandeolamilek7) December 21, 2025

The divergence between muted price action and continued network activity has drawn attention from analysts, as it may signal underlying strength despite cautious market sentiment.

Price Consolidation Reflects Risk-Off Conditions

LINK’s recent performance mirrors the wider cryptocurrencies market, which has been characterized by low volatility and reduced risk appetite. After failing to extend gains following a technical breakout earlier in the quarter, the token has entered a consolidation phase instead of resuming a clear uptrend.

Technical indicators show waning momentum. The daily Moving Average Convergence Divergence (MACD) has shifted into bearish territory, while the Relative Strength Index (RSI) has printed a bearish divergence. Together, these signals indicate slowing buying pressure rather than aggressive selling, helping explain why price has stabilized rather than declined sharply.

Network Fundamentals Remain Resilient

Despite the lack of price momentum, Chainlink’s underlying usage continues to grow. Data tracking Total Value Secured (TVS) across Chainlink-powered applications shows the metric has risen to approximately $46.03 billion, representing a roughly 2.4% increase over the past month.

This steady expansion suggests ongoing demand for Chainlink’s oracle services across decentralized finance and other blockchain-based applications. The contrast between improving fundamentals and stagnant price highlights the current disconnect between on-chain activity and market sentiment.

Whale Withdrawals Suggest Strategic Positioning

On-chain transaction data indicates that large holders may be using the consolidation period to accumulate. On December 20, a newly created wallet withdrew close to 200,000 LINK—valued at roughly $2.5 million—from Binance. The following day, the same address removed an additional 246,000 LINK, bringing its total holdings to around 446,000 tokens.

Such withdrawals during sideways price action are often interpreted as long-term positioning rather than preparation for near-term selling, particularly when retail participation remains limited.

Exchange Outflows Echo Prior Accumulation Phases

Exchange balance data from CryptoQuant shows a broader trend of LINK moving off centralized trading platforms. Historically, declining exchange balances have coincided with accumulation phases rather than distribution, as holders reduce immediate selling availability.

Similar patterns were observed during earlier market cycles, including periods preceding the 2021 expansion and the base-building phase between 2022 and 2023.

Key Levels Remain in Focus

For now, the $12–$12.50 zone remains pivotal. A sustained breakdown could expose LINK to lower demand levels near $9–$10, while upside momentum is likely capped unless the asset can reclaim major resistance closer to $27. Until clearer direction emerges, Chainlink appears locked in a holding pattern shaped by cautious sentiment and selective accumulation.

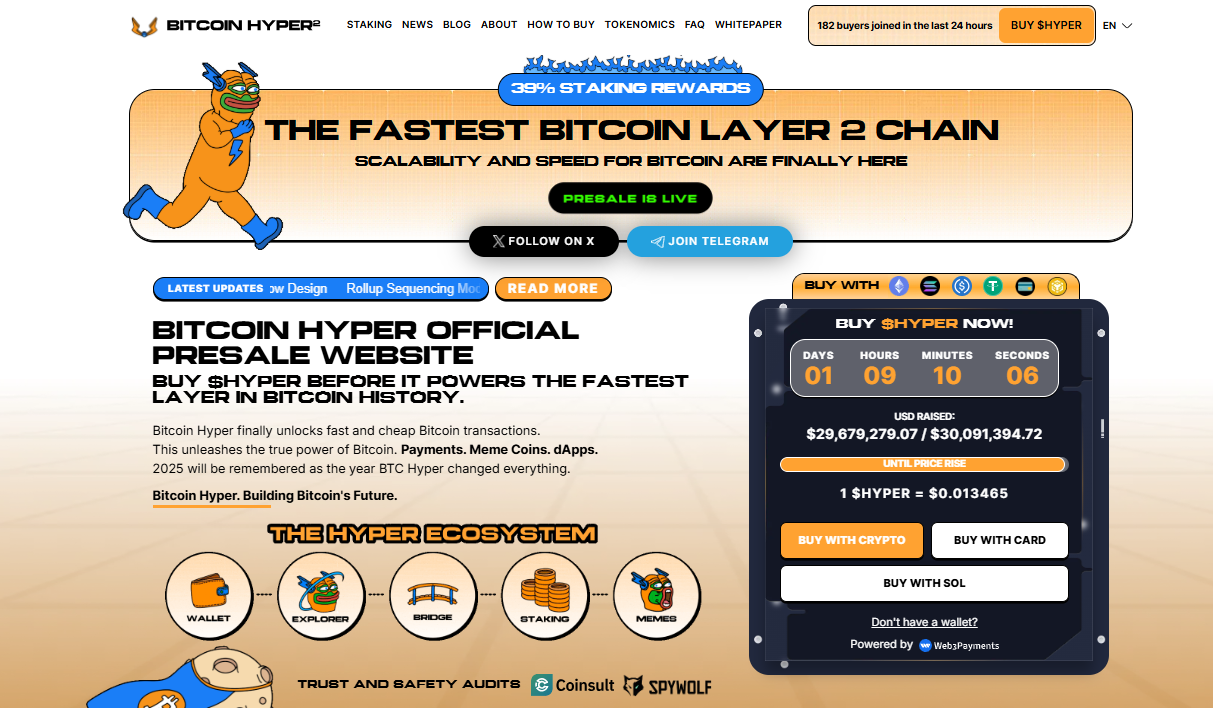

Bitcoin Hyper: A Layer-2 Coin Nearing $30 Million Milestone

Within the broader market discussion around blockchain infrastructure and cross-chain functionality, several projects are exploring ways to extend Bitcoin’s limited programmability. One example is Bitcoin Hyper (HYPER), a Solana-based layer-2 designed to support BTCFi use cases by adding a secondary execution layer that ultimately settles back to the Bitcoin network. The project positions itself as addressing Bitcoin’s lack of native smart contract support and high-throughput applications, aligning with ongoing efforts across the sector to expand Bitcoin’s role in decentralized finance without altering its base layer.

Key points:

already raised over $29.68 million,

less than 32 hours left until its next price increase.