ZKsync Overview

This article was updated with input from Loke Choon Khei in December 2025.

What Is ZKsync?

ZKsync is an Ethereum Layer 2 solution that addresses two fundamental challenges: high transaction fees and slow processing speeds. The protocol leverages zero-knowledge rollup technology to execute transactions off the Ethereum mainnet, bundling thousands of transactions into batches and submitting cryptographic validity proofs back to Ethereum's Layer 1.

In November 2025, Ethereum co-founder Vitalik Buterin publicly endorsed ZKsync, describing its work as "underrated and valuable" following the Atlas upgrade. His support validated ZKsync's technical achievements, catalyzed institutional adoption, and triggered a 50%+ surge in the ZK token price.

Buterin's backing aligns with Ethereum's "Lean Ethereum" strategy, which places ZK rollups at the center of scaling efforts — positioning ZKsync as a cornerstone of Ethereum's long-term vision over optimistic rollups.

From ZKsync Era to the Elastic Network

The project evolved from ZKsync Lite (December 2020) to ZKsync Era (March 2023), the first publicly available zkEVM. In June 2024, the ZKsync 3.0 upgrade transformed the ecosystem from a single Layer 2 into the Elastic Network — an interconnected system of autonomous ZK chains that share liquidity and security.

The Elastic Network solves blockchain's liquidity fragmentation problem by connecting chains at the protocol level through cryptographic proofs rather than traditional bridges. This creates "a united multi-chain ecosystem that feels and behaves like a single chain" with seamless cross-chain interactions, shared liquidity pools, and infinite scalability as new chains can be added without compromising performance.

Cryptographic Security vs. Economic Security

Unlike optimistic rollups that rely on fraud proofs with 7-day challenge periods, ZKsync uses validity proofs that provide mathematical certainty. This means instant finality (1 second vs. 7 days), no reliance on fraud watchers, trustless bridging between chains, and no liquidity lock-up during withdrawals.

The Team and Funding

ZKsync was created by Matter Labs, which has raised $458 million from investors including Blockchain Capital, Dragonfly, Andreessen Horowitz, and Binance. The founding team includes Alex Gluchowski (CEO) and Alexander Vlasov (co-founder), with Nana Murugesan as President (former VP at Coinbase).

How Does ZKsync Work?

ZKsync operates as a Layer 2 rollup that moves computation off the Ethereum mainnet while keeping transaction data available for verification. When users submit transactions, ZKsync processes them off-chain through its node implementation, which maintains the Layer 2 state. Once processed, verified transaction data are posted to Ethereum Layer 1 as calldata or blobs, depending on what is most cost-effective.

The system uses two main components:

ZKsync OS (Execution Layer): Handles transaction processing and maintains the Layer 2 state. It executes smart contracts, processes user transactions, and generates state changes.

ZKsync Gateway (Proof Aggregation): Acts as middleware between Ethereum and ZK chains, aggregating proofs and facilitating interoperability. This allows thousands of transactions to be verified on Ethereum with a single proof, drastically reducing costs while maintaining security through recursive ZK proofs.

Zero-Knowledge Proofs Explained

A zero-knowledge proof is a cryptographic technique that allows one party (the Prover) to prove a statement to another party (the Verifier) without revealing any information beyond its validity.

Think of it like a locked box: Imagine you have a locked box containing a valuable item, and you want to prove to someone that the item is inside without opening the box. A zero-knowledge proof is like having a special transparent window that only shows a shadow confirming something is inside, without revealing what it actually is or any details about it. The verifier can be certain the item exists, but learns nothing else.

In ZKsync's case:

The Prover (ZKsync sequencer) executes batches of transactions and generates a validity proof (zkSNARK)

The Verifier (a smart contract on Ethereum L1) checks the mathematical correctness of this proof

If verified, the L1 contract updates the Layer 2 state, guaranteeing all transactions were valid

This approach provides cryptographic certainty rather than economic security, eliminating the need for challenge periods and enabling instant finality.

Key Features of ZKsync

Here are the key features of ZKsync:

Zero-Knowledge Proofs for Instant Finality

ZKsync uses advanced cryptographic validity proofs (specifically zkSNARKs) to verify transaction correctness rather than relying on optimistic assumptions or additional validators. This provides immediate finality—unlike optimistic rollups that require a seven-day challenge period, ZKsync withdrawals complete in minutes to a few hours, with most operations achieving 1-second finality after the Atlas upgrade.

High Performance and Low Costs

Following the October 2025 Atlas upgrade, ZKsync achieves 15,000-43,000 transactions per second with 1-second finality. The Airbender proof system enables transaction costs as low as $0.0001, representing a 99% reduction from Layer 1 solutions. This combination of speed and affordability makes ZKsync suitable for high-frequency applications like trading, payments, and gaming that were previously impractical on blockchain.

The anticipated Fusaka upgrade (December 2025) is expected to further enhance Layer 2 interoperability and transaction efficiency, with projections suggesting potential throughput increases toward 30,000 TPS.

Native Account Abstraction

ZKsync features built-in account abstraction that surpasses Ethereum's EIP-4337 implementation. This enables gasless transactions, allows users to pay fees in any ERC-20 token (like USDC) instead of ETH, supports multi-signature requirements, enables session keys for smoother user experiences, and provides social recovery mechanisms. Users can interact with the blockchain through passkeys and biometric authentication (FaceID, fingerprints) without managing seed phrases — bringing Web2-level convenience to Web3.

EVM Equivalence

ZKsync achieves EVM equivalence, prioritizing compatibility while making optimizations for proof generation. The platform uses two execution modes:

EraVM (Native): A ZK-optimized virtual machine that offers the best performance and lowest gas costs.

EVM Interpreter: Added in 2025, this allows developers to deploy unmodified EVM bytecode without recompilation on top of EraVM. However, EVM bytecode incurs higher gas costs than native EraVM due to runtime translation overhead.

Both execution modes coexist seamlessly, allowing developers to choose based on their needs — native EraVM for optimal efficiency, or EVM bytecode for maximum compatibility and ease of migration from Ethereum.

Open Source Commitment

ZKsync is fully open-sourced under the MIT license, promoting transparency and enabling anyone to build, audit, or fork the technology. The codebase has undergone extensive third-party audits and public security contests.

The Elastic Network and ZK Stack

The Elastic Network represents ZKsync's evolution from a single Layer 2 into an ecosystem of interconnected ZK chains. This architecture solves critical problems facing blockchain scalability:

Native Interoperability: Chains connect at the protocol level through cryptographic proofs rather than third-party bridges, eliminating security risks and capital inefficiency associated with traditional cross-chain solutions.

Shared Liquidity: All chains tap into a unified liquidity pool on Ethereum, with fast (~1 second) network hops and consistent security guarantees.

Unified User Experience: For users, the Elastic Network operates like a single blockchain — transactions require only one wallet confirmation, assets move seamlessly between chains, and the same address works across the entire ecosystem.

Chains on Elastic Network: Notable ecosystem participants include Cronos zkEVM (Crypto.com's Layer 2), Abstract (the chain by the creators of Pudgy Penguins), Lens Protocol (decentralized social), Sophon, GRVT, Zero Network, Memento (institutional finance), and Space and Time (decentralized data warehouse).

The ZK Token and Governance

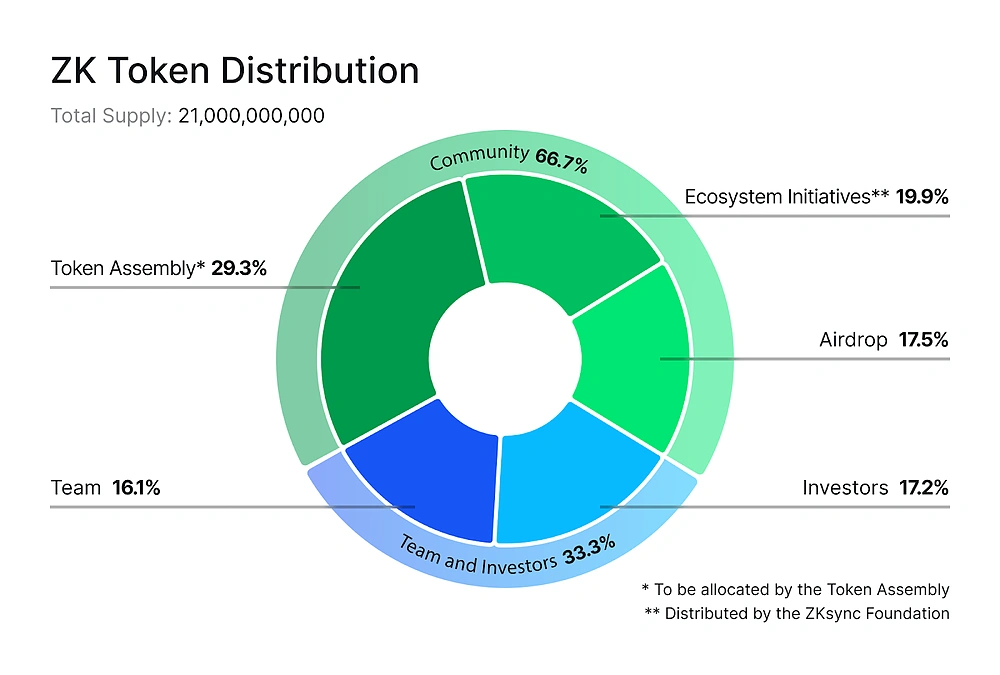

The ZK token officially launched in June 2024 with a maximum supply cap of 21 billion tokens. Rather than minting all tokens at launch, ZKsync uses a capped minter system that enables just-in-time minting, reducing treasury risks and providing flexibility in distribution timing.

Source: https://www.zknation.io/blog/zk-token

Token Distribution:

Community Airdrop - 17.5%: One-time distribution to 695,232 wallets with no lockup periods, fully liquid from day one

Token Assembly - 29.3%: Governed by community through Token Program Proposals

ZKsync Foundation - 19.9%: Administers ecosystem initiatives supporting protocol growth

Investors - 17.2%: Subject to 4-year vesting schedule with one-year cliff

Matter Labs Team - 16.1%: Subject to 4-year vesting schedule with one-year cliff

The one-year cliff passed in June 2025, unlocking 3.6% of total supply from team and investor allocations. After June 2025, a maximum of 0.8% of token supply unlocks monthly until June 2028. The community airdrop claim window closed on January 3, 2025, with unclaimed tokens added to the Token Assembly allocation for governance distribution.

Governance: ZK Nation

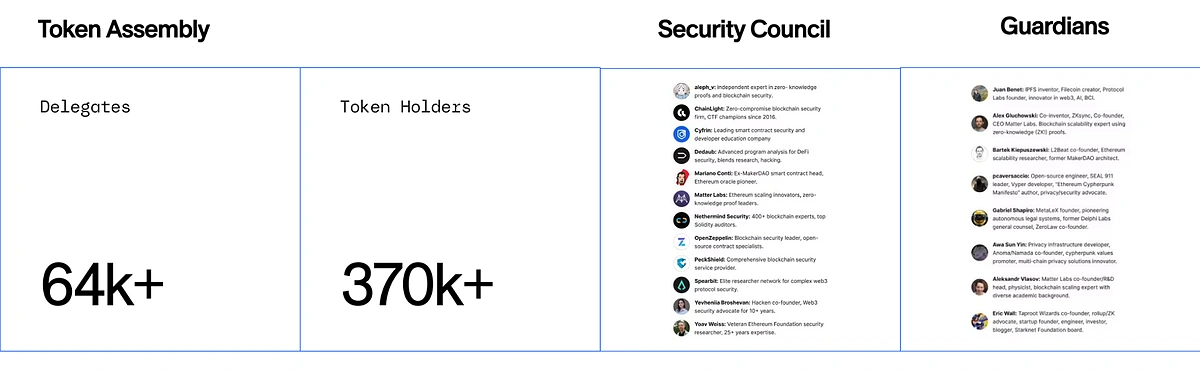

The ZK token serves as the core of decentralized governance through ZK Nation, which employs a three-body model ensuring no single entity controls the protocol:

Source: https://docs.zknation.io/voting-and-delegation/zksync-governance-101

Token Assembly: The primary governance body allocated 29.3% of total token supply. Token holders vote (through delegation) on protocol upgrades, network fees, Token Program Proposals that distribute ZK tokens to ecosystem initiatives, and core aspects of the system.

Security Council: A specialized group responsible for emergency responses and security-critical decisions, providing rapid reaction capabilities when needed.

Guardians: A protective layer ensuring the system operates within intended parameters and can intervene in extraordinary circumstances.

Token Utility

Current Uses:

Protocol Governance: Vote on ZKsync Improvement Proposals for protocol upgrades, including changes to smart contracts and core infrastructure

Token Program Allocation: Participate in Token Program Proposals aligned with the ZK Credo

Governance Advisory: Vote on off-chain governance decisions through Governance Advisory Proposals

Network Fees: Pay transaction fees on ZKsync chains using native account abstraction features

Delegation: Delegate voting power to representatives who actively participate in governance

Proposed Economic Utility (November 2025): A major governance proposal introduced by co-founder Alex Gluchowski aims to add direct value accrual to the ZK token. If passed by ZK Nation, this would use all network revenue (from on-chain interoperability fees and off-chain enterprise licensing) to fund a combination of token buybacks, token burns, and staking rewards for ZK holders, transforming ZK from a pure governance token to an asset with real economic utility tied directly to network usage.

Institutional Adoption and Real-World Use Cases

ZKsync has attracted significant institutional interest, positioning itself as infrastructure for bringing traditional finance on-chain.

Deutsche Bank: Project Dama 2

Deutsche Bank is developing an Ethereum Layer 2 blockchain using ZKsync technology as part of Project Dama 2, under the Monetary Authority of Singapore's Project Guardian initiative. The project involves 24 major financial institutions testing blockchain technology for asset tokenization and aims to address compliance challenges faced by financial institutions when using public blockchains.

Built by Memento Blockchain using the ZK Stack, Project Dama 2 features a trusted verifier mechanism and grants regulators special supervisory authority, enabling confidential, institution-grade fund issuance while maintaining regulatory oversight. A minimum viable product launched in 2025.

UBS: Tokenized Gold Pilot

UBS conducted a technical proof-of-concept for its UBS Key4 Gold product using ZKsync Validium, testing the platform's ability to support tokenized gold investments with privacy, scalability, and interoperability. The $5.7 trillion banking giant deployed smart contracts on a ZKsync Validium testnet to simulate the UBS Gold Network, testing gold token issuance, transaction processing, and reconciliation.

The pilot successfully demonstrated that ZKsync's Layer 2 technology could meet UBS's requirements for expanding its digital gold offerings globally while maintaining privacy and regulatory compliance.

Tradable: Tokenized Private Credit

Tradable has tokenized $2.1 billion in institutional-grade private credit on ZKsync. The platform brings Web3 technology to traditional asset managers, enabling them to tokenize institutional-grade investment opportunities and access new investor bases.

Tradable accounts for nearly 90% market share among ZKsync's RWA protocols, with partnership support from Victory Park Capital, Janus Henderson Investors, ParaFi Capital, Matter Labs, and Spring Labs.

Enterprise Solutions: Prividium

Prividium provides chain-level privacy where business logic remains private by default, revealed only when necessary. It features built-in KYC/AML integration, selective disclosure capabilities, and cryptographic proofs that satisfy regulatory requirements without exposing personally identifiable information. According to ZKSync, more than 35 institutions participated in workshops around Prividium. Prividium chains can also connect to public ZKsync chains, creating unprecedented synergy between Web3-native, enterprise, and institutional ecosystems.

Notable Projects on ZKsync

ZKsync has cultivated a thriving ecosystem of decentralized applications that leverage its high-speed, low-cost infrastructure. Here are some of the leading protocols:

SyncSwap

SyncSwap is one of the top DeFi protocols on ZKsync, recently announcing its V3 upgrade featuring Range Pools for enhanced capital efficiency, transforming it into a hyper-model DEX with multiple pool types optimized for different use cases.

The platform's Multi-Pool technology integrates various pool models — including Classic Pools for general trading and specialized pools for different scenarios — providing greater capital efficiency and flexibility to liquidity providers. SyncSwap is also preparing to distribute its SYNC governance token airdrop, and currently operates across multiple Layer 2 networks including ZKsync, Linea, Scroll, and Sophon.

ZeroLend

ZeroLend is a multi-chain lending protocol built on ZKsync and other Layer 2 networks, offering a decentralized, non-custodial liquidity market for borrowing and lending digital assets. As the largest lending protocol on ZKsync, ZeroLend operates with its own insurance fund — allocating a portion of platform fees to ensure growth over time.

The protocol features comprehensive DeFi lending with support for various assets, the ONEZ yield-bearing stablecoin that captures native yields from lending, and native account abstraction enabling gasless transactions and social logins. ZeroLend completed a $3 million seed round in February 2024, and has integrated ZKsync's account abstraction features including Paymasters for ERC-20 fee payments and delegated transactions.

GRVT (Gravity)

GRVT is a hybrid decentralized exchange pioneering a self-custodial centralized exchange model that removes Web3 UX complexities while maintaining self-custody and composability. As zkSync's first Hyperchain, GRVT operates as a Layer 3 Validium in the zkSync ecosystem, targeting the multi-trillion dollar derivatives market.

The platform launched its mainnet alpha in late 2024, initially offering perpetual trading before expanding to crypto spot and options trading. GRVT raised $19 million in Series A funding in September 2025, co-led by ZKsync and Further Ventures, with backing from EigenCloud and 500 Global. The exchange aims to process up to 600,000 trades per second with less than two milliseconds of latency, bridging the gap between centralized exchange performance and decentralized security.

Final Thoughts

ZKsync has evolved from an ambitious Layer 2 project into a comprehensive blockchain infrastructure platform positioned at the intersection of cutting-edge technology and institutional adoption. The transformation from ZKsync Era into the Elastic Network demonstrates Matter Labs' vision of creating blockchain infrastructure that delivers Web2-level performance with Web3's trustlessness and self-sovereignty.

With partnerships with major financial institutions including Deutsche Bank and UBS, ZKsync is establishing itself as critical infrastructure for the next generation of blockchain applications. The combination of breakthrough technologies like Airbender (enabling sub-second proofs at $0.0001 per transaction) and Prividium (enterprise-grade privacy), native account abstraction for improved user experience, and the Elastic Network's solution to liquidity fragmentation creates a compelling foundation for mainstream blockchain adoption.

As the ecosystem continues expanding, ZKsync's focus on developer accessibility, institutional-grade privacy and compliance, and seamless interoperability positions it as a key player in bridging traditional finance with decentralized Web3 — bringing the benefits of blockchain technology to global-scale applications and everyday users.