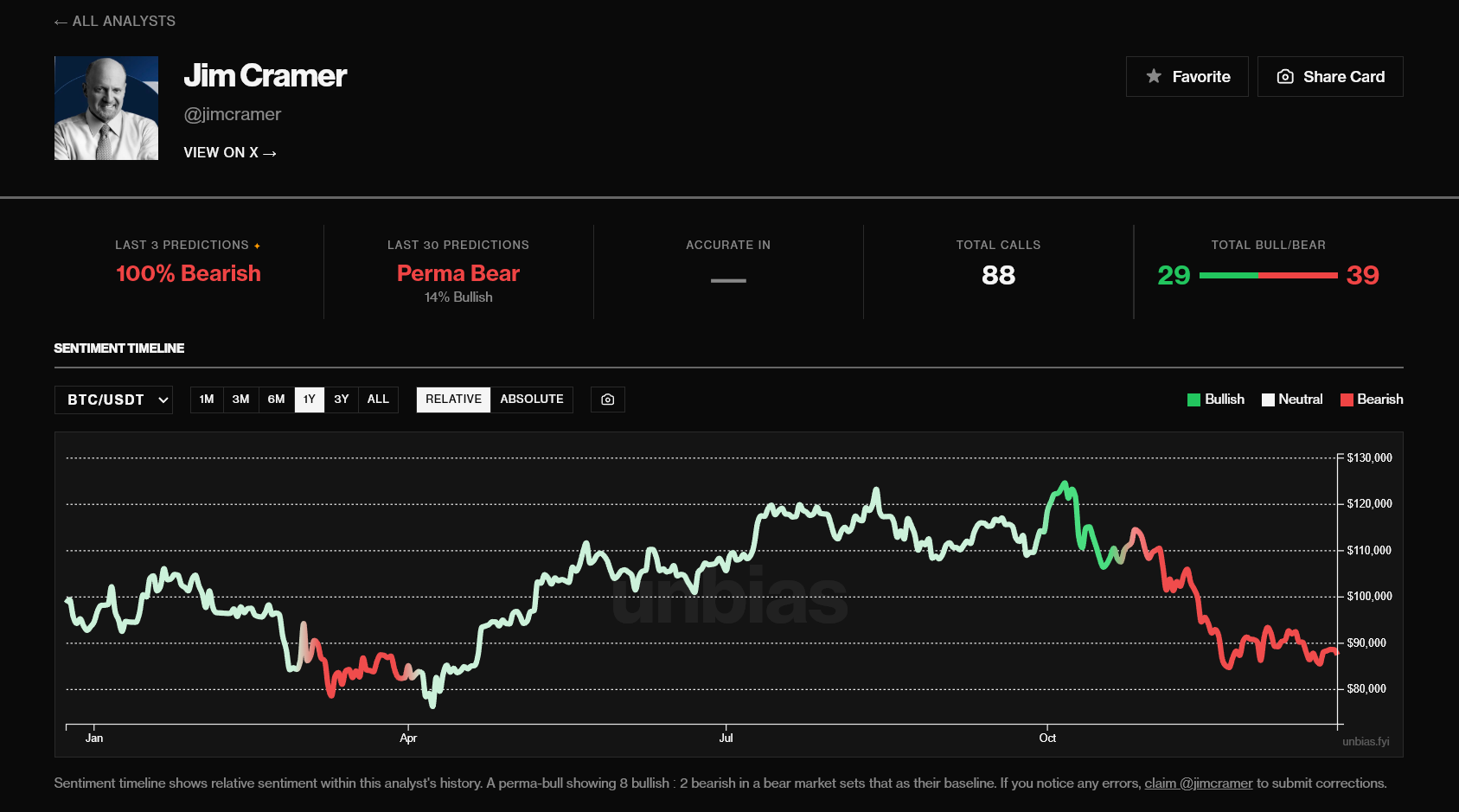

Jim Cramer’s latest Bitcoin stance has flipped to 100% bearish, according to sentiment-tracking data from Unbias.

The shift immediately caught the attention of crypto traders, not because Cramer commands Bitcoin’s direction, but because his calls have become an informal sentiment indicator inside the market.

Inverse Cramer Narrative In Full Flow?

Data shows that Cramer’s last three Bitcoin predictions were all bearish, pushing his near-term outlook into what Unbias categorizes as “perma-bear” territory.

Jim Cramer Bitcoin Prediction. Source: Unbias

Historically, such moments tend to spark discussion across crypto social channels, where Cramer’s commentary often triggers the well-known “Inverse Cramer” narrative.

This latest turn comes as Bitcoin trades in the mid-$80,000 range.

Since the October 10 crash, price action has remained choppy and defensive.

Analysts broadly describe the market as range-bound, with resistance near $90,000–$93,000 and structural support closer to $81,000–$85,000.

The failure to reclaim higher levels before year-end has weighed on short-term sentiment.

All Signs Point to a Bitcoin Bear Market?

Market indicators reinforce that cautious tone. The Crypto Fear & Greed Index recently slipped into “Extreme Fear”, reflecting risk aversion rather than panic buying.

At the same time, spot Bitcoin ETFs recorded consecutive daily outflows into the Christmas week, signaling reduced institutional appetite as investors lock in profits and rebalance portfolios ahead of year-end.

US Bitcoin ETFs Continue to Bleed. Source: SoSoValue

Against that backdrop, Cramer’s bearish shift fits the prevailing mood — but it also explains why his views remain so visible in Bitcoin circles.

As the long-time host of Mad Money, Jim Cramer has become a cultural reference point for crypto traders.

His emphatic, short-term calls often clash with Bitcoin’s cycle-driven nature, turning his commentary into a meme-driven contrarian signal rather than conventional analysis.

That dynamic has persisted through multiple market cycles. When Cramer grows confident in one direction, crypto traders often treat it as a sentiment extreme rather than a forecast.

Looking ahead to the New Year’s week, analysts expect thin liquidity and heightened volatility. Bitcoin’s direction may hinge on whether ETF flows stabilize and whether price can reclaim the $90,000 level after options-related positioning clears.

Until then, Cramer’s 100% bearish read may say less about Bitcoin’s fundamentals — and more about how cautious the market feels heading into 2026.