Ethereum is facing renewed selling pressure as market uncertainty deepens and confidence continues to erode across the broader crypto landscape. After weeks of fragile price action and failed recovery attempts, ETH has struggled to attract sustained demand, pushing an increasing number of analysts to warn that the market may be entering the early stages of a bear cycle.

Volatility remains elevated, sentiment is weak, and traders appear hesitant to commit capital as downside risks grow more pronounced.

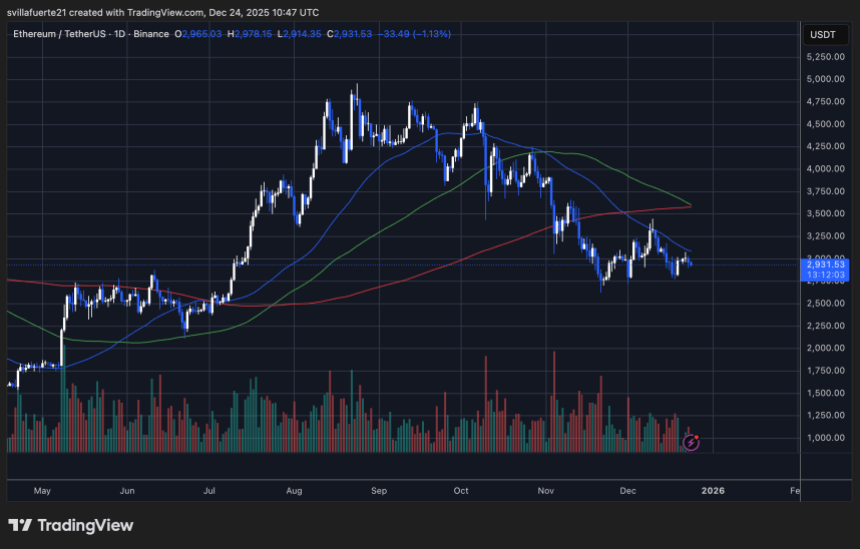

Recent on-chain and technical analysis from CryptoQuant highlights why concerns are mounting. Ethereum’s price structure has tightened into a descending triangle formation, a pattern that often emerges during periods of distribution rather than accumulation.

Price remains capped below a well-defined downtrend line, while key moving averages continue to act as overhead resistance, limiting upside momentum. This compression reflects a market where sellers maintain control, even as prices attempt to stabilize.

Historically, this type of technical setup increases the probability of a downside resolution. In Ethereum’s case, the $2,800 level has become a critical support zone. A sustained break below it would likely confirm a broader bearish continuation, potentially accelerating losses as stop orders are triggered.

On-Chain Supply Tightening Challenges Ethereum’s Bearish Technical Outlook

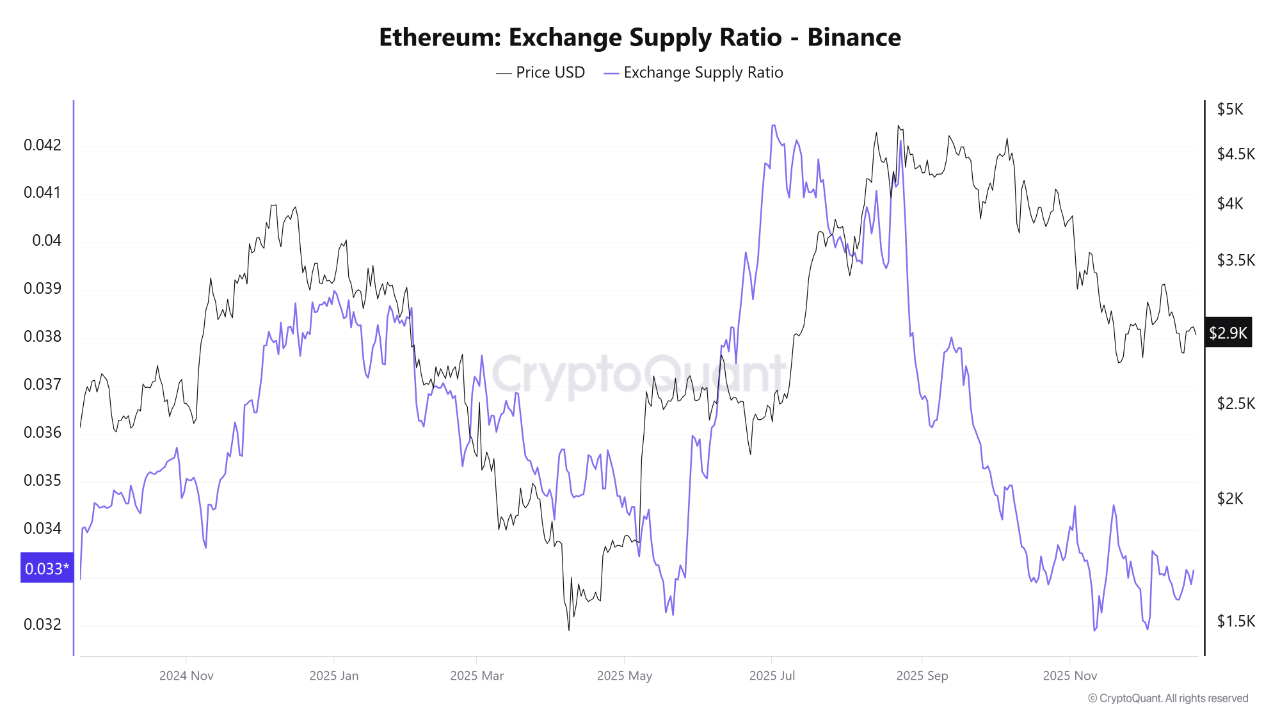

While Ethereum’s price structure continues to reflect stress, on-chain data is telling a more nuanced story. Analysis shared by CryptoOnchain highlights a sharp contraction in the amount of ETH available for immediate sale on major exchanges, particularly Binance. The Ethereum Exchange Supply Ratio on Binance has fallen to 0.032, its lowest reading since September 2024, pointing to a meaningful reduction in liquid supply despite ongoing price weakness.

This drop suggests that market participants are moving ETH off exchanges and into self-custody, a behavior typically associated with longer-term positioning rather than imminent selling. In practical terms, fewer coins sitting on exchanges reduces the immediate sell-side pressure that often exacerbates downtrends. The timing is notable, as this supply contraction is unfolding while Ethereum remains locked in a bearish technical formation.

The contrast between the chart and the on-chain data is becoming increasingly relevant. From a purely technical perspective, the descending triangle and persistent resistance argue for caution. However, shrinking exchange supply introduces the risk of a supply-driven move if demand stabilizes. Should buyers successfully defend the $2,800 support zone, even modest inflows could have an outsized impact on price due to reduced available liquidity.

For now, the market sits at an inflection point. A decisive break above the downtrend line would strengthen the case that accumulation is taking precedence over distribution, potentially shifting the balance away from the prevailing bearish narrative.

Ethereum Consolidates as Bearish Structure Remains Intact

Ethereum is trading around the $2,930 level on the daily chart, continuing to consolidate after an extended decline from its late-summer highs. The broader structure remains technically weak, with price still forming a sequence of lower highs and lower lows since failing to hold above the $4,500–$4,800 zone earlier in the cycle. This rejection marked a clear trend shift, transitioning ETH from expansion into a corrective and potentially distributive phase.

From a trend perspective, Ethereum remains capped below its key daily moving averages. The faster moving average has rolled over sharply and continues to act as immediate resistance, while the 111-day and 200-day simple moving averages sit higher, converging in the $3,400–$3,600 range. This layered resistance suggests that any upside attempts are likely to face strong selling pressure unless momentum improves meaningfully.

Price action over recent weeks reflects indecision rather than recovery. ETH has been oscillating in a tight range between roughly $2,850 and $3,050. Indicating short-term stabilization but not a confirmed reversal. Volume supports this view, as selling spikes dominated the initial breakdown, while subsequent rebounds have lacked strong participation from buyers.

Technically, the $2,800–$2,900 zone remains critical. Holding this area preserves the possibility of base-building, but a decisive breakdown would open the door to a deeper retracement. For structure to improve, Ethereum would need to reclaim the $3,200–$3,300 region and regain acceptance above its declining daily averages.

Featured image from ChatGPT, chart from TradingView.com