Key Notes

XRP price continues to be under selling pressure by whales and long-term holders while extending its six-month downtrend.

XRP realized profit and loss metrics show aggressive Q4 selling at a loss by big players, while active XRP Ledger addresses have fallen to a monthly low.

On the other hand, US spot XRP ETFs have recorded no outflows since launch, attracting $1.13 billion in net inflows and $1.25 billion in AUM.

Ripple’s native cryptocurrency, XRP , continues to be under strong selling pressure and is already trading 7% down since the beginning of 2025. Amid the strong selling pressure coming from whales and long-term holders, the XRP price is on a 6-month downtrend. This comes despite the continuous positive inflows into spot XRP ETFs.

XRP Price May See End of Two-Year Bull Run

The ongoing market cycle risks breaking a two-year run of positive annual returns XRP. XRP price gained 81% in 2023 and surged 238% in 2024, supported by improving regulatory clarity and strong speculative interest. In contrast, this time the altcoin has shown negative returns, in tune with the Bitcoin performance.

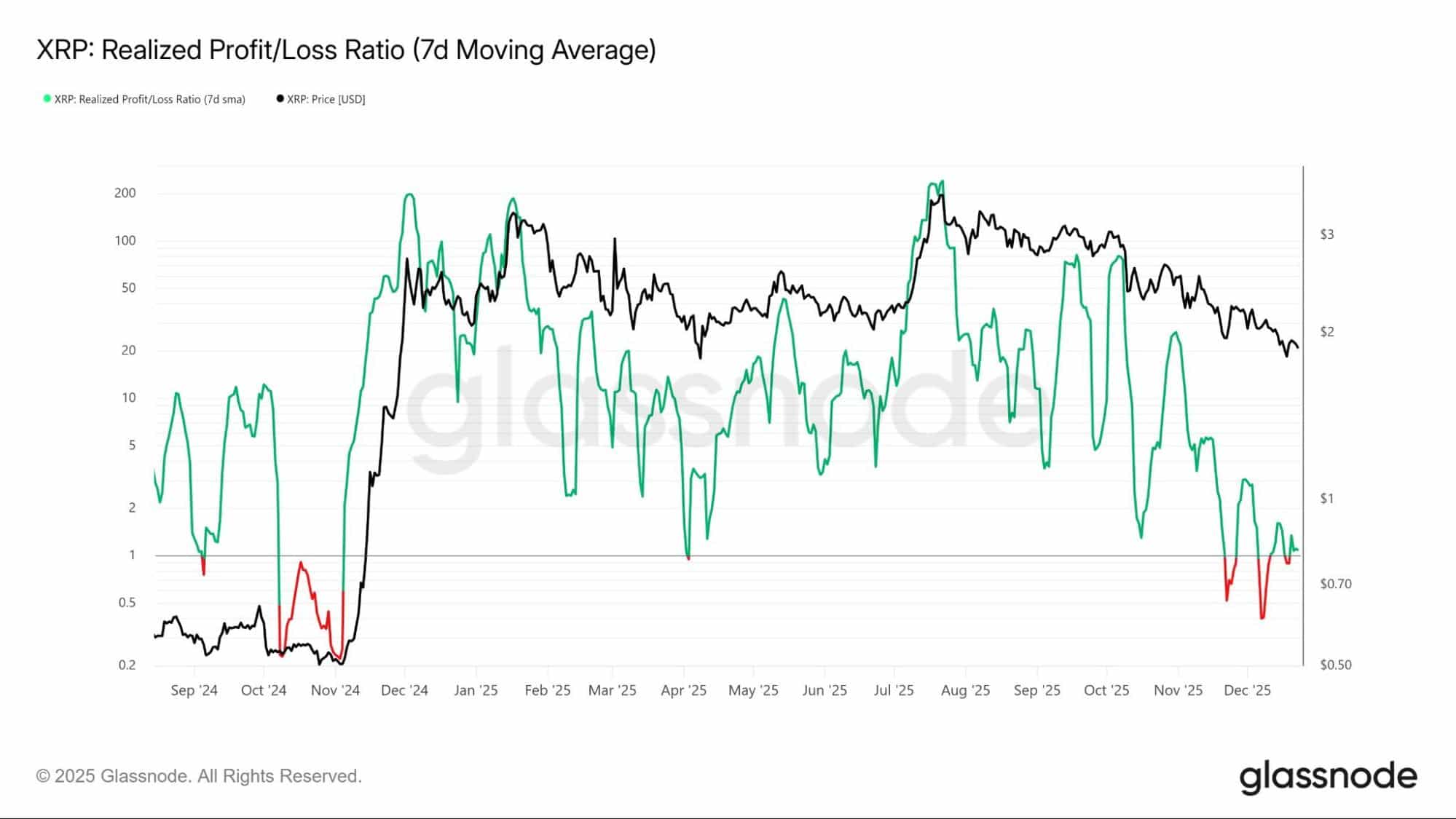

On-chain realized profit and loss data indicate that selling activity in the fourth quarter was very high. XRP holders exited positions at a loss, triggering a major drop in investor confidence.

Related article: XRP ETFs Show Strength, Bitcoin ETF, Ethereum ETFs Bleed $490-$650M Last Week

Historically, large-cap token investors have tended to hold through drawdowns in anticipation of a recovery rather than locking in losses. However, the investor behaviour has shifted during this cycle.

The willingness to sell at a loss reflects growing uncertainty around XRP’s near-term outlook. Moreover, the risk aversion sentiment has outweighed long-term conviction, thereby leading to continuous downside pressure.

XRP Realized Profit Loss | Source: Glassnode

Furthermore, the trading activity on the XRP Ledger has also declined by the end. Network data shows that the number of active transacting addresses fell to a monthly low of 34,005. The decline in participation suggests the absence of active participation from both retail and institutional players.