Jito (JTO) had a rapid intra-day rally after talks of eventual buybacks. The token rose after a Jito Foundation contributor raised the discussion of token buybacks and rewards.

Jito (JTO), the native token of the JitoSOL validator, rose to $2.60 after a 7% intraday rally. JTO is awaiting a breakout, but for now, manages short-term rallies. Immediately after the news, a whale order absorbed over 161K JTO on Binance.

A Jito Foundation contributor launched a forum discussion on potential JTO buybacks or other forms of revenue redistribution. The Jito community and DAO have already proposed various changes to tokenomics to benefit more ecosystem participants.

The contributor pointed out his position is not representative of the Jito Foundation, Jito DAO, or any other associated entities.

“Jito is in a unique position. There are not many examples of DeFi ecosystems which have generated as much real value as quickly as the Jito Network, and most of them are contemporary Solana projects with a limited track record to learn from,” wrote the forum contributor andrewt.

The research noted that Jito was not only a MEV builder and validator, but carried 40% of SOL staked into liquid staking protocols. Jito locks in $2.37B in total value, with a peak of over $3.6B depending on the value of SOL.

Jito stores its fees into the Jito DAO treasury, which is then distributed according to the DAO’s rules of governance. The Treasury receives funds from JitoSOL and the TipRouter. The collected funds are then redistributed through governance, spent on special programs or sent to liquidity pools.

The proposal for new tokenomics suggests more proactive reward distribution, or a form of re-staking for JTO to tap the token’s value within the ecosystem. The proposal looks at the ‘fee switch’ technique, which automatically distributes some of the fees for staked tokens. Jito also has the option to redistribute value through buybacks and burns, modeling other successful protocols on Solana or Ethereum.

The contributor gave examples of successful redistribution from protocols like Raydium (RAY) and PancakeSwap (CAKE), which have a fee switch. GMX also pays fees via a staking mechanism, using ETH and AVAX instead of a native token. Ethena DAO is also in favor of the fee switch, and may become the biggest fee distributor among DeFi projects.

Buybacks are also a common technique for fee distribution, recently adopted by another top Solana protocol, Jupiter (JUP). Jupiter’s program is removing JUP from the market, though without a token burn. The protocol will vest the funds for three years to reduce supply, but will not burn the tokens. Additionally, Jupiter is still to launch another Jupuary in early 2026 with 700M JUP to enter the market.

Jito still among top 10 fee producers

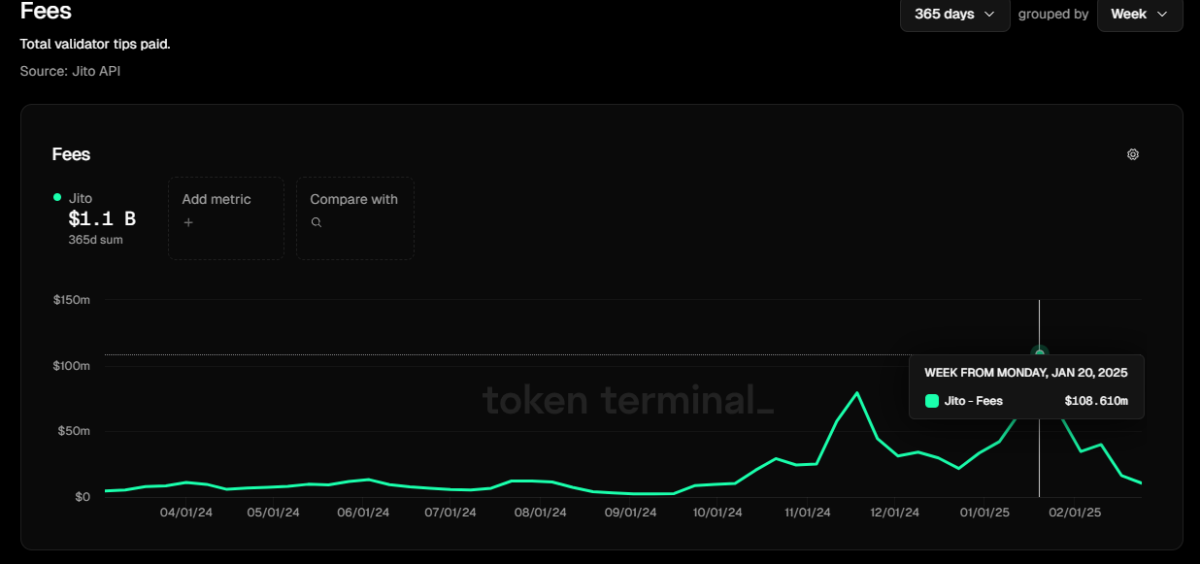

Jito was among the most successful protocols for fee production, especially during the Solana boom in January and February. Since then, the activity has slowed down, and Jito produces $1.3M in daily fees.

Jito’s yearly fees surpassed those of Ethereum’s LidoDAO, reaching $1.04B. The protocol receives over 17M daily tips, gaining between $1.70 and $12 per user, depending on Solana’s varied levels of activity. Jito fees reached a record at $108.6M on January 20, a time of peak token and DEX activity on Solana.

The contributor’s research warns that Jito is still a relatively young protocol, and the recent extraordinary gains may be a one-off event. Additionally, the model of Jupiter, where there is a mix of locked tokens and new airdrops may not work as intended for the token’s price.

The fees and revenues of Jito may have to re-adapt to the new levels of Solana activity, now that the meme token market has slowed down.