According to Charles Hoskinson, the race between Solana and Ethereum looks different depending on the time frame. Solana may win ground quickly because it moves fast. Ethereum looks set to aim for a broader, slower build that could matter more later.

Short-Term Gains For Solana

Solana’s appeal is plain. Its network pushes a lot of transactions every day and it can adopt upgrades more quickly, Hoskinson said. That speed has helped projects bring tokenized stocks and other finance tools onto the chain.

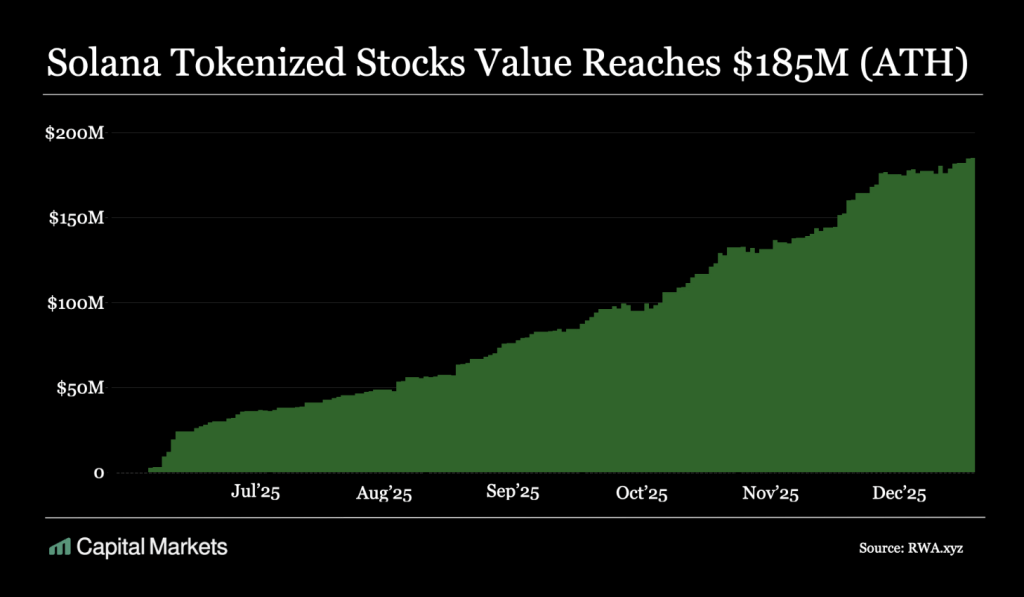

Reports have disclosed that the total value of tokenized equities on Solana recently hit about $185 million. Platforms such as xStocksFi, Superstate, and Remora Markets are among those building there. For traders and some institutions, low fees and high throughput are hard to ignore.

A Large Financial Gap Remains

Still, there are big differences under the surface. Solana’s total value locked and stablecoin use sit at about 10% of Ethereum’s levels. That gap means the kinds of financial activity seen on Ethereum are not yet matched on Solana.

The size of a chain’s financial ecosystem affects what kinds of services and markets can grow on it. So while adoption on Solana is growing, the scale of on-chain lending, staking and stablecoin volumes is still much smaller when compared with Ethereum.

Ethereum’s Research-First Approach

Ethereum’s work is focused on research and longer-term upgrades, especially in areas like zero-knowledge proofs and advanced scaling methods. Reports have suggested that Ethereum is aiming to move more of its validation to cryptographic proof systems so it can act as a verification layer for many networks.

Speed Now, Strategy Later

Hoskinson framed the difference as one of timing. Solana’s leadership and design allow quicker decisions and faster rollout of new features. Ethereum’s path is marked by heavy research and slow coordination.

This means Solana may capture use and attention in the near term, while Ethereum’s technical direction could shape broader infrastructure over a longer span. Both approaches come with trade-offs. One focuses on quick adoption, the other on building systems that rely on stronger mathematical proofs.

What This Means For Markets

For investors and builders, the split is clear: architects chasing rapid growth may prefer Solana today, while those betting on deep financial stacks and broad verification may stick with Ethereum.

The $185 million milestone for tokenized stocks on Solana signals rising trust in blockchain-based equity products, but it is small compared with traditional markets. Reports and comments from industry figures like Hoskinson help explain why different teams pick one chain over another.

In the end, both chains are being tested by real use, and their paths will be measured by what users and institutions choose to run on them.

Featured image from Equiti, chart from TradingView