The crypto market may be drifting into unfamiliar territory. Not because prices can’t rally anymore, but because the forces that decide when, how, and why markets move have fundamentally changed. The old script - retail hype ignites a rally, leverage piles in, everything collapses, and the cycle resets - is starting to look outdated.

That is the deeper implication behind the latest institutional outlook from Coinbase Institutional. Rather than describing a new “bull” or “bear” phase, the report points to a market that is slowly losing its wild-west characteristics and behaving more like a regulated, macro-sensitive financial system.Key Takeaways

Crypto is moving away from hype-driven boom-and-bust cycles toward a more institutional, macro-linked market.

Derivatives now shape price action more than spot trading or retail sentiment.

Regulation is no longer a headwind but part of crypto’s market structure.

Crypto is no longer isolated from the real economy

One of the most important shifts is that crypto is no longer floating in its own speculative bubble. The broader U.S. economy matters again. Rising productivity and a still-resilient labor market are acting as shock absorbers, reducing the odds of sudden liquidity freezes that once crushed risk assets.

Instead of framing the current environment as the final, euphoric stage of a bubble, Coinbase’s analysts lean toward a mid-cycle comparison. Growth continues, but uncertainty remains wide. That distinction matters. It suggests crypto is being shaped by the same forces influencing equities, rates, and global liquidity, rather than by internal hype alone.

Price moves are now engineered, not emotional

The biggest behavioral change in crypto markets is invisible to casual observers. Spot trading is no longer where prices are decided. Perpetual futures and other derivatives now dominate volume, meaning leverage, funding rates, and liquidation thresholds dictate market direction.

This explains why late-2025 drawdowns looked violent but controlled. Excess leverage was wiped out quickly, yet the damage failed to spiral into full-blown collapse. In earlier cycles, similar events would have triggered cascading failures. Today, tighter margin rules and institutional risk management stop the bleeding faster.

The result is a market that still moves aggressively, but for mechanical reasons rather than emotional ones.

Regulation quietly rewired participation

Much of the crypto conversation still treats regulation as a looming threat. In reality, 2025 already changed the game. Clearer U.S. and global frameworks unlocked spot ETFs, digital asset treasury strategies, and standardized custody models.

Instead of chasing speculative upside, institutions are now forced to think in terms of compliance, capital efficiency, and long-term exposure. That shifts behavior. Capital becomes stickier, positioning more deliberate, and exits less disorderly. Regulation, in this context, doesn’t kill volatility – it reshapes it.

Institutions stop “buying crypto” and start using it

Early institutional adoption was simple: buy assets, hold them, signal conviction. That phase is fading. What replaces it is more nuanced. Coinbase’s outlook suggests institutions are beginning to treat crypto infrastructure itself as strategic.

Block space, liquidity access, custody services, and execution quality are becoming the real focus. In other words, crypto is no longer just an asset class – it is becoming operational infrastructure.

Another quiet evolution is happening at the protocol level. As legal clarity improves, token models are shifting away from vague narratives toward direct value capture. Fee-sharing, buybacks, and supply-reduction mechanisms are gaining traction because they can now be justified and structured more clearly.

This pulls crypto closer to revenue-linked valuation frameworks and away from purely sentiment-driven pricing. Tokens start behaving less like stories and more like financial instruments.

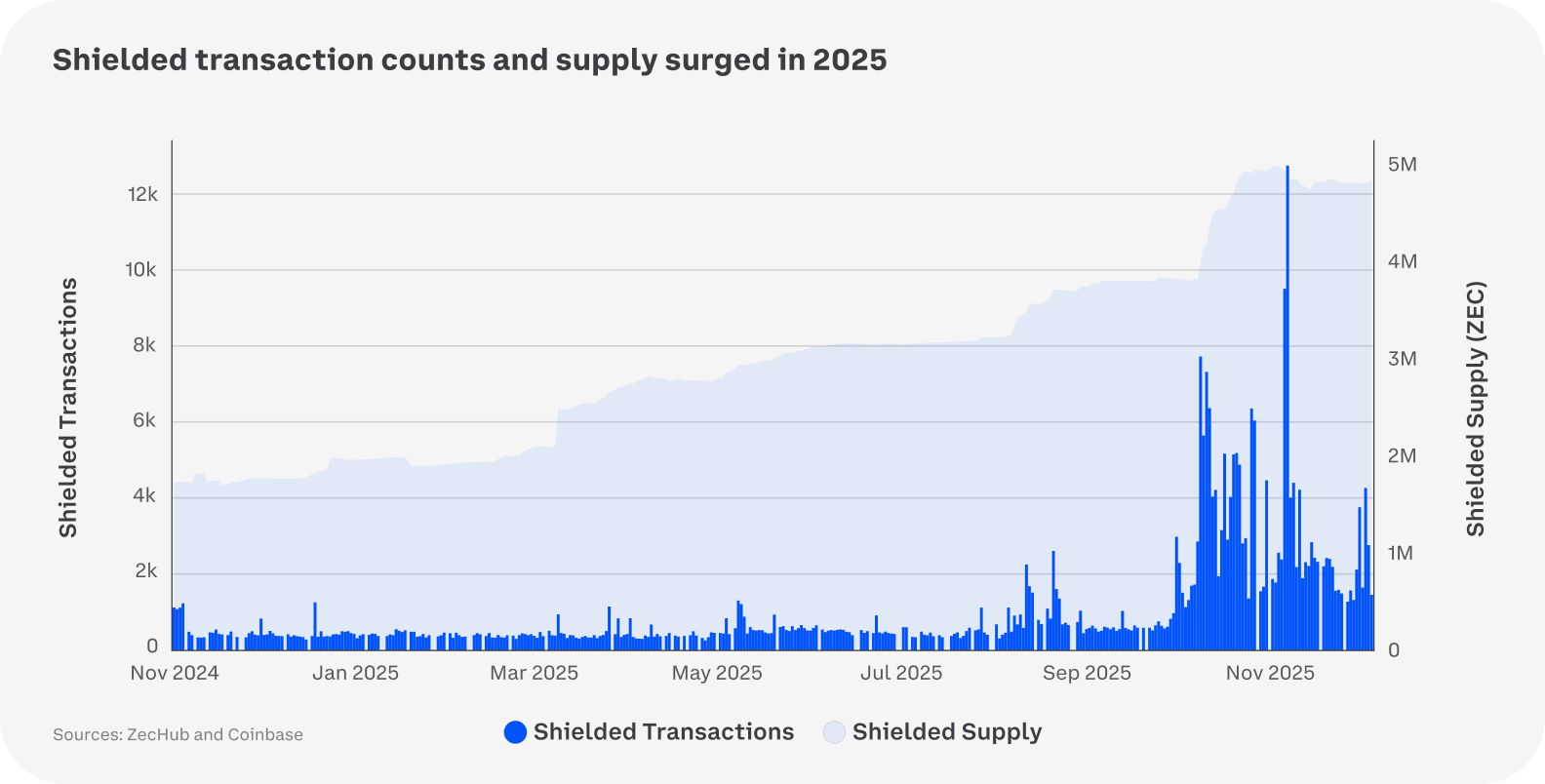

Privacy returns for practical reasons

Privacy is also making a comeback, but not for ideological reasons. As institutions and enterprises use crypto rails, confidentiality becomes a requirement. Technologies like zero-knowledge proofs and advanced encryption are expanding because real economic activity demands discretion.

This trend suggests privacy will coexist with regulation rather than fight it, reshaping how onchain activity scales.

Rather than competing, AI and crypto appear increasingly complementary. Autonomous systems require continuous, programmable settlement layers to function at scale. Crypto rails provide exactly that. The intersection is less about speculation and more about enabling machine-to-machine commerce.

Tokenization inches toward legitimacy

Tokenization of real-world assets remains early, but momentum is building. Tokenized equities, credit, and treasuries gained traction in 2025 because they offer faster settlement, composability, and more flexible collateral structures than traditional systems.

If these advantages survive regulatory scrutiny, tokenization could expand quietly but meaningfully, without the hype that defined earlier crypto narratives.

The next phase for crypto is not about explosive upside or dramatic crashes. It is about durability. Derivatives, stablecoins, prediction markets, and tokenized assets must prove they can grow under regulation, institutional oversight, and macro uncertainty at the same time.

If they do, the crypto market that emerges may feel unfamiliar to veterans of earlier cycles. Less chaotic. Less emotional. And far harder to trade using the old playbook.