KEY TAKEAWAYS

Verge was founded in 2014 as a spin-off from Dogecoin.

XVG has dropped recently but is still up more than 50% year-on-year.

Our Verge price prediction suggests XVG could reach $0.0137 this year.

Interested in buying or selling VERGE XVG coin? Read our review of the best exchanges to buy and sell VERGE XVG.

Verge, a privacy-based crypto coin that has existed since 2014, has been in a downturn since a cycle peak of above $0.02 in early December 2024.

However, it has still managed to rise by more than 50% in the last 12 months, and on Feb. 18, 2025, XVG was worth about $0.006.

Investors hope that founder Justin Valo’s Feb. 17 announcement will “probably” bring a Verge update this week.

Let’s examine our Verge price predictions, made on Feb. 18, 2025. We will also examine the Verge price history and discuss what Verge is and does.

Verge Coin Price Prediction

Let’s now take a look at our Verge price predictions, made by CCN on Feb. 18, 2025. While we take the utmost care with our price forecasts, we need to remind you that price predictions, especially for something as potentially volatile as crypto, can often be wrong.

| Minimum XVG price prediction | Average XVG price prediction | Maximum XVG price prediction | |

|---|---|---|---|

| 2025 | $0.0016 | $0.009 | $0.0137 |

| 2026 | $0.005 | $0.015 | $0.025 |

| 2030 | $0.01 | $0.035 | $0.08 |

Verge Price Prediction 2025

Verge (XVG) is expected to continue its recovery from the recent corrective phase, with a potential bottom near $0.0016 if bearish conditions persist. If a breakout above key Fibonacci levels occurs, the price could average around $0.009, with bullish momentum pushing it toward $0.0137.

Verge Price Prediction 2026

By 2026, broader market cycles and potential network developments could drive XVG higher, with $0.005 as a conservative floor. If adoption and sentiment improve, the price may stabilize around $0.015, with bullish surges reaching up to $0.025.

Verge Price Prediction 2030

Long-term growth prospects depend on sustained adoption and improved market sentiment, with a potential minimum of $0.01. If Verge remains relevant in the crypto ecosystem, its price could average $0.035, with a strong bull market potentially lifting it to $0.08.

Verge Price Analysis

Verge (XVG) has completed a five-wave Elliott structure, followed by an ABC correction, with Wave C nearing support at the 0.786 Fibonacci retracement at $0.0057. The highlighted green zone, a historical reversal region, could trigger a bounce if support holds. However, a breakdown could extend losses toward $0.0016.

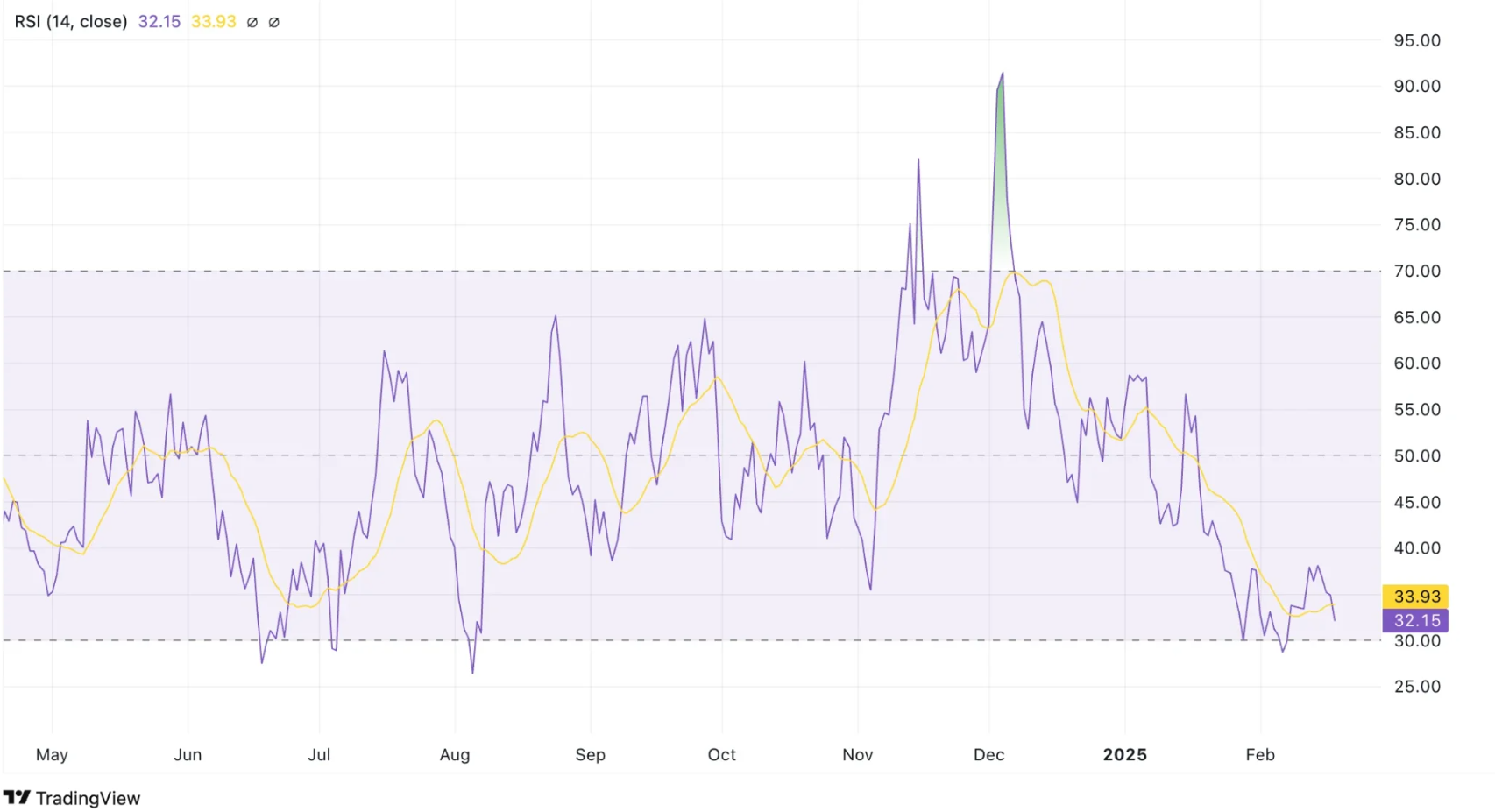

The daily RSI remains oversold, hinting at weakening bearish momentum. Immediate resistance lies at $0.009, with further hurdles at $0.0113 and $0.0137. A breakout above these levels would signal a trend reversal.

Short-term Verge Price Prediction

On the one-hour chart, XVG appears to be in the final wave of its downtrend, targeting between $0.0058 and $0.0016. A rebound could follow if support at $0.0058 holds, initially targeting $0.0090.

A rally beyond this level would confirm a stronger recovery toward $0.0113.

If selling pressure persists, the price may test the lower boundary of the green zone, with $0.0016 as the ultimate support.

The RSI remains oversold, suggesting a possible short-term bounce, but confirmation is needed for a bullish reversal, and the Verge price prediction for the next 24 hours depends on this.

Verge Average True Range (ATR): XVG Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

Looking for a safe place to buy and sell VERGE XVG? See the leading platforms for buying and selling VERGE XVG.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility. Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On Feb. 18, 2025, Verge’s ATR was 0.0009, suggesting relatively high volatility.

Verge Relative Strength Index (RSI): Is XVG Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold.

Movements above 70 and below 30 show over and undervaluation, respectively. Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On Feb. 18, 2025, the Verge RSI was at 32, indicating bearish conditions but not quite oversold.

Verge Price Performance Comparisons

Verge is a smart contract-based privacy coin that was a spin-off from Dogecoin. So, let’s compare how it has performed over the last year with a smart contract platform, a privacy coin, and DOGE.

| Current price | One year ago | Price change | |

|---|---|---|---|

| XVG | $0.006 | $0.00397 | +51.1% |

| XMR | $234.50 | $123.17 | +90.3% |

| KAS | $0.102 | $0.166 | -38.5% |

| DOGE | $0.2525 | $0.0857 | +194% |

Best Days and Months to Buy Verge

We looked at the Verge price history and found the best times to buy XVG.

| Day of the Week | Wednesday |

| Week | 21 |

| Month | December |

| Quarter | Second |

XVG Price History

Let’s now take a look at some of the key dates in the Verge price history. While past performance should never be taken as an indicator of future results, knowing what the coin has done can help give us some very useful context when it comes to either making or interpreting an XVG price prediction.

| Time period | XVG price |

|---|---|

| Last week (Feb. 11, 2025) | $0.007047 |

| Last month (Jan. 18, 2025) | $0.01404 |

| Three months ago (Nov. 18, 2024) | $0.00774 |

| Last year (Feb. 18, 2025) | $0.00397 |

| Five years ago (Feb. 18, 2020) | $0.005057 |

| Launch price (Oct. 26, 2014) | $0.00000697 |

| All-time high (Dec. 23, 2017) | $0.3006 |

| All-time low (Feb. 5, 2015) | $0.000002167 |

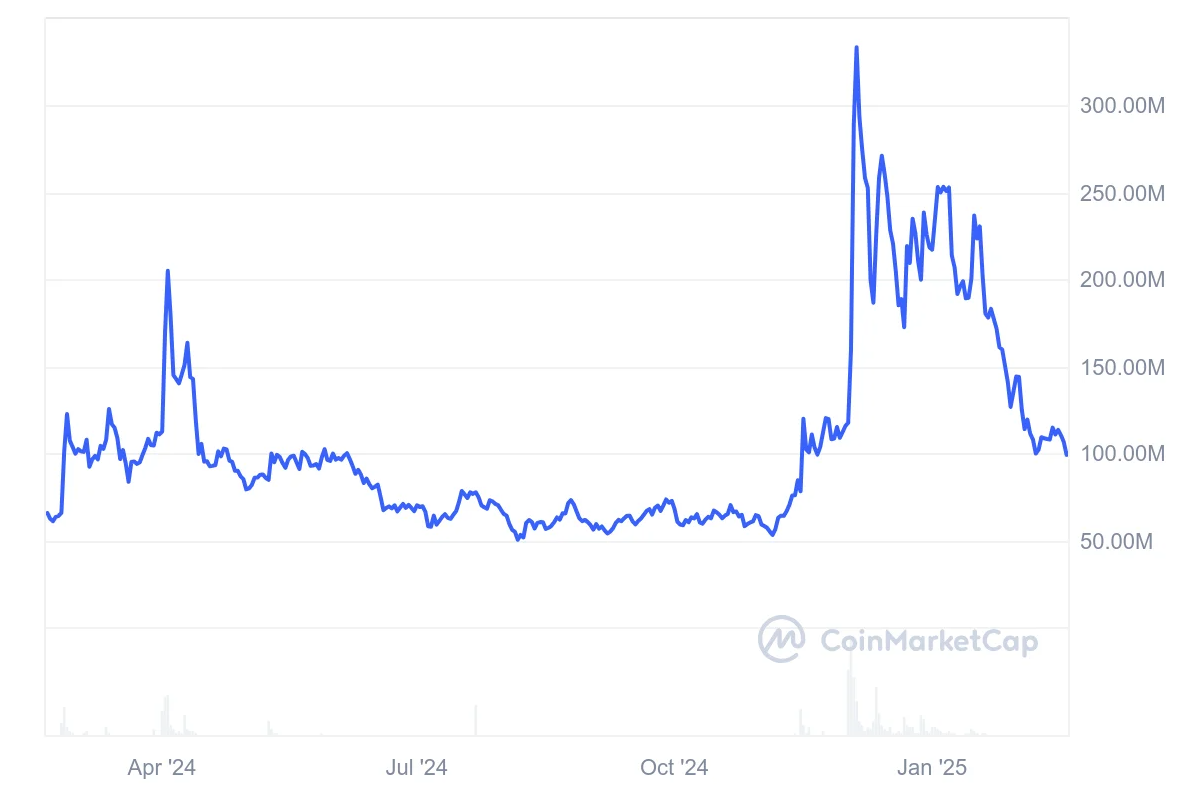

Verge Market Cap

The market capitalization, or market cap, is the sum of the total number of XVG in circulation multiplied by its price.

On Feb. 18, 2025, Verge’s market cap was $99.48 million, making it the 384th-largest crypto by that metric.

Verge Supply and Distribution

| Supply and distribution | Figures |

|---|---|

| Total supply (as of Feb. 18, 2025) | 16,521,951,235 |

| Circulating supply (as of Feb. 18, 2025) | 16,521,951,235 (100% of total supply) |

From the Verge Whitepaper

Verge’s technical documentation, or whitepaper, says: “Verge was created to bring tailored transactional applications and inherent privacy implementations to strengthen user obfuscation while maintaining Nakamoto’s vision of a decentralized electronic payment system based on cryptographic proof instead of third-party trust.”

Verge (XVG) Explained

One of the key concepts behind the blockchain and cryptocurrency is that it is supposed to be private.

However, there have been some concerns about people’s details and transactions being revealed on the blockchain, leaving some crypto enthusiasts searching for a coin or token that offers them real anonymity.

Verge is a platform that promises people privacy. Created as a hard fork, or spin-off, of the Dogecoin (DOGE) blockchain, it was founded in 2014 by crypto entrepreneur Justin Valo and rebranded to Verge in 2016.

Verge is supported by its native, eponymous coin, which goes by the ticker handle XVG.

How Verge Works

Verge uses technology to blur people’s online locations and IP addresses, which should, in theory, stop them from being identified by people who want to know who is buying which crypto at any time.

The system also features Atomic Swaps, which allow people to exchange crypto tokens across different blockchains and, hopefully, prevent the need for centralized exchanges.

The Verge blockchain uses a Proof-of-Work (PoW) consensus mechanism. This mechanism requires people to solve increasingly complex mathematical equations to verify transactions and add blocks to the blockchain. In return, they are paid in XVG.

XVG is also used to pay for Verge transactions, which can be bought, sold, and traded on exchanges.

Is Verge a Good Investment?

It is difficult to tell right now. Verge is a long way from the top 100 cryptos, and considering it has been around for more than 10 years now, it is hard to see what it could do to remove it from obscurity.

Not only that, but Verge’s focus on privacy could attract regulators’ unwanted attention, which would be bad news for the XVG price.

As always with crypto, you should do your own research before deciding whether or not to invest in XVG.

Will Verge go up or down?

No one can really tell right now. While the longer-term Verge crypto price predictions are largely positive, with the exception of CaptainAltCoin, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can and do go down as well as up.

Should I invest in Verge?

Before you decide whether or not to invest in Verge, you will have to do your own research, not only on XVG but also on related coins and tokens such as Monero (XMR) or Zcash (ZEC).

Either way, you must also ensure that you never invest more money than you can afford to lose.