Bitcoin may be approaching a familiar turning point against gold, according to a growing number of analysts watching the BTC/gold ratio rather than headline prices.

A recurring historical sequence is back in focus. In previous cycles, gold tended to lead during periods of macro uncertainty, while Bitcoin lagged. During that phase, the Bitcoin-to-gold ratio compressed for extended periods, quietly building pressure.

Key Takeaways

The BTC/gold ratio is back in a tight range that in past cycles came before Bitcoin outperformed gold.

Macro models still warn Bitcoin could lag if market volatility stays low.

Technical signals suggest gold may be losing momentum, a setup that previously favored Bitcoin.

When the balance eventually shifted, Bitcoin began to outperform sharply, often before sentiment or narratives changed.

Why the BTC/gold ratio matters more than price headlines

Market observers stress that this type of transition rarely announces itself. Instead of showing up in news flow or investor sentiment, it usually appears first in relative performance. The ratio tightens, volatility fades, and then momentum flips. At present, BTC/XAU is again trading near structural zones that in past cycles preceded Bitcoin taking the lead from gold.

Bloomberg view: muted volatility could still favor gold

Not everyone is convinced a rotation is imminent. Bloomberg’s Mike McGlone recently cautioned that Bitcoin could continue underperforming gold.

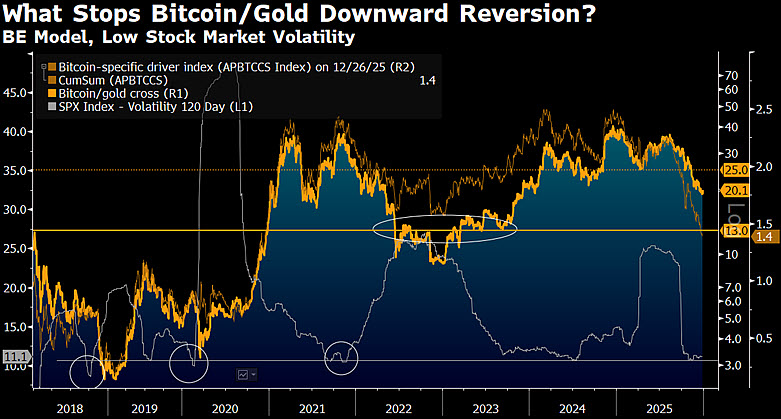

Drawing on Bloomberg Economics models, McGlone noted that the BTC/gold ratio has already fallen from around 20x and could gravitate toward the 13x region, a level that previously aligned with fair value during low stock-market volatility. In his view, subdued equity swings reduce the conditions that typically allow Bitcoin to outperform.

Technical signals hint gold may be losing momentum

From a technical perspective, some analysts argue gold’s leadership may already be weakening. Michaël van de Poppe highlighted that gold recently slipped below a prior all-time-high zone and formed a bearish divergence on the daily timeframe.

Unfortunately, I don't think we'll continue to see a rally here on Gold.

It broke beneath the previous ATH made in September '25.

It's also rejecting this level, and it made a technical bearish divergence on the daily timeframe (yes; but fuck TA, this thing will go to $100K! is… pic.twitter.com/vbuW7gKN7b

— Michaël van de Poppe (@CryptoMichNL) December 30, 2025

Similar setups in past cycles, including 2020, were followed by stronger performance from risk-on assets as gold peaked and rolled over.

A rotation that tends to reveal itself late

The divide between macro models and technical signals underlines a broader uncertainty in markets. Historically, periods like this were not when gold delivered its strongest gains. Instead, they often marked the early stages of Bitcoin reclaiming leadership, with the rotation becoming obvious only after the move was well underway.

For now, the BTC/gold ratio remains tightly coiled, keeping attention on relative performance rather than absolute prices. Whether this compression resolves in favor of gold or signals another phase of Bitcoin outperformance is likely to show up in the ratio first, long before it becomes a consensus view.