Price holds above key EMAs as buyers defend pullbacks and maintain a bullish structure

Rising open interest signals fresh leverage, increasing volatility risk near resistance

Supply concentration boosts upside momentum but heightens downside risk during pullbacks

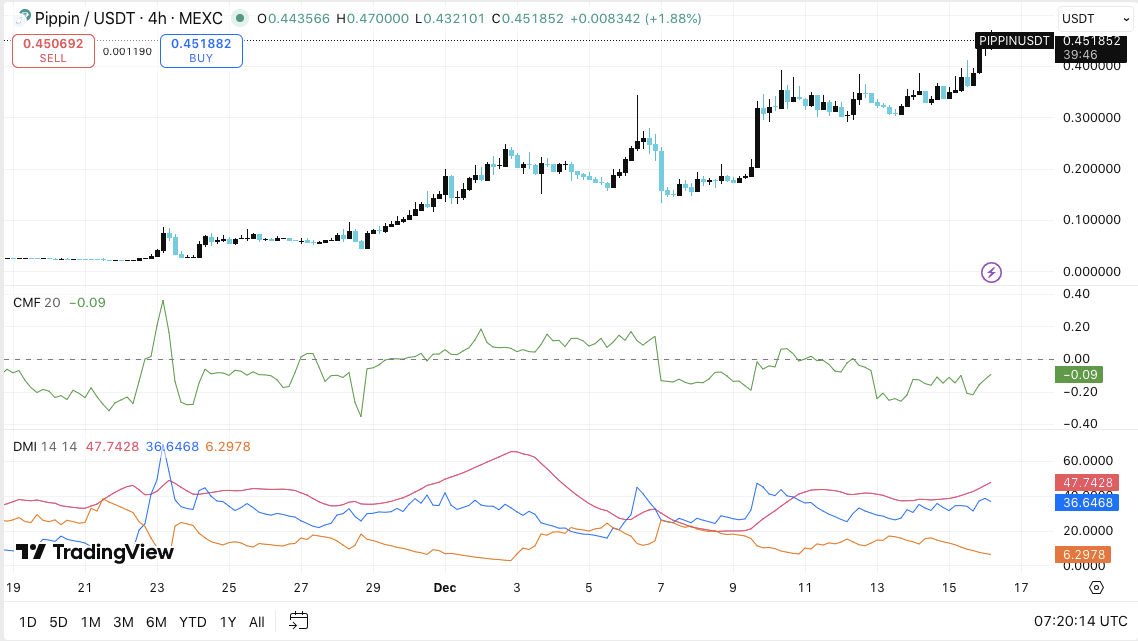

PIPPIN continues to draw market attention as price action strengthens on the 4-hour chart. The token recently advanced toward $0.45, setting a new higher high and reinforcing its broader bullish structure. Traders now track whether momentum can extend or pause near overhead supply.

PIPPIN Price Trend Shows Firm Bull Control

On the 4-hour timeframe, PIPPIN trades above all major exponential moving averages. Price remains above the 20, 50, 100, and 200 EMAs, confirming trend alignment. Hence, buyers continue to defend dips rather than chase breakouts blindly. The Supertrend indicator also remains positive, supporting ongoing upside pressure.

Resistance stands near $0.45 to $0.47, where sellers previously stepped in. A decisive close above this zone could open a path toward $0.50. However, rejection from this range may trigger a controlled retracement. Consequently, traders monitor structure rather than short-term candles.

Support rests near $0.40 and $0.39, aligning with recent consolidation. Additionally, the $0.37 area holds importance due to the 20 EMA and breakout structure.

Deeper pullbacks could test $0.31 to $0.30 near the 50 EMA. Loss of this zone would weaken trend confidence. Moreover, $0.26 remains the last major support tied to the 100 EMA.

Indicators Reflect Strength With Early Caution

Momentum indicators continue to favor buyers, though caution emerges. The DMI shows the positive directional index leading the negative line. ADX strength confirms an active trend rather than exhaustion. However, CMF prints slightly negative readings. This suggests mild profit-taking rather than heavy distribution.

Hence, capital flows still support price, though traders watch for shifts. A sharp CMF drop could signal deeper corrections. Until then, structure remains constructive above $0.37.

Open Interest Surge and Supply Control Add Volatility Risk

Derivatives data shows a notable shift in market behavior. For months, PIPPIN futures open interest stayed flat, signaling limited leverage. That changed in late November as open interest began rising alongside price. Significantly, December saw open interest exceed $200 million as price approached $0.43.

This rise confirms new speculative positioning, not just short covering. Consequently, leverage increases potential liquidation risk during sudden pullbacks. Sharp volatility could follow any failed breakout attempt.

https://twitter.com/wublockchain12/status/2000787425216569355

On-chain data adds another layer. GMGN data shows PIPPIN once surpassed a $450 million valuation. One address invested about $179,600 to acquire 8.2 million tokens near $0.022.

After holding for 53 days, the position reached roughly $3.4 million, reflecting massive gains. Moreover, prior analysis suggested one entity controlled over 70% of supply through multiple wallets. Such concentration amplifies both upside momentum and downside risk.

Technical Outlook for PIPPIN Price

PIPPIN price continues to trade within a clearly defined bullish structure on the four-hour chart, with momentum favoring buyers despite rising volatility risk. Price recently printed a higher high near $0.45, confirming trend continuation while testing a nearby supply zone. As long as PIPPIN holds above key structural support, the broader bullish setup remains intact.

Upside levels: Immediate resistance sits at $0.45–$0.47, where sellers previously emerged. A decisive four-hour close above this range could unlock continuation toward the $0.50 psychological level. Beyond that, sustained momentum may expose higher extension zones if volume expands.

Downside levels: Initial support rests at $0.40–$0.39, aligning with recent consolidation structure. A deeper pullback may test $0.37, which coincides with the 20 EMA and the prior breakout base. Failure to hold this level would shift focus toward $0.31–$0.30 near the 50 EMA. The $0.26 zone remains major trend support.

Resistance ceiling: The $0.45–$0.47 region acts as the key level to flip for short-term continuation. Acceptance above this range would reinforce bullish momentum and reduce downside pressure.

From a technical perspective, PIPPIN shows signs of controlled expansion rather than exhaustion. Price remains above all major EMAs, while trend indicators continue to favor buyers. However, futures open interest has expanded sharply alongside price, increasing the risk of volatility spikes during corrections.

Will PIPPIN Continue Higher?

PIPPIN’s near-term direction depends on whether buyers can defend the $0.37 support zone during any pullbacks. Holding this level keeps the bullish structure intact and maintains pressure on the $0.45–$0.47 resistance band. A confirmed breakout could open a path toward $0.50.

Conversely, a breakdown below $0.37 may trigger a deeper retracement toward $0.31. For now, PIPPIN remains in a pivotal zone, where leverage, liquidity, and technical confirmation will define the next leg.