TNSR’s sharp breakout ends months of compression and forms a new bullish structure.

Rising open interest signals traders preparing for stronger volatility ahead.

Outflows continue but easing selling pressure hints at early stabilization signs.

Tensor’s market structure shifted sharply this week as TNSR posted one of its strongest moves in months. The token spent several weeks pinned under heavy resistance while traders monitored fading activity and persistent outflows.

However, price action flipped when an unexpected breakout lifted TNSR from deep monthly lows. The move created a new discussion about whether the rebound can sustain after months of selling pressure. The chart now shows a developing tug-of-war between renewed buyer interest and key resistance levels from earlier declines.

Breakout Emerges After Weeks of Compression

TNSR traded inside a narrow band for most of October and November as sellers controlled each attempt to rebound. The token hovered below $0.05 during this period. It struggled to rise above trend indicators that capped every bounce.

Moreover, Supertrend readings continued to signal firm bearish pressure. This quiet trend ended when price accelerated sharply and moved from $0.04 to above $0.20 in one impulse.

The surge pushed TNSR through several Fibonacci levels before meeting heavy resistance near the 0.618 retracement at $0.26. That zone formed the first strong reaction area after the vertical move.

The chart now shows $0.15 as the nearest support. It aligns with the breakout wick and the 0.382 retracement. A drop below this area exposes $0.10 before attention returns to the old base near $0.04. On the upside, buyers look for a break above $0.22 to revisit the next resistance region at $0.30.

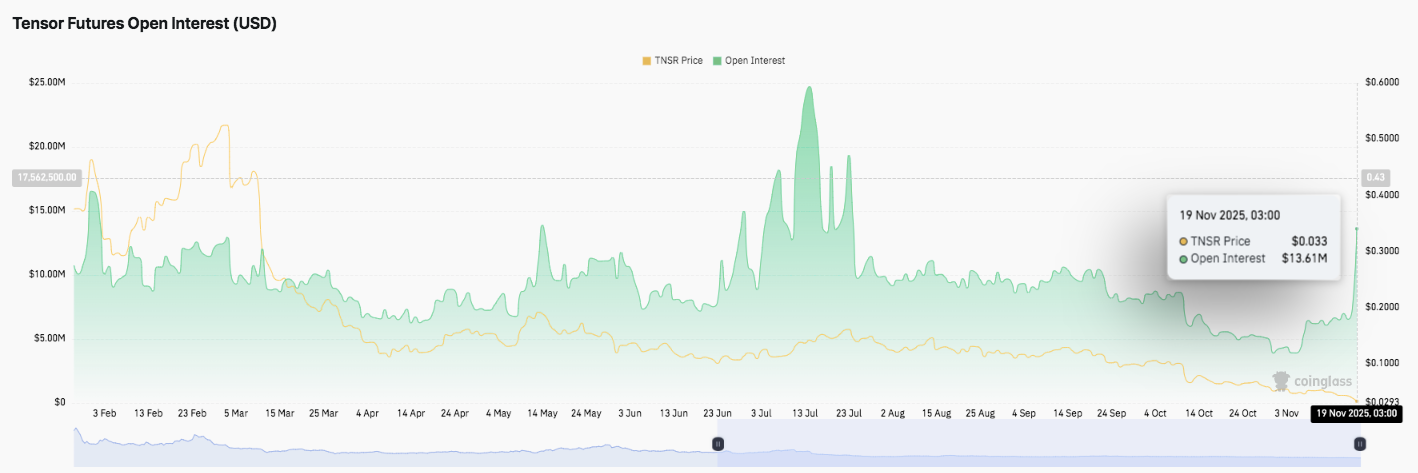

Traders Re-Enter as Open Interest Climbs

Open interest also shifted. Futures positions fell steadily from March’s $17.5 million peak as participation thinned. Activity remained soft through late summer. Open interest rarely moved above $10 million during September and October.

However, November brought a mild rebound as traders returned to the market. The latest reading shows $13.61 million while TNSR trades near $0.033. This increase suggests that traders are preparing for higher volatility.

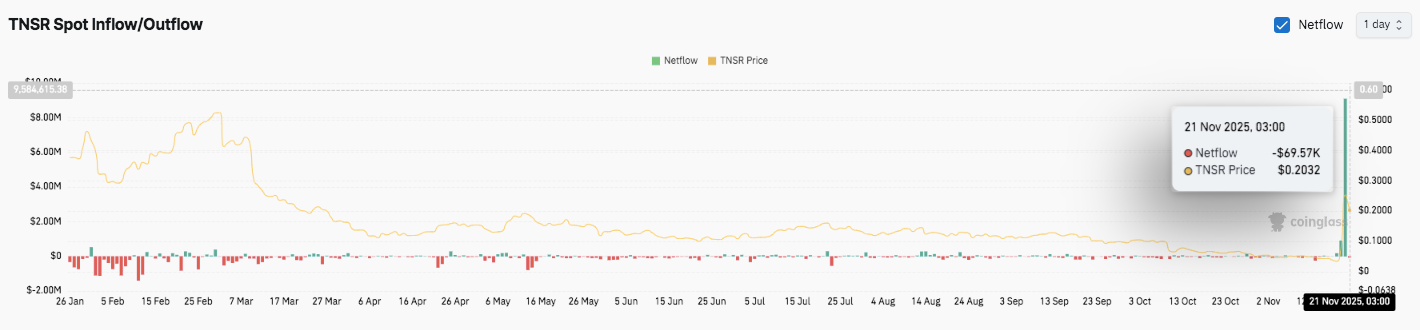

Outflows Persist but Selling Pressure Eases

Flow data shows a long period of net outflows through most of the year. Selling intensified between March and June and matched the deeper decline in price. Outflows later decreased but remained consistent. The most recent reading shows a $69.57K net outflow as TNSR trades near $0.2032. This indicates lingering caution, although price has begun to stabilize.

Technical Outlook for Tensor (TNSR) Price

Key levels remain well-defined following Tensor’s explosive breakout from months of compression.

Upside levels: $0.22, $0.26, and $0.30 stand as the next major hurdles. A clean break above $0.30 may open a path toward $0.34 and $0.38 if momentum strengthens.

Downside levels: $0.15 holds as the immediate support zone, followed by $0.10 and the deeper structural base near $0.04.

Trend pivot: $0.22 acts as the first key level that buyers must reclaim to sustain medium-term bullish momentum.

The technical picture shows TNSR stabilizing after a vertical breakout that lifted price from $0.04 to above $0.20 in a single impulse. Price now trades inside a retracement structure, where $0.15 defines the line between healthy consolidation and deeper correction. A decisive recovery above $0.22 may trigger renewed volatility, especially as Fib clusters align with short-term resistance near $0.26 and $0.30.

Will Tensor Continue Higher?

Tensor’s near-term trajectory depends on whether buyers defend the $0.15 support zone long enough to challenge the $0.22–$0.26 resistance cluster. Continued compression between these levels suggests a buildup toward a larger move. If bullish momentum expands alongside stronger futures positioning, TNSR could attempt a retest of $0.30 and then $0.34.

A failure to hold $0.15 increases the risk of a pullback into $0.10 and possibly a revisit of the pre-breakout floor near $0.04. For now, TNSR remains in a pivotal region. The recent breakout improved sentiment, but conviction flows and sustained reclaim levels will determine the next major direction.