Bitcoin price has spent several sessions attempting to secure a daily close above the $90,000 mark. The crypto king has hovered just below this psychological barrier for nearly three weeks.

This prolonged consolidation suggests building momentum, though renewed whale selling could still delay a decisive breakout.

Bitcoin Whales Are Selling Sharply

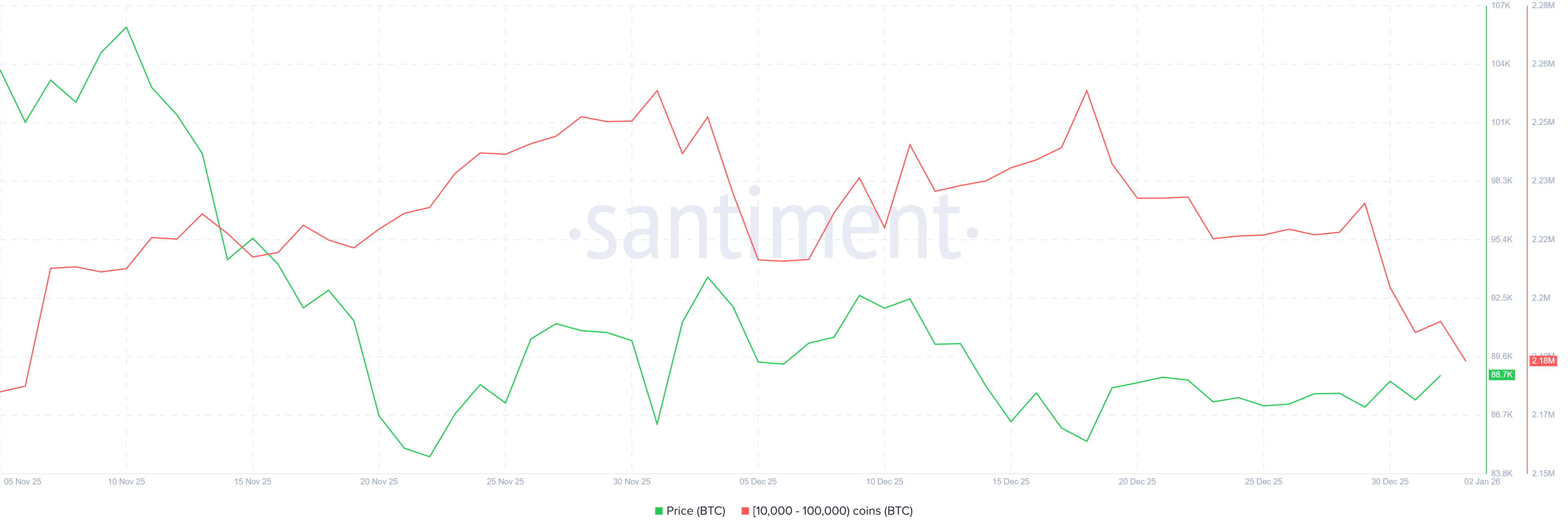

Mega whale activity has intensified since late December 2025. Wallets holding between 10,000 BTC and 100,000 BTC have collectively sold more than 50,000 BTC in just four days, with their balance reaching a two-month low. At current prices, those sales exceed $4.47 billion, reflecting caution among the largest holders.

Such selling often signals declining confidence from influential market participants. Mega whales typically shape broader price trends due to their scale. Despite this pressure, the Bitcoin price has continued rising, suggesting demand from other cohorts is absorbing supply and supporting the current advance.

Bitcoin Whale Holding. Source: Santiment

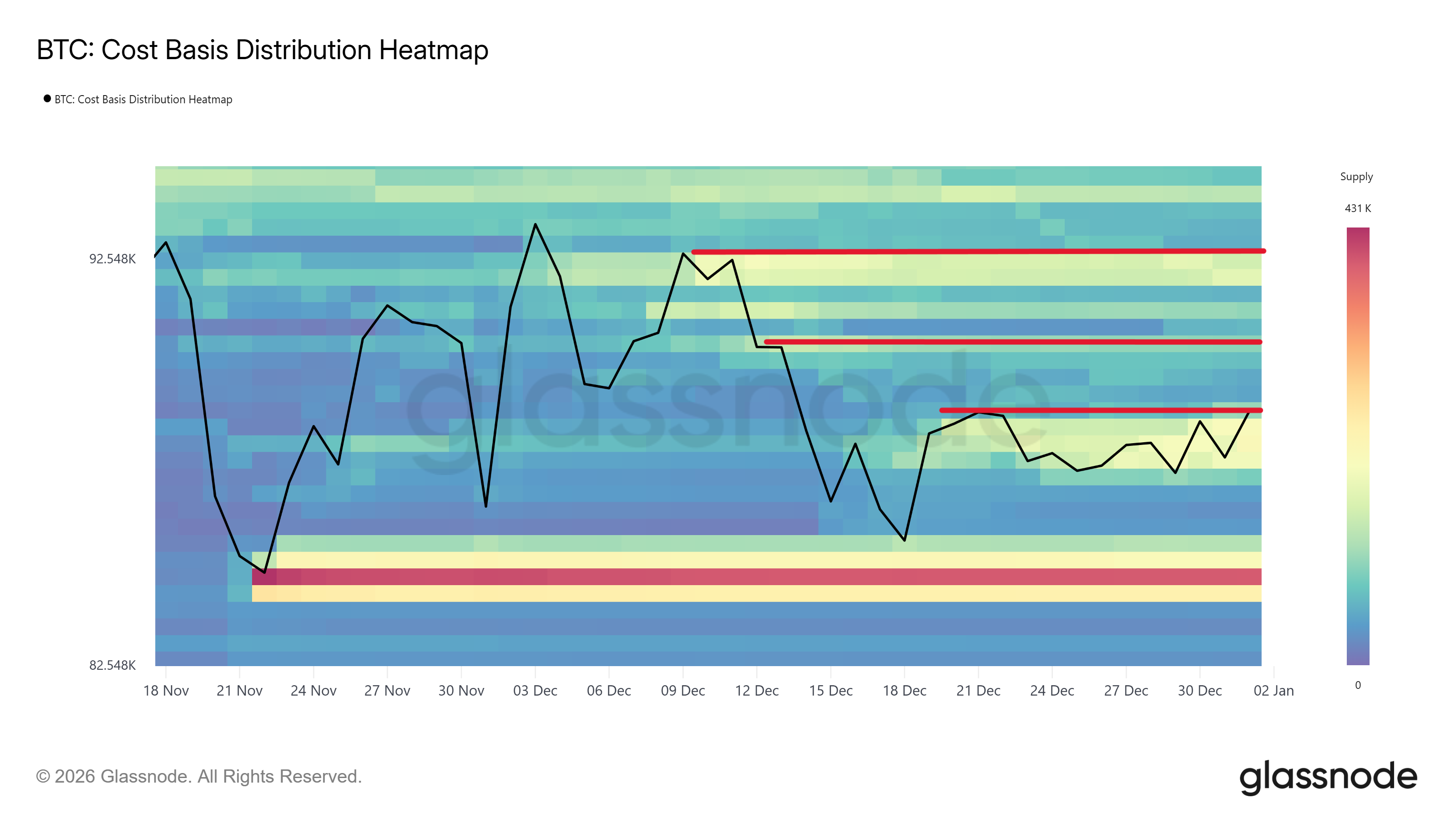

Macro data offers additional context for Bitcoin’s resilience. The Cost Basis Distribution Heatmap identifies three key resistance zones. The first (red line above price) sits between $88,000 and $88,500, where approximately 201,474 BTC were accumulated, forming a strong demand foundation.

The next resistance appears near $90,500, a level tied to purchases totaling 97,766 BTC. Clearing this zone without triggering heavy selling could unlock further upside. Beyond it, $92,700 emerges as a major level, supported by roughly 170,763 BTC in historical accumulation.

Bitcoin has already crossed the lower resistance band, reinforcing near-term strength. The ability to hold above $88,500 reduces downside risk. However, sustained progress now depends on market participants resisting the urge to distribute at higher cost basis levels.

Bitcoin CBD Heatmap. Source: Glassnode

BTC Price Needs To Secure This Support Level

Bitcoin trades near $89,543 at the time of writing, remaining below a month-long downtrend line. Despite this technical constraint, price action continues to compress toward the $90,000 threshold. This setup often precedes strong directional moves when momentum builds.

A breakout above $90,000 appears increasingly likely. Securing $90,308 in support would confirm bullish continuation. If achieved, Bitcoin could target $92,031 next, assuming whale selling pressure moderates and broader demand remains intact.

Bitcoin Price Analysis. Source: TradingView

Downside risk persists if mega whale distribution accelerates. Increased selling could stall the breakout and push BTC back toward the $88,210 support. Such a move would extend range-bound trading and delay confirmation of a sustained move above $90,000.