Moving alongside Bitcoin, the Ethereum price has actually been able to reclaim $3,000, moving up faster than anticipated over the weekend. This resulted in an over 6% daily increase by Sunday, as sentiment began to move toward the positive again. However, this move has not completely erased the bearish expectations surrounding the cryptocurrency, especially as one crypto analyst points out that the digital asset has now actually entered overbought levels.

Ethereum In Dangerous Territory

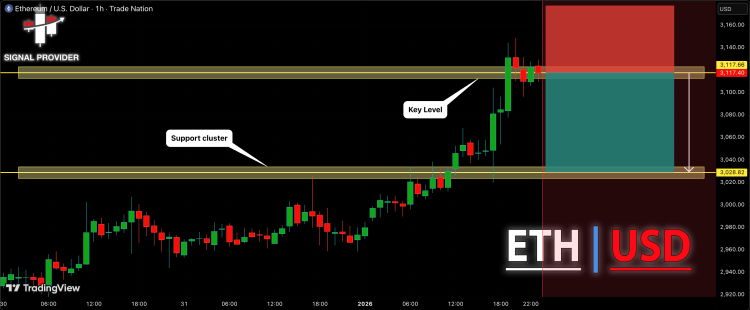

In a TradingView post, crypto analyst SignalProvider highlighted that Ethereum has now entered overbought levels, something that is bearish for the price. As explained by the analyst, using the ETheruem -Hour timeframe, the trend is currently bearish as the 7-period RSI shows that the digital asset is now in oversold levels.

This comes as the Ethereum price continues to trade above $3,100, which the analyst calls a solid horizontal structure. However, this structure has not held as strongly as expected, leading to weakness in the market. As a result, the crypto analyst explains that this could result in a price decline.

If the decline plays out as expected with the overbought levels, then the first target is $3,028, according to the analyst. This could then serve as a support level that could begin the next uptrend. However, there is a possibility that this does not play out soon, as prices entering overbought levels can take time to play out.

ETH Price Is Not Entirely Bearish

While the entrance into overbought levels remains a bearish signal for the Ethereum price, another analyst has presented a possible bullish path for the cryptocurrency from here. This lies in the ability of bulls to break out completely from the $3,100 level.

As crypto analyst TheSignalyst explains, the lower bound of the channel has been working to serve as support for the Ethereum price above $3,000. If this channel continues to hold, then the bullish trend remains intact. “From a structure point of view, ETH remains bullish, trading cleanly inside a flat rising channel,” the post read.

When the breakout is completed, then the price could rise as high as $3,600, which is the top of the current ascending channel. But TheSignalyst explains that until this breakout happens, Ethereum investors should expect more sideways chop as the price continues to build up.