Lighter price has climbed sharply over the past two days, extending gains as bullish sentiment returned across the broader crypto market. LIT rallied alongside improving risk appetite, but the move was also supported by internal network developments.

Lighter has begun fulfilling its post-launch commitments, raising questions about whether the current price surge can be sustained.

Lighter Team Shares Update

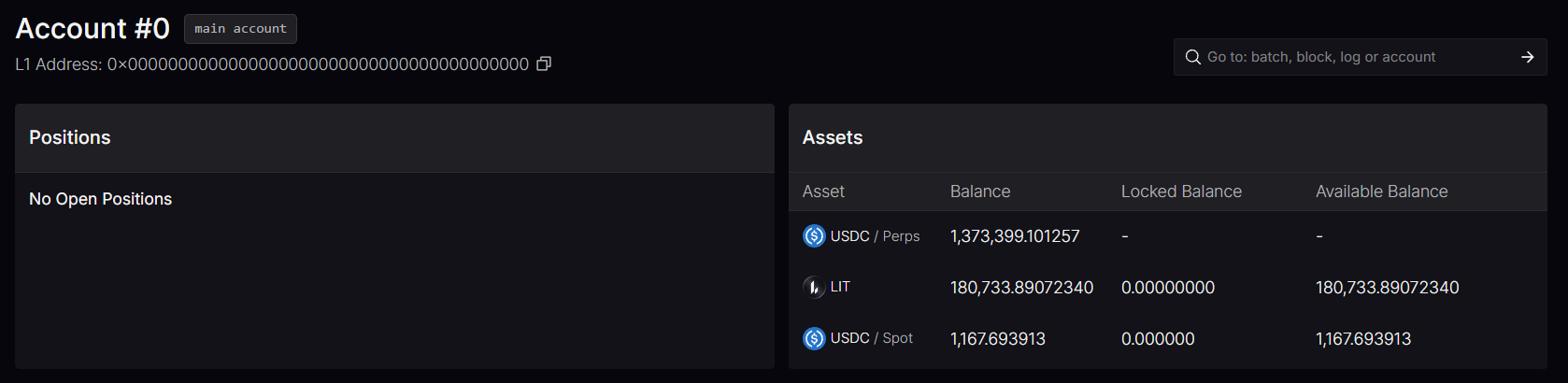

The Lighter team initiated its buyback program on January 6, marking a key milestone for the project. The announcement was made publicly through social media, where the team shared a direct link to its treasury wallet.

The disclosed treasury account held approximately 180,733 LIT, valued at $564,609 at the time. While the amount is not exceptionally large in absolute terms, the action itself carries weight. This move aligns with earlier promises made during LIT’s launch.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

“Revenues from our core DEX product as well as future products and services can be tracked in real-time on chain and will be allocated between growth and buybacks depending on market conditions. We are long term builders and the goal is to maximize the long-term value created.” Lighter team stated on December 30.

Lighter Treasury Account. Source: Lighter

How Sustainable Is LIT’s Rise?

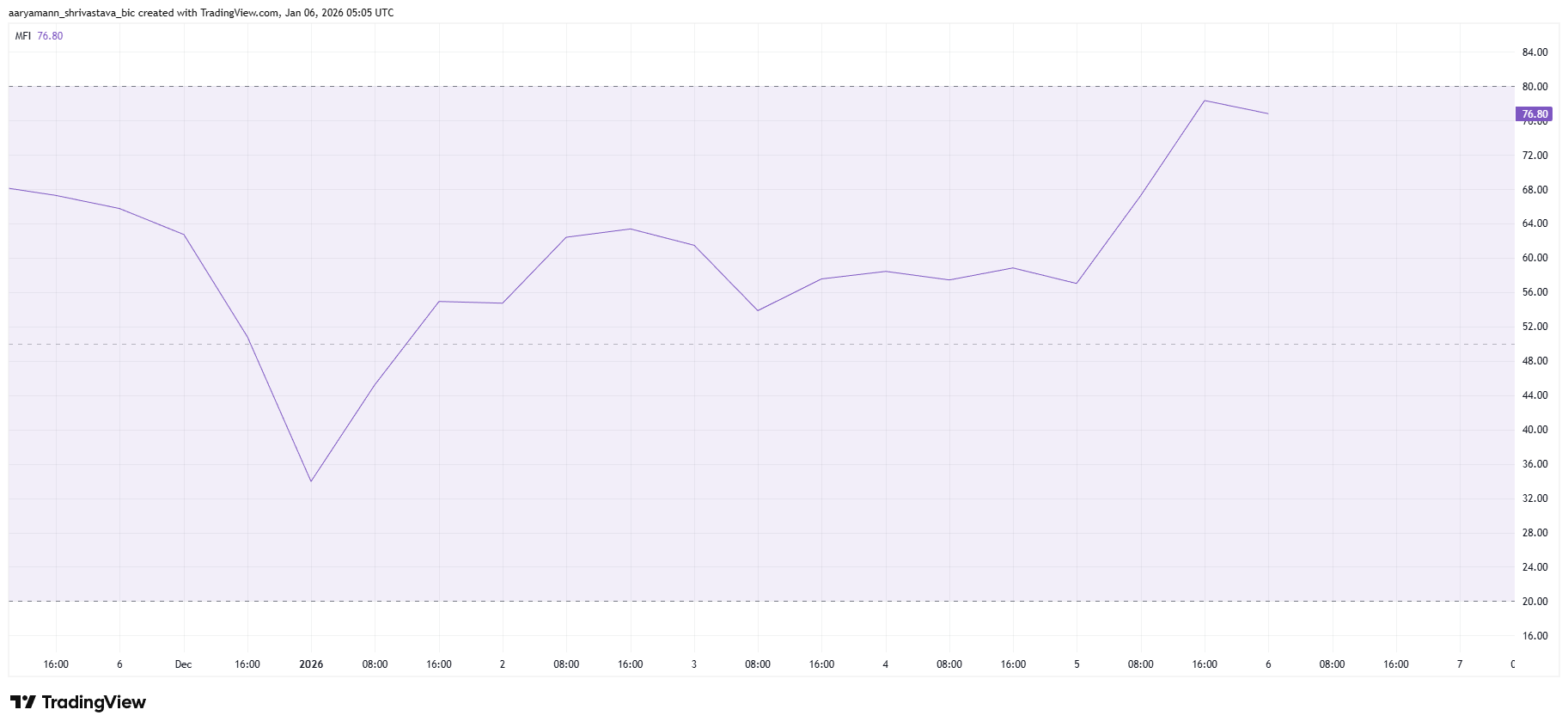

Capital flow data support the recent price movement. The Chaikin Money Flow indicator shows strengthening inflows during the latest rally. CMF evaluates accumulation and distribution by combining price action with volume trends, offering insight into whether buyers or sellers control momentum.

Earlier signals were less constructive. On January 1, LIT formed a bearish divergence as price rose while outflows increased. That imbalance led to a pullback the following day, confirming weak underlying support at the time.

LIT CMF. Source: TradingView

Over the last 48 hours, conditions have shifted. Outflows have declined as prices continued higher, indicating improving accumulation. This alignment between price and capital flow suggests investors are backing the move, increasing the likelihood that the rally is more than a temporary bounce.

Buying Pressure Is Rising, But LIT Is Not Overbought

Momentum indicators also reflect strengthening conditions. The Money Flow Index is holding above the neutral threshold, signaling sustained buying pressure. MFI incorporates both price and volume, making it useful for validating the strength behind market moves.

In LIT’s case, rising MFI readings match the recent price increase. This synchronization implies buyers are actively participating rather than passively following the price. Positive MFI readings reduce the probability of an immediate reversal.

LIT MFI. Source: TradingView

Furthermore, the indicator has not yet pushed past the overbought threshold at 80.0. This suggests that the buying has not saturated yet, and the price rise will remain stable.

LIT Price Has A Target

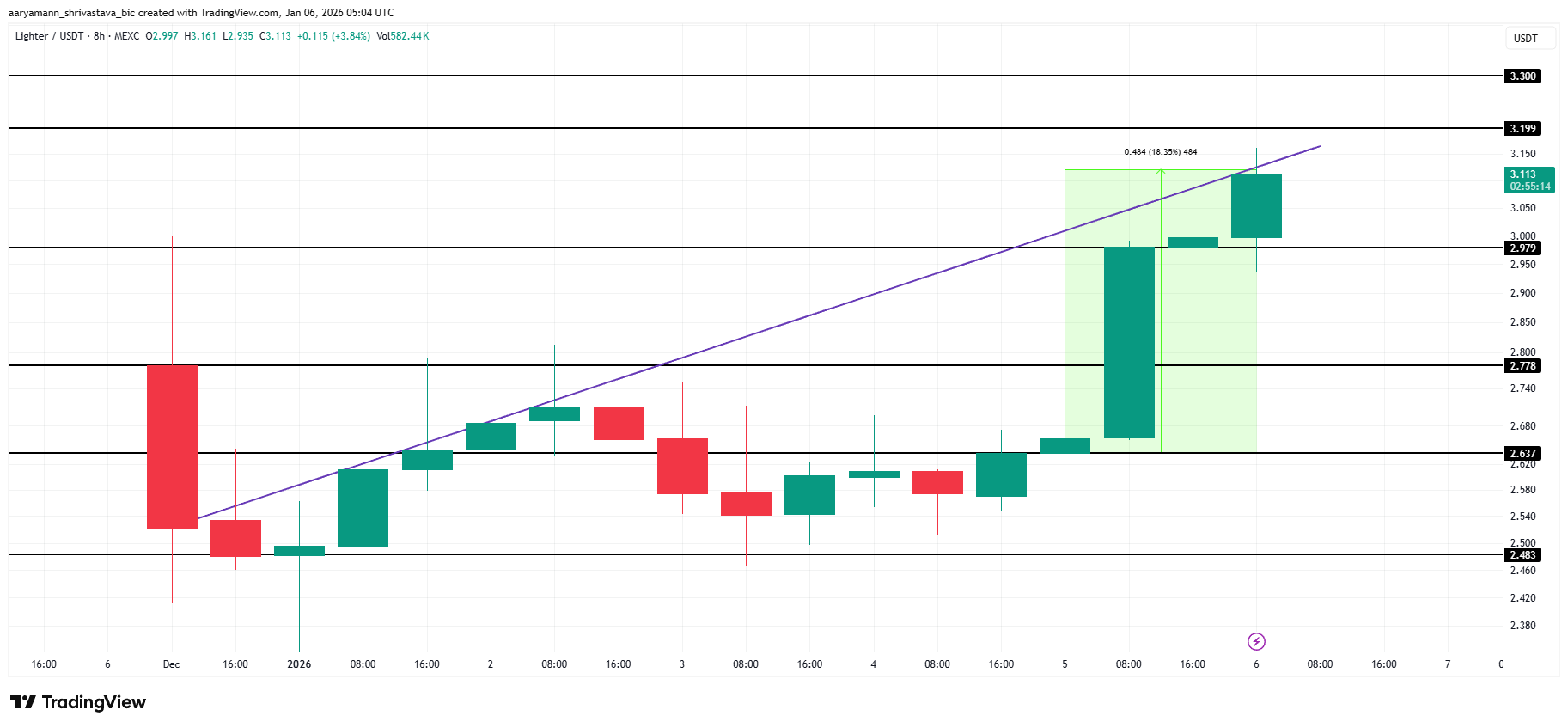

LIT price surged 18.3% over the past 24 hours, trading near $3.11 at the time of writing. The rally reflects renewed confidence and raises the possibility of a short-term trend reversal. Recent price action suggests LIT is attempting to break out of its descending structure.

Although LIT briefly traded above the downtrend line intraday, confirmation requires a daily close above resistance. The key level to watch is $3.19. Flipping this zone into support would validate the breakout and strengthen bullish continuation prospects.

LIT Price Analysis. Source: TradingView

Downside risks persist if sentiment shifts. A return of selling pressure could push LIT back below $2.97. Under such conditions, the price may slide toward $2.77, invalidating the bullish thesis and reintroducing consolidation or corrective risk.