Bitcoin (BTC) has climbed 6.54% so far in 2026, showing early signs of strength amid ongoing geopolitical uncertainty and a cautious return of market optimism.

As the recovery continues, an analyst has identified a critical level that could determine whether Bitcoin transitions from a bearish structure to a renewed bullish trend in 2026.

Bitcoin Extends Early-2026 Gains

While market fear lingered toward the end of 2025, the new year has begun on a strong footing for Bitcoin and the broader crypto market. On Monday, the largest cryptocurrency surged over $95,000, a price not seen since early December.

At the time of writing, Bitcoin was trading at $93,230, representing a 0.69% increase over the past 24 hours. The broader crypto market has also strengthened, with multiple sectors posting notable gains as risk appetite gradually returns.

Bitcoin Price Performance. Source: BeInCrypto Markets

Analysts attribute the renewed upside to several converging factors, including fresh new-year allocations following year-end tax-related selling, increased safe-haven demand amid the US strike on Venezuela, and improving market sentiment.

This shift in sentiment is further supported by strong inflows into exchange-traded funds (ETFs). BeInCrypto reported that on January 5, the ETFs pulled in nearly $695 million, marking their largest single-day inflow in three months.

What Bitcoin Needs For a Bullish Trend Reversal

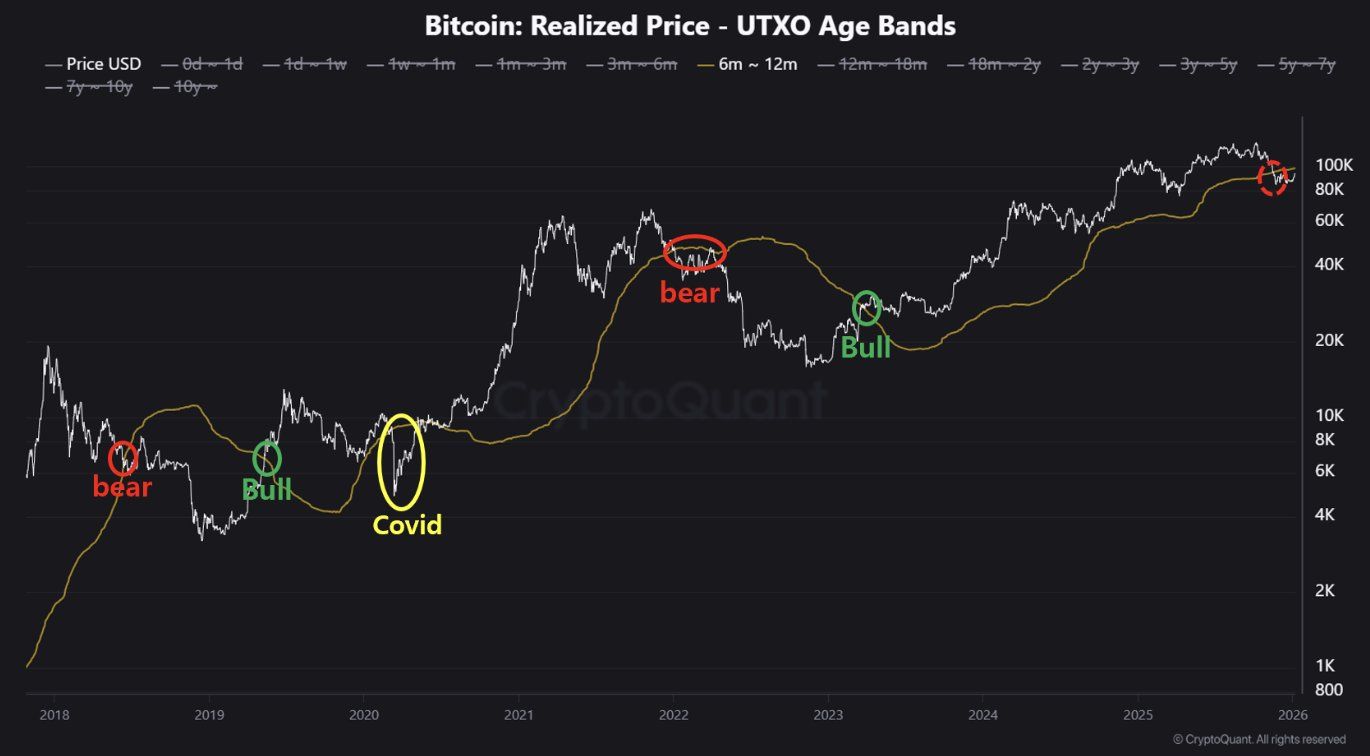

Amid this recovery attempt, analyst Crypto Dan highlighted a key on-chain level that could determine Bitcoin’s broader trend direction. Dan noted that Bitcoin is currently trading below a crucial indicator: the cost basis of coins last moved 6 to 12 months ago, which is near $100,000.

Historically, when the price remains below this level, market conditions tend to skew bearish, with downside risks remaining elevated.

Bitcoin’s Critical Cost Basis Level. Source: CryptoQuant

The analyst explained that reclaiming this cost basis would mark a meaningful shift in market structure. In previous cycles, such a move has coincided with a transition toward bullish conditions, as selling pressure from underwater holders eases and price gains room to extend higher.

“After weeks of sideways movement, Bitcoin is showing early signs of a rebound, making this level the key threshold to watch. Failure to break above it would signal that the broader downtrend is still intact. Ultimately, whether the market flips bullish comes down to this single level — and we won’t have to wait long to find out,” Dan wrote.

The key question now is when Bitcoin will test this level. Analyst Ted Pillows observed that Bitcoin is currently attempting to reclaim its 2025 yearly open level. According to the analyst, a few daily closes above this zone could pave the way for a move toward $100,000 in the coming weeks.

“A fakeout means BTC will drop towards the $90,000-$91,000 support zone,” Pillows wrote.

Beyond chart-based indicators, broader macroeconomic factors are also shaping expectations for Bitcoin’s next move. Some analysts point to the possibility of increased oil supply if the US gains access to Venezuela’s reserves, a development that could ease energy prices and alter global liquidity conditions.

Lower energy costs may encourage capital to rotate into alternative assets such as Bitcoin. In this scenario, crypto markets could benefit as investors reallocate funds in response to shifting macro dynamics.

Venezuela’s alleged Bitcoin reserve of over 600,000 coins could become a longer-term market factor. Should those holdings be seized, the resulting reduction in available supply could create conditions that support higher Bitcoin valuations over time.