When a big name stops delivering the same kind of returns, money often looks for the next curve. That is how crypto cycles work. A token that once moved fast can still rise, but the upside shape changes as it gets larger. At the same time, new Altcoins with clear utility timelines can start drawing attention, even before their full product goes live.

That is the comparison some market commentators suggest is forming around Dogecoin (DOGE) and Mutuum Finance (MUTM). One is a long-running headline coin with deep liquidity. The other is a DeFi crypto project still early in its growth arc.

Dogecoin (DOGE)

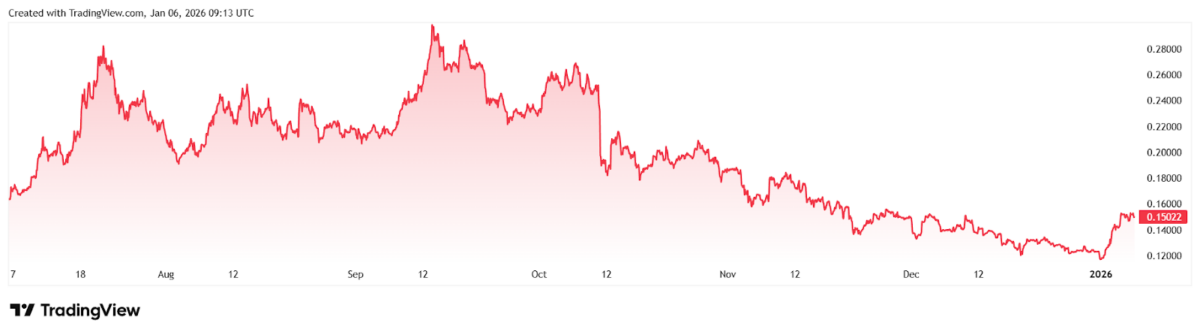

Dogecoin (DOGE) is trading around $0.152. On CoinMarketCap, DOGE’s market cap is shown at roughly $25.6B, which puts it among the top crypto coins by size. From a chart standpoint, recent technical coverage has pointed to resistance near $0.166, with another hurdle around $0.181 if momentum continues. These zones matter because they often become the levels traders watch on crypto charts when deciding if a move has real follow-through.

The downside is that DOGE can still slip quickly if the market mood turns. One bearish take argues DOGE could fall sharply in 2026, even warning it could drop below $0.01 if sentiment shifts hard against meme-style coins. Whether or not that plays out, it shows why some DOGE holders are open to rotating into projects with a different demand story.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is building a lending and borrowing protocol. The idea is straightforward: users supply assets into liquidity pools, borrowers take loans against collateral, and the protocol manages risk through automated rules like LTV limits and liquidations.

Mutuum Finance has described core parts like the Liquidity Pool, mtToken, Debt Token, and a Liquidator Bot, with initial markets planned around ETH and USDT for lending, borrowing, and collateral. In progress, Mutuum Finance has stated it is preparing a V1 release on the Sepolia testnet, then finalizing for mainnet, with launch timing described as coming shortly.

Mutuum Finance is also in Presale. It reports $19.6M raised, around 18,750 holders, and about 825M tokens sold. Phase 7 is active at $0.04, up from $0.01 in Phase 1, which is a 300% increase across stages since early 2025. The project also references an official launch price of $0.06.

3 Reasons Why Investors Believe MUTM Can Outperform

The first reason is scale. DOGE already sits near a $25B market cap. That size does not stop it from rising, but it changes the math. It is harder to repeat the early-style surges when a token is already that large. Mutuum Finance is still much earlier in its growth cycle and is priced at $0.04 in Phase 7. The market cap is not in the same universe yet, which is why some investors see more room for appreciation if the product lands well.

The second reason is utility design. Dogecoin is widely viewed as a meme coin. Its demand has often depended on attention cycles and social momentum rather than protocol usage. Mutuum Finance is built around lending utility, where demand can be tied to borrowing activity and platform revenue. Mutuum Finance also develops a value loop connected to mtTokens. When referencing the distribution mechanism.

The third reason is timing. Some early DOGE holders look for the next crypto narrative when they see a clear shift from idea to execution. Mutuum Finance has communicated V1 Protocol progress toward Sepolia, with mainnet finalization next. That kind of milestone often matters more than short-term noise, because markets tend to price utility expectations early.

Phase 7 and The Halborn Security

Phase 7 matters because it reflects where Presale demand is sitting. Mutuum Finance’s Presale uses fixed stages with fixed token allocations, so stronger demand can move the price ladder faster. With $19.6M raised and 18,750 holders reported, the project has framed Phase 7 as a later stage in a Presale that began in early 2025.

Security is also a key part of the story for any lending protocol. Mutuum Finance has stated that HalbornSecurity completed an independent audit of its V1 lending and borrowing protocol. For investors comparing a meme-style coin with a DeFi crypto protocol, audit completion is often treated as a baseline requirement before broader capital commitments.

For anyone asking “next crypto to hit $1,” the practical point is this: DOGE can still run, but its scale and attention-driven demand can limit the upside profile. Mutuum Finance is being watched because it is earlier, it is utility-focused, and it is approaching visible delivery milestones.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance