Zenchain Tokenomics Ignite Q1 2026 Airdrop and Mainnet Listing Expectations

The long-anticipated Zenchain ecosystem has entered a decisive new phase after the official release of its $ZTC tokenomics on January 6, 2026. The announcement has immediately intensified market speculation surrounding the Zenchain airdrop listing date, the long-awaited mainnet launch, and the project’s Token Generation Event (TGE)—all widely expected to land in Q1 2026.

With more than 19 million transactions already processed on its test network, Zenchain is positioning itself as a next-generation blockchain designed to merge Bitcoin-grade security with Ethereum-style programmability. The publication of its updated litepaper signals that the project is transitioning from testing to execution, with the community now focusing on timing, distribution mechanics, and potential exchange listings.

ZTC Tokenomics: A Scarcity Model Inspired by Bitcoin

At the core of Zenchain’s design is a supply structure deliberately modeled after Bitcoin’s scarcity principle. The total supply of $ZTC is permanently capped at 21 billion tokens, with no future inflation mechanisms planned. According to the team, this fixed supply model is intended to protect long-term value while aligning incentives across validators, developers, and users.

official website litepaper,

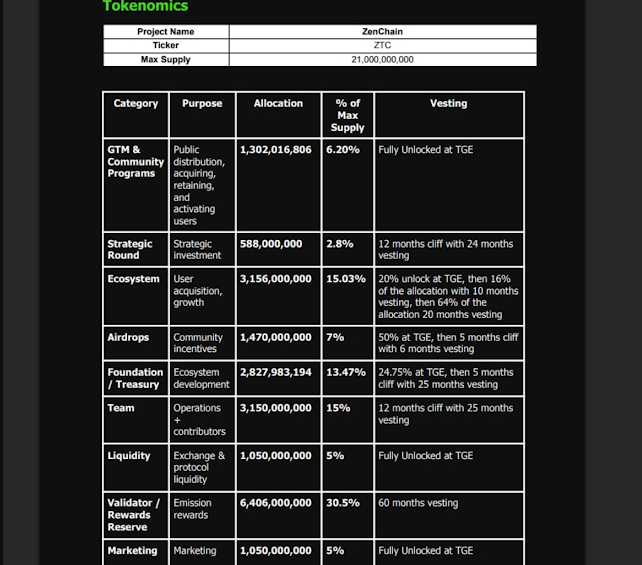

The distribution structure outlined in the official litepaper emphasizes sustainability rather than short-term speculation. The allocation is divided into carefully defined categories, each with distinct roles in maintaining network security and ecosystem growth.

ZTC Token Allocation Breakdown

Validator and Rewards Reserve – 30.50%

The largest allocation is dedicated to validators and network participants. These tokens will be distributed gradually as rewards for securing the blockchain and supporting transaction finality.Ecosystem Development – 15.03%

This portion is reserved for developer grants, infrastructure tools, decentralized applications, and long-term ecosystem expansion.Team and Core Contributors – 15.00%

Team tokens are subject to long-term vesting schedules, designed to ensure sustained commitment and prevent early sell pressure.Community Airdrop – 7.00%

Early users, testers, and contributors will receive tokens through the Zenchain airdrop program, with claim mechanics to be announced closer to launch.Foundation and Treasury – 13.47%

Funds allocated to the treasury will support governance initiatives, future upgrades, and operational resilience.

The team confirmed that airdrop rewards will follow a claim-based model, rather than immediate distribution. This approach is widely viewed as a stabilizing mechanism that reduces sudden supply shocks at launch.

Zenchain Mainnet and TGE: Why Q1 2026 Looks Increasingly Certain

While the Zenchain team has not published an exact launch date, multiple signals point clearly toward Q1 2026. On December 17, 2025, the project teased its roadmap with a cryptic social media post asking, “Who is ready for Q1?” That message gained renewed significance following the release of Litepaper v2 earlier this week.

Source: Zenchain Official X Account

Industry analysts reviewing the updated documentation believe that the Token Generation Event and mainnet launch window likely falls between mid-January and late March 2026. The timing aligns with the completion of key technical milestones and the conclusion of the current rewards era.

From a development perspective, Zenchain is positioning itself to solve a long-standing limitation in the crypto ecosystem: Bitcoin’s lack of native programmability. Through Zenchain’s architecture, users can bridge Bitcoin into an environment that supports smart contracts, decentralized finance, NFTs, and even AI-assisted security tools.

Bridging Bitcoin and Ethereum: Zenchain’s Core Value Proposition

Zenchain’s roadmap revolves around a simple but ambitious framework summarized by four steps: Bridge, Stake, Earn, and Build.

Bitcoin holders can move BTC onto Zenchain, where it becomes usable within decentralized applications without sacrificing security. Once bridged, assets can be staked, used as collateral, or integrated into DeFi protocols and NFT marketplaces.

This hybrid model allows Zenchain to function as a utility layer for Bitcoin—something many developers have attempted, but few have successfully scaled. The project’s testnet metrics suggest early traction that extends beyond speculative interest.