The best crypto to buy now may look different after a significant institutional move: Morgan Stanley has filed to launch exchange-traded funds (ETFs) tied to Bitcoin and Solana, marking a notable shift in how large U.S. banks approach digital assets.

The dual filing signals an expansion of crypto offerings beyond just Bitcoin and Ethereum, and puts Solana in the spotlight as a potential next-in-line asset for regulated investment vehicles.

The filing, submitted to the U.S. Securities and Exchange Commission, aims to establish spot ETFs that directly track the Bitcoin price prediction.

While Bitcoin’s inclusion is expected, Solana’s presence in the filing is drawing attention from analysts and institutional observers, who see it as an indication of changing attitudes toward altcoins in regulated finance.

Why Solana and Why Now?

Solana’s selection is not arbitrary. The network has rebounded from previous setbacks and now holds the #6 position by market cap, with a current price of $134.50 and a circulating supply of 564.13 million SOL.

Despite a 2.66% 24-hour price dip, trading volume remains high at $4.1 billion, reflecting ongoing market interest. Its low fees, fast transaction speed, and support for decentralized applications have contributed to its rise in institutional conversations.

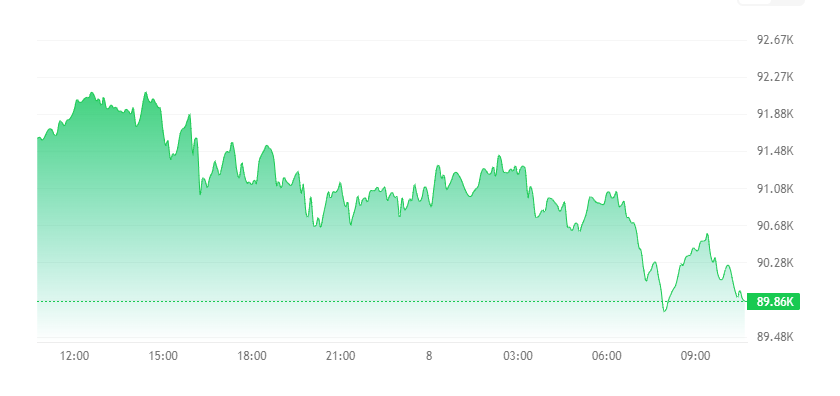

While the broader crypto market is experiencing pullbacks – with Bitcoin at $89,953 and Ethereum at $3,105, both down over 2% and 3% respectively in 24-hour performance – Solana’s technical fundamentals and growing developer ecosystem make it a distinct case.

The next crypto to explode, in this context, becomes a question of institutional alignment. Solana’s presence in a bank’s ETF portfolio signals potential for near-term accessibility and long-term positioning.

Institutional Behavior and Crypto Access

Morgan Stanley’s move follows months of rising institutional interest in crypto ETFs. What makes this filing different is the inclusion of Solana alongside Bitcoin – a first for a major U.S. bank.

NEW: Morgan Stanley becoming the first major bank to launch its own Bitcoin ETF is a “huge endorsement,” according to CNBC ?

Michael Saylor said major banks would adopt Bitcoin in 2026.

Here we go ? pic.twitter.com/xpZF9sg9sB

— Bitcoin Archive (@BitcoinArchive) January 7, 2026

Banks have historically acted as custodians or facilitators in the crypto space, but Morgan Stanley is now stepping into active product creation, with the aim of bringing regulated crypto exposure to a broader class of investors.

It’s also worth noting that Morgan Stanley followed this filing with a separate application for an Ethereum ETF, which differs structurally by including staking rewards reflected in net asset value.

That distinction matters: while Ethereum ETFs explore yield-generation, Solana’s ETF proposal centers on price exposure, which may appeal more directly to investors seeking high‑growth altcoins without complex staking mechanics.

Comparing the Assets: BTC, ETH, SOL

In terms of supply dynamics, Bitcoin remains tightly capped at 21 million, with 19.97 million already in circulation, a structure that continues to drive its narrative as digital gold. Ethereum, by contrast, has a circulating supply of 120.69 million, but operates under a dynamic monetary policy since the shift to proof-of-stake.

Solana sits apart with a large and flexible token supply, lower transaction fees, and higher throughput – all of which cater to developers and users building on-chain apps.

These traits, combined with the ETF filing, have prompted some analysts to ask whether SOL is becoming the best crypto to buy now for those anticipating institutional inflows and altcoin growth.

However, volatility remains high. Solana’s past includes network outages, regulatory uncertainty, and competition from other layer-1 platforms. Yet institutional recognition may bring some reputational stability, particularly if the ETF gains approval and opens new demand channels.

Risk, Timing, and Access

For individual and institutional investors alike, ETF filings represent more than new products – they serve as indicators of which assets are being de-risked in the eyes of traditional finance. Bitcoin is already well-integrated into ETF offerings. Ethereum is next. Solana now enters the stage as a potential third pillar in the line of the best long-term cryptos.

Filing for a Solana ETF during a market cooldown, when prices are consolidating, suggests that long-term positioning may be underway. While the market cap and trading volumes for Bitcoin and Ethereum dwarf Solana’s, the relative upside for institutionally recognized altcoins is attracting attention.