Cardano price prediction sentiment has turned cautiously optimistic after open interest in ADA futures surged by nearly $817 million in just 24 hours. This spike, driven by growing speculation around a potential Grayscale spot ETF approval, pushed ADA close to the critical $0.40 resistance.

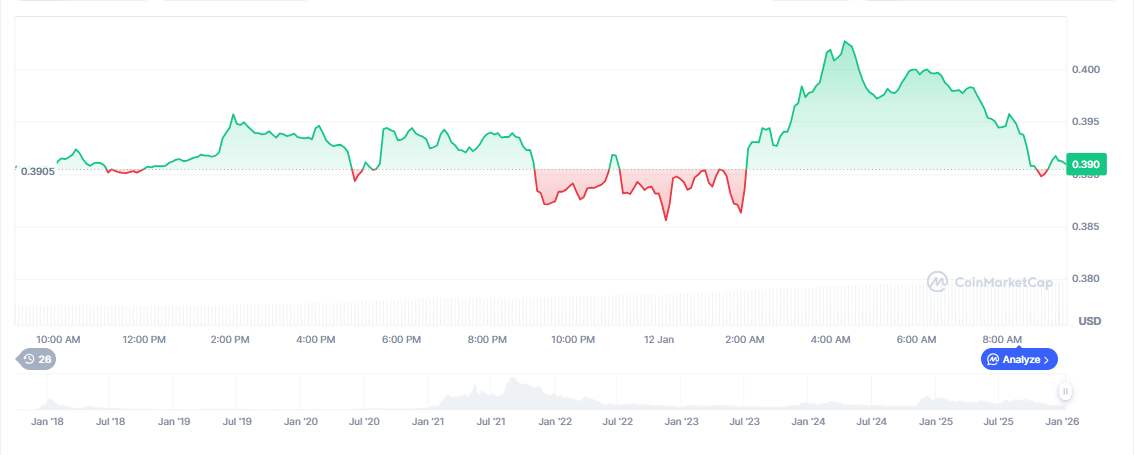

Cardano is trading at $0.3911, up slightly on the day, but still facing strong overhead pressure. As technical indicators tighten and volume remains uncertain, traders are watching closely to see if ADA can confirm a bullish breakout – or risk slipping back toward its December lows near $0.34.

Grayscale ETF Rumors Drive Futures Market Surge

Open interest in Cardano futures surged by 1.29%, reaching a total of 1.99 billion ADA, equivalent to $816.97 million. This uptick coincides with speculation surrounding Grayscale’s spot Cardano ETF application.

Although the U.S. Securities and Exchange Commission (SEC) has yet to issue a decision, traders are interpreting the potential approval as a trigger for adoption and upside price action.

Grayscale's spot Cardano $ADA ETF hasn't been approved by the SEC yet. ??

The application is still under review, with a decision now expected in early 2026.

Fingers crossed we see an approval in the coming weeks! pic.twitter.com/h9c1gVWqfN

— Cardanians (CRDN) (@Cardanians_io) January 7, 2026

Gate.io saw the most aggressive positioning, with 502.05 million ADA (over 25.18% of total OI) committed. Other top exchanges include Binance (16.33%), Bybit (12.8%), and LBank (8.91%), reflecting widespread participation across platforms.

According to Cardanians, while Grayscale’s application is still under review, market behavior shows early frontrunning by speculators anticipating an approval-based rally. This dynamic has helped reverse months of underperformance and draw renewed attention to ADA’s price potential.

Technical Signals Suggest Mixed Momentum Near $0.40

Despite ETF-fueled enthusiasm, ADA’s price has struggled to sustain bullish momentum above key resistance zones. It recently touched a daily high of $0.4357 but failed to break past the $0.45 resistance, remaining vulnerable to downside pressure.

As of January 11, ADA is trading at $0.3911, down 1.56% from the previous day’s high of $0.4127. Volume remains subdued at $524.86M, suggesting a lack of strong conviction despite the ETF chatter. Analysts note that descending volatility and low follow-through are stalling upward price action.

The Supertrend indicator currently sits at $0.3756, while the SAR dots hover near $0.3401. This places ADA in a tight technical squeeze, with breakout potential hinging on macro sentiment and confirmation above key levels.

Charles Hoskinson Responds to Dumping Allegations

Adding to the narrative pressure, Cardano founder Charles Hoskinson addressed renewed allegations of dumping ADA during its $3 peak. On December 25, he denied selling at $3, calling the accusations “bot-driven misinformation” and reaffirmed his long-term commitment to the project.

These comments come amid growing frustration from investors, as ADA remains down 58% year-to-date and fell 15.6% in December alone. Critics argue that confidence is waning due to perceived lack of founder-led accumulation at current levels, with ADA recently dropping to as low as $0.30 before rebounding.

Despite these concerns, Hoskinson stressed that the community should focus on long-term fundamentals, not on speculative fear or misinformation, to identify the best altcoins.

Short-Term Forecast: Can Cardano Hold $0.39?

Recent price action suggests that ADA must defend the $0.3750–$0.38 support zone to avoid a bearish breakdown. A fall below $0.3380–$0.34 would likely open the path to $0.30–$0.32, an area with little historical support.

On the upside, $0.40–$0.41 remains a critical resistance band for the next crypto to explode, where the mid-December consolidation ended. Multiple rejections in that area suggest strong seller interest, meaning a bullish breakout requires high volume and ETF momentum confirmation.

| Date | Prediction | Change |

| Jan 13 | $0.3994 | +1.74% |

| Jan 14 | $0.3980 | +1.40% |

| Jan 15 | $0.3971 | +1.17% |

| Jan 16 | $0.4001 | +1.92% |

| Jan 17 | $0.4023 | +2.49% |

These projections suggest gradual upside pressure, with targets approaching the $0.40–$0.41 ceiling.

Long-Term Outlook: Can ADA Regain $0.60 in 2026?

Looking further ahead, analysts forecast progressive recovery if macro conditions stabilize and ETF approvals materialize. Here’s the latest monthly Cardano price prediction for 2026:

| Month | Avg. Price | Max. Price | Change |

| Jan 2026 | $0.4577 | $0.5632 | +43.44% |

| Feb 2026 | $0.5826 | $0.6218 | +58.37% |

| Mar 2026 | $0.6158 | $0.6469 | +64.76% |

| Apr 2026 | $0.6148 | $0.6499 | +65.53% |

| Jul 2026 | $0.6580 | $0.7189 | +83.12% |

While these numbers reflect bullish expectations regarding the best crypto to buy, execution depends on market structure, volume support, and external catalysts like regulatory clarity.