Artificial Intelligence is widely believed to be the most impactful technology of the twenty-first century. However, the industry faces two major challenges: reliability and privacy. Lagrange aims to address both of these concerns using blockchain technology, and to propel AI into a new paradigm.

In this article, we’ll provide a comprehensive overview of Lagrange and explain its origin and inner workings, as well as the tokenomics of its native token, LA. We’ll also guide you through a step-by-step process for trading Lagrange’s LA token on Bybit.

Key Takeaways:

Lagrange combines zero-knowledge (ZK) proofs with blockchain to solve AI’s biggest challenges — privacy and reliability.

Its modular architecture — including DeepProve, ZK Coprocessors and Prover Network — enables scalable and verifiable off-chain computation.

Users can now trade the LA token on Bybit’s Spot and Perpetual markets, with up to 25x leverage available.

What is Lagrange?

Lagrange Labs, inspired by the mathematician and astronomer Joseph-Louis Lagrange, began as a venture using cryptography and zero-knowledge proofs to solve interoperability challenges between blockchain protocols. However, Lagrange’s scope has evolved beyond solely cross-chain solutions. The project now aims to unlock data-intensive and cross-chain use cases by enabling verifiable computation over blockchain data through its hyper-parallel ZK Coprocessor. Furthermore, Lagrange’s State Committees generate state proofs for optimistic rollups, supporting secure interoperability via protocols like LayerZero, Axelar and Polymer.

Lagrange has also launched DeepProve, a groundbreaking zkML (zero-knowledge machine learning) library designed to make verifiable AI inferences faster and more scalable than ever — up to 158x faster than the leading zkML solution.

Lagrange’s founders and investors

Lagrange Labs was co-founded by Ismael Hishon-Rezaizadeh and Amir Rezaizadeh.

The project has successfully raised a total of $17.2 million across two rounds from noted investors like Maven11, Lattice Fund, CMT Digital, Founders Fund and Archetype Ventures.

How does Lagrange work?

Lagrange relies on zero-knowledge proofs, a cryptographic technique that allows one party to prove the validity of a computation without revealing its underlying data. It combines a ZK proving technique called DeepProve with its ZK Coprocessor and Prover Network. This combination enables complex tasks to be computed while providing on-chain verifiability that they were executed as intended. Let’s look at each of these components in detail below.

DeepProve

Lagrange’s zero-knowledge machine learning (zkML) framework allows developers to cryptographically prove the correctness of AI model inferences without revealing the underlying model parameters or data. This can be used by projects to protect their proprietary data while proving the authenticity of the output.

By utilizing advanced cryptographic techniques, DeepProve achieves proving times that are significantly faster than previous zkML solutions. For example, it can prove the inference of a neural network up to 158 times faster than leading alternatives.

ZK Coprocessor

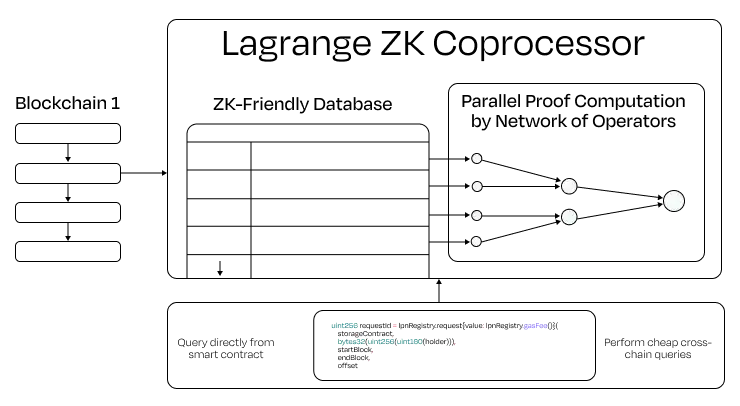

Lagrange has pioneered an SQL-based ZK Coprocessor that’s designed for performing complex off-chain computations on data and verifying the results on-chain with cryptographic proofs. To achieve this goal, blockchain data is transformed into a ZK-friendly format. Provers use this data to perform intensive off-chain computations and generate ZK proofs that attest to the correctness of the computations. These proofs are then submitted to smart contracts on-chain, enabling trustless verification without revealing the underlying data.

Source: Lagrange

ZK Prover Network

The Prover Network is a decentralized network system for generating ZK proofs at scale. The participants include well-known institutions like Coinbase, OKX, P2P and many more. They perform computational tasks off-chain, and are rewarded for their service. Each Prover participant is required to stake via EigenLayer, and is penalized for delays or malicious activities in order to ensure the network’s reliability.

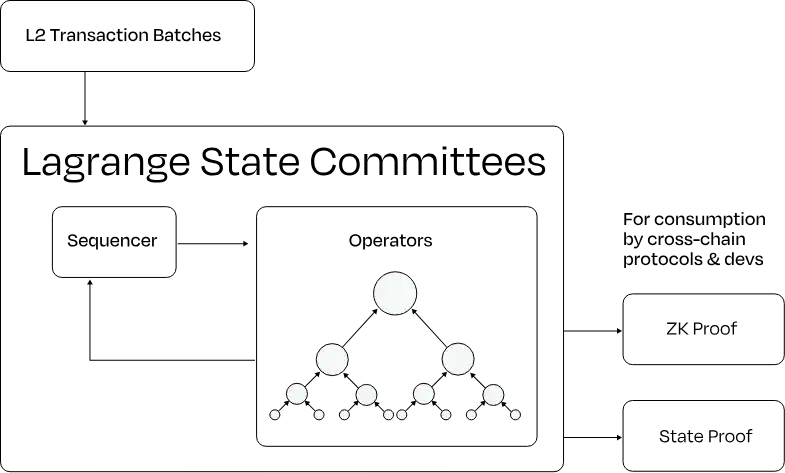

Lagrange State Committees

In addition to these three components, Lagrange has also introduced Lagrange State Committees, a decentralized network that acts as a ZK light client protocol for optimistic rollups like Arbitrum, Optimism and Mantle Network. Each committee comprises nodes that have restaked at least 32 ETH via EigenLayer.These nodes monitor rollup activity and attest to the finality of blocks. Their collective signatures are aggregated into succinct ZK proofs that applications can use to verify rollup states without waiting for lengthy challenge periods.

Source: Lagrange

LA token utility, distribution and listing

The LA token is integral to Lagrange’s decentralized ZK infrastructure, as it’s used for facilitating proof generation fees, staking and governance participation. The total supply of LA is capped at 1 billion, and as of Jun 2025, 193 million of these tokens are in circulation. During the initial distribution,34.8% of the tokens were allocated to the community, 25.4% to early contributors, 18.5% to the foundation and 21.3% to investors.

On June 3, 2025, Bybit announced the listing of the LA/USDT Spot pair on its exchange, along with a 2,500,000 LA prize pool for its users. For Perpetuals traders, Bybit has also announced the listing of the LAUSDT Perp contract, with up to 25x leverage, on Jun 5, 2025.

How to trade Lagrange (LA) on Bybit

Spot LA/USDT

Sign up or log in to your Bybit account.

Visit https://www.bybit.com/en/trade/spot/LA/USDT.

Ensure that Spot is currently selected in the Trade section.

Enter your order value or quantity.

Check the order details, and click on Buy or Sell in the confirmation window.

For more details on how to place a Spot order on Bybit, check out Bybit’s Help Center article here.