Discover the top crypto presales January 2026 that smart money is tracking today. See which early-stage projects, led by IPO Genie, show real potential before exchange listings.

January 2026 is becoming an important period for early-stage crypto positioning. If you’re searching for top crypto presales January 2026, the goal is simple: finding projects that experienced investors are watching before exchange listings and broader market exposure.

As capital shifts carefully and market narratives adjust, smart money, including venture funds, DAO treasuries, and crypto-native angels, is entering crypto presales before exchange listing with a clear focus. These investors are not chasing short-term price moves. They are prioritizing structure, real utility, and long-term demand.

This article breaks down the crypto presales smart money is tracking today, explains why IPO Genie ($IPO) continues to appear at the top of January 2026 watchlists, and shows how these projects align with wider early crypto investment opportunities 2026.

What This Article Covers

Which crypto presales smart money is tracking right now

Why certain projects stand out among upcoming crypto presales with potential

What signals whales, funds, and DAOs look for before allocating capital

How hype-driven, low-quality presales are identified and avoided

Why Smart Money Is Back In Crypto Presales In January 2026

January often marks the start of early positioning cycles, and 2026 is following the same playbook. Smart money does not chase 20%–30% short-term price spikes. It enters early, often months before narratives attract broad attention. Crypto presales offer asymmetric upside when valuation, structure, and timing align at the right stage.

For experienced investors assessing the best crypto presales to buy today, three factors consistently drive decisions:

This disciplined approach allows participation in crypto presales before exchange listing while risk remains visible and measurable, rather than inflated by hype-driven pricing after public launches.

What “Smart Money” Actually Tracks In 2026 (Reality Check)

Crypto Presales Smart Money Is Tracking, How Decisions Are Made

In the current market, smart money typically includes:

Venture capital firms

DAO treasuries

Crypto-native angels

Protocol founders and builders

These investors are not following influencer narratives, Telegram trends, or short-lived market excitement.

Instead, they focus on:

Early traction and adoption signals

Revenue paths or clearly defined value capture

Strategic partnerships or ecosystem integrations

Token utility tied directly to real demand

Key principle: smart money tracks structures, not slogans, especially when evaluating upcoming crypto presales with potential.

Key Signals Smart Money Looks For In A Presale (2026 Edition)

1. Clear Revenue Or Value Capture Model

Fees, access rights, staking yields, or usage-based mechanics must be defined from the start. Tokens built on vague “future utility” promises are increasingly ignored in 2026.

2. Token Designed For Use, Not Exit Liquidity

Healthy vesting schedules and emissions aligned with growth matter more than fast-flip incentives.

3. Real Product Progress Before Public Sale

Presales without MVPs, pilots, testnets, or early users struggle to attract serious capital compared to other early crypto investment opportunities 2026.

4. Narrative Alignment With Capital Flows

Smart money capital is concentrating around:

AI infrastructure

DeFi 3.0 and sustainable yield

Modular and app-specific blockchains

On-chain data, analytics, and identity

Web3 consumer monetization

5 Top Crypto Presales Smart Money Is Tracking For January 2026

1. IPO Genie ($IPO): AI-Driven Private Market Access

Why Smart Money Is Watching

IPO Genie is drawing strong interest in January 2026 because it addresses a long-standing gap in the market: access to private and pre-IPO investments. Global private markets are estimated at $15–20 trillion, yet participation remains restricted to institutions and high-net-worth investors. IPO Genie focuses on opening this market through structured, on-chain access supported by AI-based screening and allocation tools.

For smart money, the appeal is grounded in numbers, not speculation. Even conservative assumptions make the opportunity clear:

Capturing 0.05% of a $15T market equals roughly $7.5B in facilitated deal flow

A 1–2% platform capture implies $75M–$150M in annual revenue potential

This type of early asymmetry is what experienced investors look for.

Key Reasons Smart Money Is Watching:

Exposure to a large, under-tokenized market

AI filtering that improves deal quality signals

Token demand linked to access, governance, and participation

Presale Highlights

Category: AI-driven private market access / alternative investments

Token price: ~ $0.00011540 per token (current presale phase 39)

Utility-first token design for deal access and governance

Multi-phase presale with incremental pricing

Venture-style exposure built on blockchain infrastructure

As alternative investments move on-chain, IPO Genie stands out as an access layer, not a hype-driven presale.

2. Bitcoin Hyper ($HYPER): Bitcoin Layer-2 Infrastructure

Why Smart Money Is Watching

Bitcoin Hyper is gaining attention because it tackles one of Bitcoin’s long-standing limits: scalability and programmability. Bitcoin is the most secure and widely used blockchain, but its base layer was never designed to support complex applications or high transaction volumes. Bitcoin Hyper builds on top of Bitcoin to extend its capabilities while preserving the network’s security.

Smart money looks for projects that improve Bitcoin, not ones that try to compete with it. As more people use Bitcoin, the network needs faster transactions, lower costs, and basic programmability. Bitcoin Hyper steps in to support these needs by making the Bitcoin network more flexible and usable.

Presale Highlights

Category: Bitcoin Layer-2 infrastructure

Token price: ~ $0.013605 per token (early presale stage)

Token utility tied to network fees, staking, and participation

Focus on real Bitcoin-based use cases

Infrastructure-first design built for long-term usage

If Bitcoin continues to act as crypto’s primary store of value, Layer-2 infrastructure like Bitcoin Hyper may see rising demand beyond basic transfers.

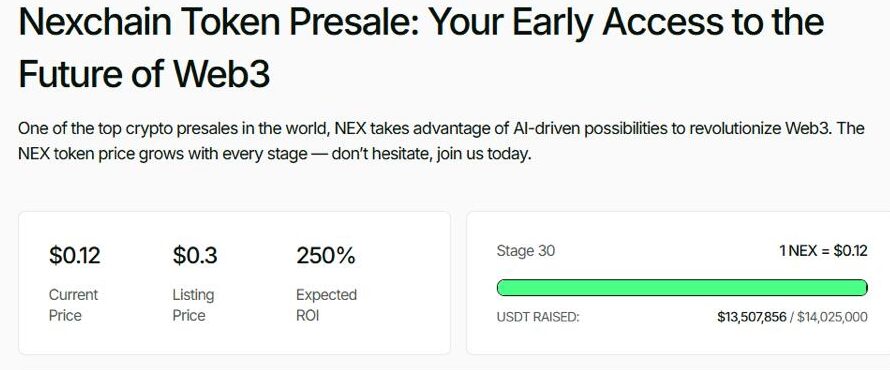

3. NexChain ($NEX): AI-Ready Layer-1 Blockchain

Why Smart Money Is Watching

NexChain.ai runs as a Layer-1 blockchain built to handle AI-driven and data-heavy applications. As AI tools move on-chain, many existing blockchains struggle with speed, data flow, and cross-chain communication. NexChain.ai is designed to solve these problems at the network level instead of patching them later.

Smart money often favors Layer-1 infrastructure because it can support many applications rather than a single product. NexChain.ai’s focus on interoperability allows AI, DeFi, and data-driven applications to operate more efficiently across different ecosystems, which is increasingly important as on-chain AI use cases expand.

Presale Highlights

Category: AI-ready Layer-1 blockchain infrastructure

Token price: ~$0.12 per token

Infrastructure-first design rather than app-specific development

Strong emphasis on developer adoption and ecosystem growth

Architecture suited for AI-native and data-heavy workloads

As decentralized AI services continue to grow, Layer-1 blockchains purpose-built for these demands, such as NexChain.ai, may capture long-term network value beyond short-term market cycles.

4. BlockchainFX ($BFX): Unified Trading And Analytics Platform

Why Smart Money Is Watching

BlockchainFX solves a common problem traders face in crypto. Most people use one platform for charts, another for trades, and a third for market data. This setup wastes time and creates mistakes. BlockchainFX brings these tools into one place, so traders can analyze and act without switching platforms.

Smart money tends to favor platforms with recurring usage. When a tool becomes part of a daily workflow, demand stays more stable across market cycles.

Presale Highlights

Category: Trading, analytics, and on-chain data platform

Token price: ~$0.031 per token (presale allocation)

Token unlocks platform features and analytics tools

Designed around real trading workflows

Utility tied directly to ongoing platform usage

Trading and analytics platforms with consistent users often outperform hype-driven projects over longer cycles.

5. RWA Nexus ($RWAN): Real-World Asset Tokenization

Why Smart Money Is Watching

RWA Nexus focuses on tokenizing real-world assets, a sector increasingly seen as a practical bridge between traditional finance and blockchain infrastructure. Tokenization allows assets that are typically illiquid to be represented on-chain, improving access, transparency, and settlement efficiency.

Smart money interest comes from the direct link to the real economy. Unlike purely crypto-native projects, real-world asset platforms draw demand from established markets. This reduces reliance on speculative narratives and increases appeal to institutional and compliance-focused capital.

Presale Highlights

Category: Real-world asset tokenization

Token price: ~$0.025 per token (initial presale phase)

Exposure to real-economy assets rather than purely digital assets

Designed with institutional participation in mind

Positioned within a growing real-world asset tokenization narrative

As financial markets continue moving on-chain, real-world asset tokenization is expected to remain a long-term growth area rather than a short-term trend.

Quick Comparison: Crypto Presales Smart Money Is Tracking (January 2026)

| Project | Core Focus | Token Utility | Narrative Alignment (2026) | Why Smart Money Cares |

| IPO Genie ($IPO) | Private market access + AI | Deal access, governance, platform participation | AI finance, alternative investments | Opens venture-style exposure on-chain |

| Bitcoin Hyper ($HYPER) | Bitcoin Layer-2 | Fees, staking, network usage | Bitcoin scaling, infrastructure | Unlocks new Bitcoin use cases |

| NexChain ($NEX) | AI-ready Layer-1 | Network usage, ecosystem growth | AI infrastructure, interoperability | Foundation layer for AI-native apps |

| BlockchainFX ($BFX) | Trading & analytics platform | Tool access, platform utilities | On-chain data, AI tooling | Sticky usage and recurring demand |

| RWA Nexus ($RWAN) | Real-world asset tokenization | Asset access, protocol participation | Real-world assets, TradFi bridge | Exposure to real-economy value |

How Smart Money Evaluates These Presales

Before allocating capital, experienced investors ask:

Does this protocol generate value without relying on token speculation?

Who benefits if the token appreciates, users or insiders?

Is the presale valuation supported by current progress?

Would this project survive a prolonged bear market?

If the answer is “no” more than twice, smart money usually walks away.

Final Thoughts

January 2026 is about early positioning, not quick returns. The crypto presales smart money tracking today tends to be disciplined, structured, and utility-driven rather than viral or hype-focused.

When a presale can hold up without hype, it deserves attention, and among the top crypto presales in January 2026, IPO Genie remains one of the clearest names smart money is watching most closely.