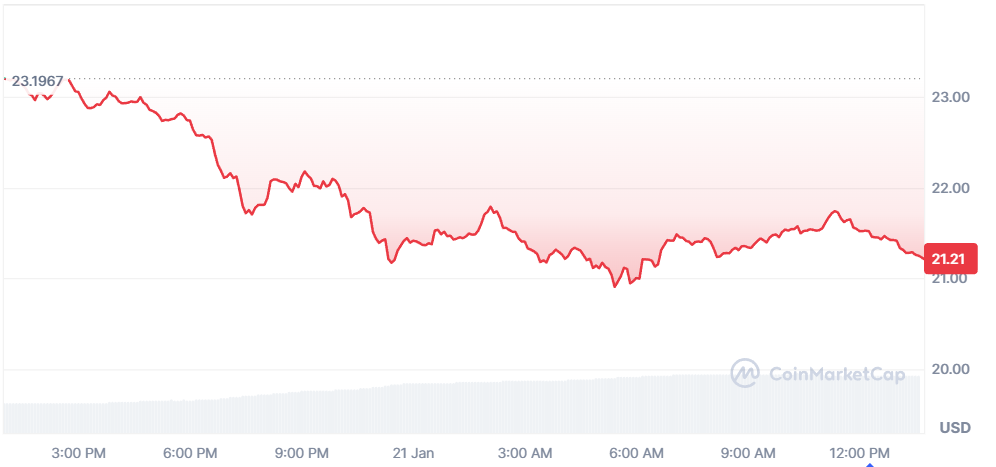

Hyperliquid (HYPE) price forecast is in focus once again after it dipped to an 8-month low of $20.8 on Tuesday amid a sharp market-wide correction. Currently, HYPE is trading at $21.4, down 9.3% over the past 24 hours, and its market cap has dropped below $7 billion.

The downward rally was triggered by intense selling pressure in the wider market, which drove the Hyperliquid price below the $22.5 support level. If the bearish momentum persists, the token could drop to lower levels, towards the next major support at $17.

Another reason for the sharp decline was that Trove Markets’ plan shifted away from Hyperliquid integration and toward Solana development. This was a major Hyperliquid project that was abruptly switched to Solana, causing a 95% crash in Trove and impacting Hyperliquid’s ecosystem and the HYPE token price.

However, Hyperliquid is still leading the perp DEX space and rising network activity, but the market structure is signaling extreme bearish pressure. Traders are watching the $20 key support zone closely to see if the crypto could rebound or break down for a deeper bear leg.

Why is Hyperliquid Price Falling Today?

Hyperliquid’s price is down by more than 9% today due to a combination of factors, including significant selling pressure in the broader market, a recent project failure, and bearish technical signals, such as a negative MACD. Low funding rates have also triggered some large traders to take short positions, signaling reduced confidence in an immediate recovery.

Source: CoinMarketCap

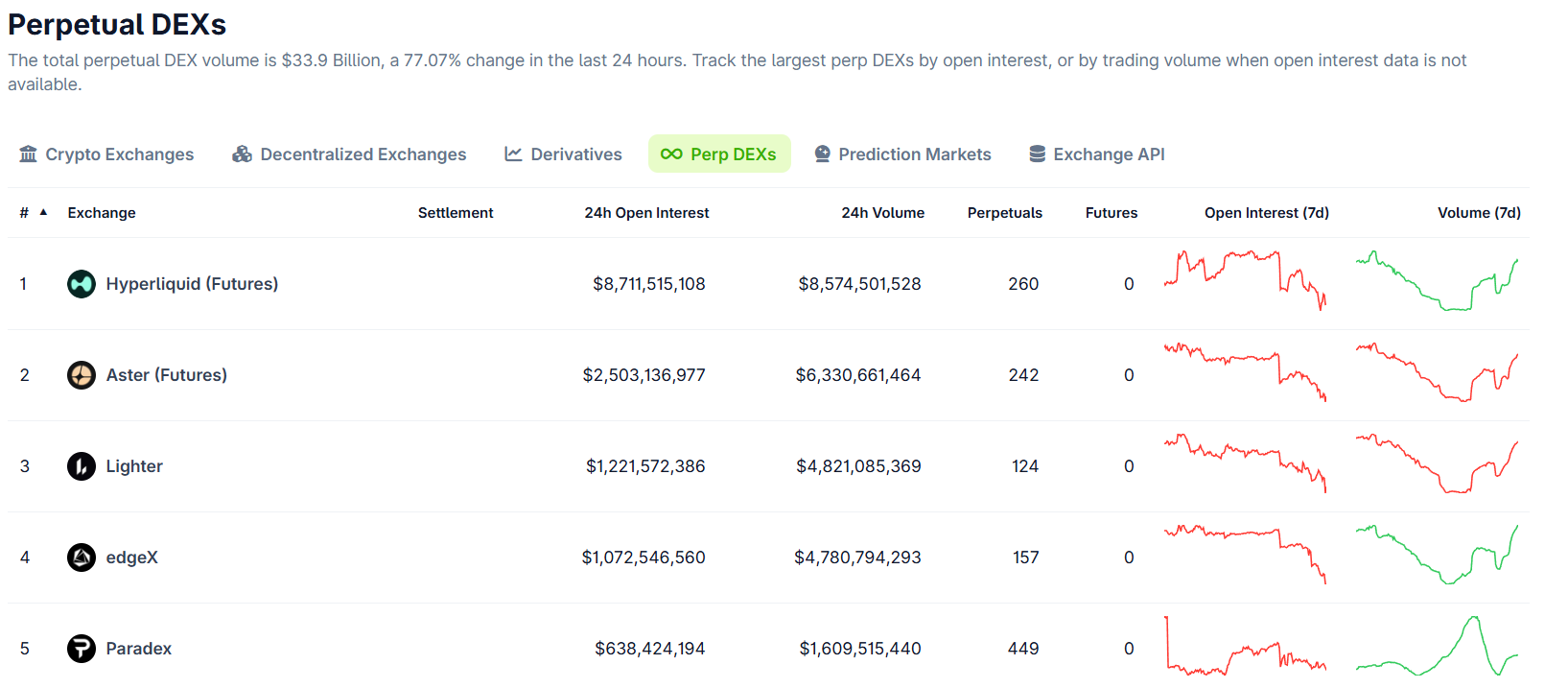

While market volatility is a major reason, increasing competition is also weighing on HYPE’s price action. Platforms like Lighter have successfully attracted volume and users. However, the platform has returned to the lead among perp DEXs while ranking 14th among decentralized exchanges.

Hyperliquid Tops Perp DEX Chart

The perpetual decentralized exchange market saw another change this week, with Hyperliquid reclaiming the top spot. Aster and Lighter exchanges hold the second and third positions, respectively. The reshuffle occurred after Lighter’s weekly perpetual trading volume had dropped significantly from its peak.

Data from Coingecko shows that Hyperliquid recorded about $8.6 billion in trading volume over the last 24 hours. Aster came in second with $6.3 billion, while Lighter fell to third with $4.8 billion.

Source: Coingecko

Traders looking for high leverage without giving up decentralization still choose Hyperliquid. Even as reward-based trading slows on rival platforms and the bearish Hyperliquid (HYPER) price forecast, trading activity on Hyperliquid remains strong. This steady preference suggests the platform continues to attract users, though it remains uncertain whether its growing dominance will translate into long-term gains for HYPE token holders.

Trove Pivot: Dropped Hyperliquid for Solana

Trove, a specialized Decentralized Exchange (DEX), recently held a presale to build on Hyperliquid HIP-3, but after the sale, it pivoted to Solana. The move came only weeks after the team raised more than $11.5 million in a TROVE token sale. Now, investors are demanding refunds, saying the project changed direction after they invested.

$TROVE will launch on Solana

ICO participants who contributed via EVM, can connect their Solana wallet to receive $TROVE, on our ICO site: https://t.co/1VtxZ3pbB9. Ends 18th January, 5pm UTC. pic.twitter.com/NBCrpirq1c

— TROVE (@TroveMarkets) January 16, 2026

Trove’s decision to abandon Hyperliquid after raising $11.5 million has hurt market sentiment around the ecosystem, adding uncertainty rather than direct selling pressure. While Hyperliquid itself remains operationally strong, the incident raises concerns about the trustworthiness of projects built on it, which can weigh on short-term HYPE price performance by discouraging speculative inflows and new developer interest.

Hyperliquid (HYPE) Price Forecast: Can it Rebound in January?

Hyperliquid’s price has remained bearish since its September 2025 peak, when it was rejected near $60. Since then, the token has lost nearly 60% of its value and is currently trading above the key $20 support level.

During the recent market drop, HYPE faced selling pressure near the $28.30 resistance level. This rejection sparked a bearish rally, driving the price to a new 8-month low of $20.8. The chart for every time frame continues to print consecutive lower lows and lower highs, signaling that sellers remain in control and that downside continuation remains the dominant trend.

Hyperliquid (HYPE) price chart. Image courtesy: TradingView

It has also slipped below its short-term 10 and 20-day moving averages on this decline, with price trending lower toward the $20 support zone. The RSI (Relative Strength Index) is now hovering near the oversold region, so dip buyers might step in to protect lower levels. However, every recovery attempt to push higher was short-lived, with sellers stepping in near prior resistance levels.

Right now, the market is in a wait-and-watch mode. Most investors are hoping for a bottom soon, but experts are already accumulating top tokens that could deliver outsized returns once the market bottoms. If the market holds steady at these levels, it could create a stronger base. However, any fresh setbacks are likely to push traders’ patience and confidence to the limit.