Institutional flows across crypto exchange-traded funds showed renewed volatility in mid-January, with Bitcoin and Ethereum products recording sizable outflows, while Solana and XRP-linked vehicles remained comparatively resilient.

Data from multiple issuers shows that investor positioning has shifted rapidly over recent sessions, reflecting a more selective approach to digital asset exposure rather than a broad risk-off move across the sector.

Key takeaways

Bitcoin and Ethereum ETFs recorded significant net outflows

Solana and XRP ETFs showed relative resilience with net inflows

The data points to capital rotation, not wholesale exit from crypto

Product structure, fees, and staking features are increasingly influencing flows

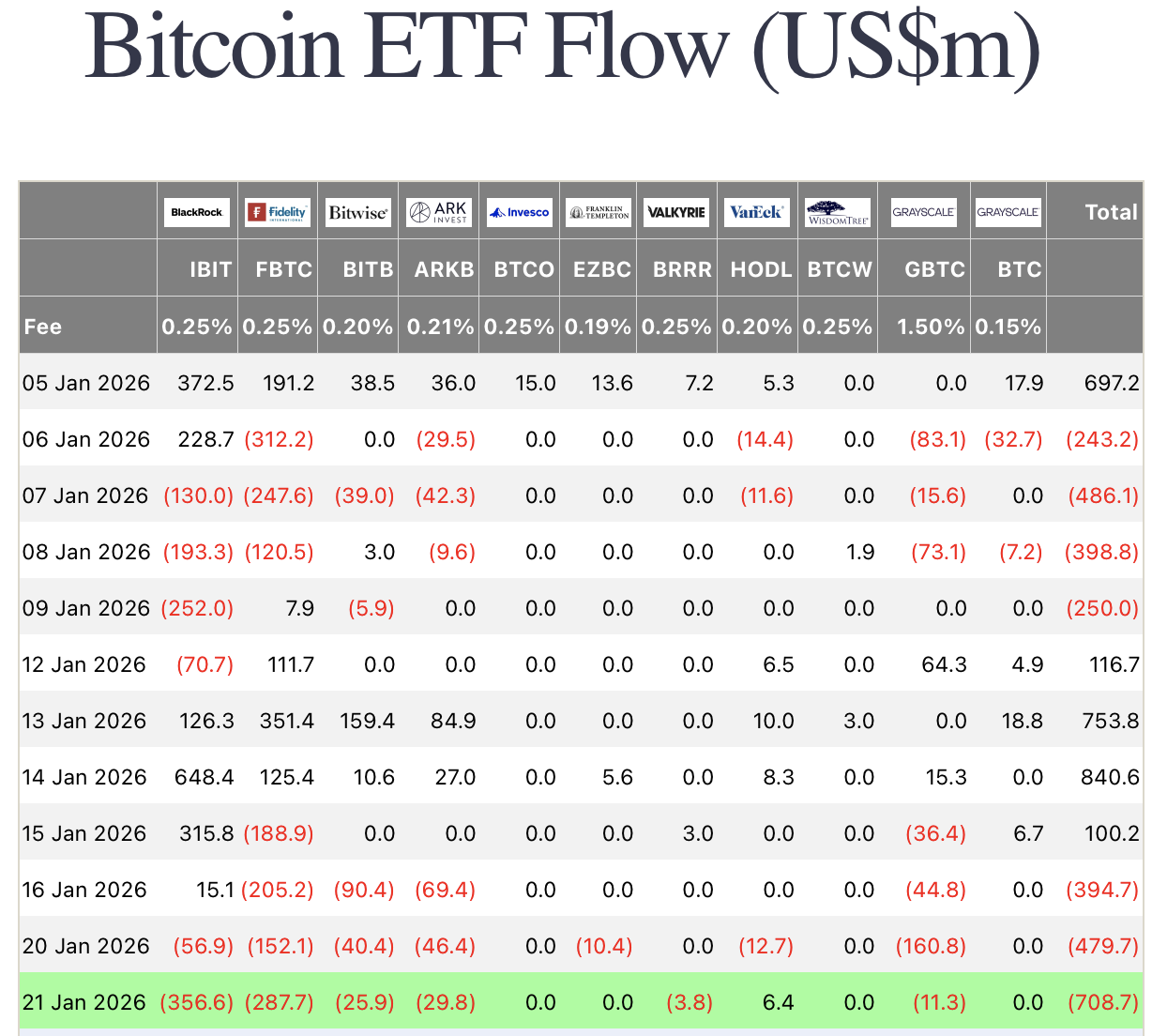

Bitcoin ETF flows turn sharply negative

Bitcoin ETFs experienced heavy outflows on January 21, with total net withdrawals exceeding $700 million. The pullback followed several sessions of alternating inflows and outflows, highlighting fragile short-term sentiment despite earlier institutional demand.

Products issued by firms such as BlackRock, Fidelity, and ARK Invest all posted net redemptions on the day, while Grayscale products continued to see consistent capital leakage. The data suggests that investors are actively trimming exposure rather than exiting the asset class entirely, potentially locking in gains after earlier inflow-heavy sessions.

The sharp reversal underscores how sensitive Bitcoin ETF flows remain to macro signals, price volatility, and shifting expectations around monetary policy and regulation.

Ethereum ETFs see continued pressure

Ethereum ETFs mirrored Bitcoin’s weakness, posting roughly $287 million in net outflows on January 21. While several sessions earlier in the month showed steady inflows, recent data points to waning momentum.

Notably, products that do not yet offer staking features saw more pronounced outflows, while legacy vehicles retained some stability. This divergence suggests that yield expectations and structural product features are becoming increasingly important factors for institutional allocators evaluating Ethereum exposure.

Despite the short-term weakness, cumulative flows for Ethereum ETFs remain positive for the month, indicating that recent selling may represent tactical repositioning rather than a structural shift in demand.

Solana and XRP ETFs show relative resilience

In contrast, Solana ETFs recorded modest but positive inflows on January 21, adding approximately $3 million across issuers. While small in absolute terms, the consistency of inflows stands out against broader market volatility.

Solana ETF products continue to benefit from staking support and lower fee structures, which appear to be attracting niche institutional interest even as flows into larger assets fluctuate.

XRP-linked ETFs also posted net inflows on the day, totaling nearly $3.8 million. Products issued by firms including Bitwise and Franklin Templeton contributed to the positive total, suggesting selective demand for alternative large-cap exposure.

Flows point to rotation, not retreat

Taken together, the ETF flow data paints a picture of rotation rather than broad institutional capitulation. Investors appear to be reallocating between assets and structures, favoring products with clearer yield dynamics or differentiated exposure while trimming positions in more crowded trades.

As crypto ETFs mature, daily flow data is increasingly reflecting nuanced portfolio management decisions rather than simple directional bets. Whether outflows in Bitcoin and Ethereum stabilize or extend further will likely depend on upcoming macro developments, regulatory clarity, and price action across the broader digital asset market.

For now, the divergence in flows highlights an important shift: institutional participation in crypto is becoming more selective, strategic, and product-specific.