The best altcoins to buy now in February include a volatile mix of meme-fueled presales, ecosystem tokens tied to legal risk, and perpetual trading platforms targeting traditional commodities.

Maxi Doge continues attracting presale capital while questions over transparency remain. Pump.fun faces a class-action lawsuit but is expanding its investment arm.

Hyperliquid posted over $1.25 billion in silver trades as its native token rallied more than 30% in January. Meanwhile, Pepe is attempting to confirm a bullish breakout as sentiment shifts across meme assets.

Pump.fun Expands Utility While Facing Insider Trading Lawsuit

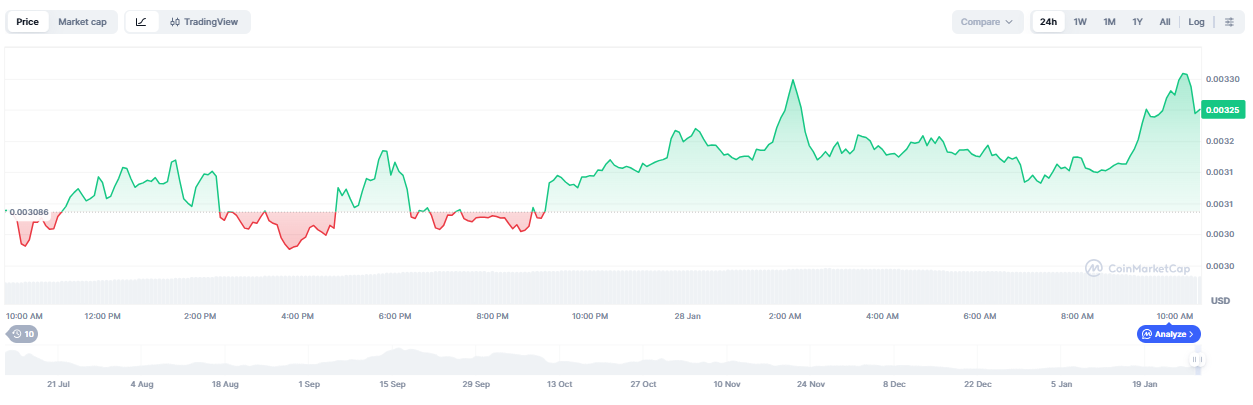

Pump.fun (PUMP) is trading at $0.003305, up 7.6% in the past 24 hours, with a $1.16 billion market cap and $388.75 million in 24h volume. The token has reclaimed the neckline of an inverse head-and-shoulders pattern, but legal risks are mounting.

A class-action lawsuit filed in late January alleges internal manipulation of token launches and preferential treatment for insiders during the launchpad’s peak traffic months.

In response, the team announced a $3 million Pump Fund aimed at funding early-stage meme tokens and expanding developer grants. On-chain data shows new deployments rising as builders explore Pump.fun alternatives, including Solana-native forks using similar mechanics.

Meanwhile, technical indicators remain bullish. RSI sits above 60, and the CMF has returned to neutral, signaling restored inflows after a sharp dip earlier this month.

If $0.0038–$0.0040 breaks cleanly, analysts expect a run toward $0.0045 into February. Regulatory action, however, could complicate listings and treasury use.

Maxi Doge Presale Surpasses $4.5M but Liquidity and Listing Unclear

Maxi Doge ($MAXI) has raised over $4.5 million in its ongoing presale, attracting a growing base of retail traders drawn to its culture-first positioning. The project offers 70% staking rewards and weekly leaderboard competitions such as Maxi Ripped and Maxi Gains, which reward early holders for engagement and performance.

With its presale pricing currently at $0.0002801, $MAXI operates on a time-based tier system that increases the token price as new milestones are reached.

The branding leans into high-volatility trader culture with slogans like “1000x leverage” and “no stop loss,” resonating with meme investors who previously rallied behind Dogecoin and PEPE cycles.

Participation continues to accelerate across Telegram and trading forums for traders wanting to buy Maxi Doge, with early backers positioning ahead of expected exchange announcements following the presale’s final phase.

$MAXI remains one of the most closely watched presales this month, with its growth driven entirely by momentum, identity, and cycle timing.

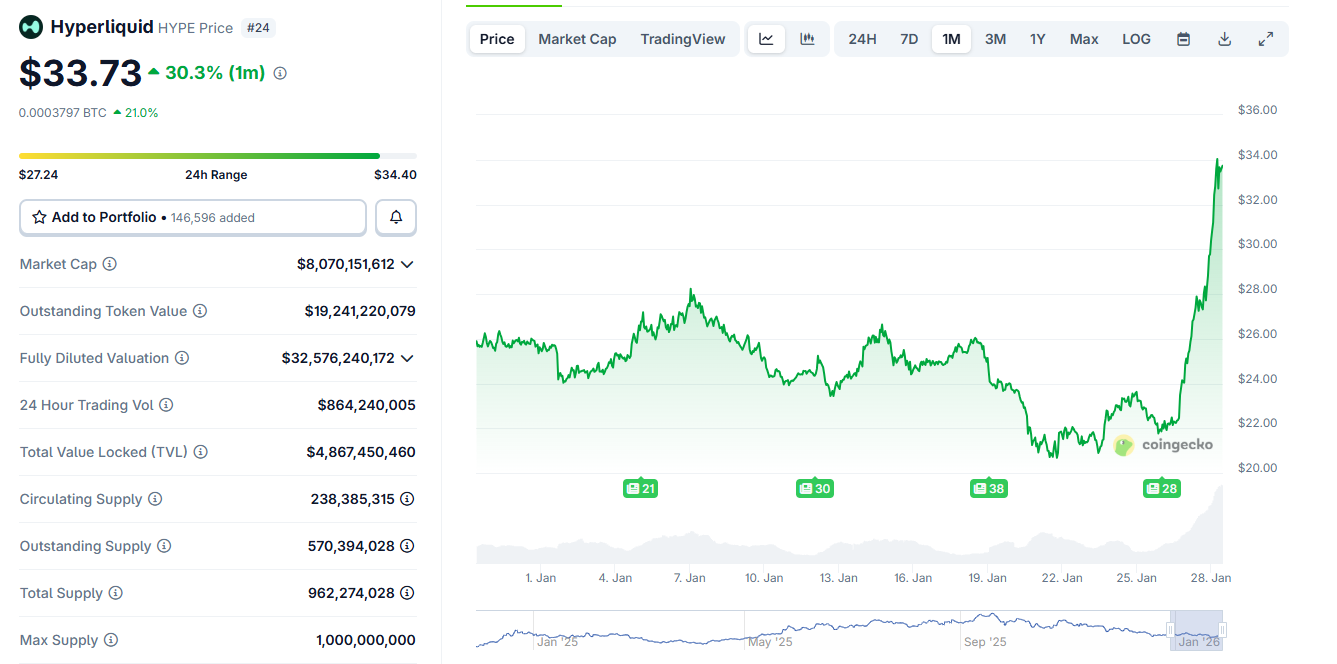

Hyperliquid Hits $33.73 as Silver Perpetuals Post Record Volume

Hyperliquid (HYPE) is trading at $33.73, up 30.3% in January, with a market cap of $8.07 billion, FDV of $32.57 billion, and $4.86 billion TVL.

The price rally coincided with explosive activity in commodity futures, especially silver, which recorded over $1.25 billion in daily volume and $155 million in open interest on the platform.

These volumes placed Hyperliquid above GMX and dYdX for the week in aggregate perpetuals activity.

The exchange’s 50/50 fee split between platform and market creators remains a major attractor for liquidity, and buybacks funded via the Assistance Fund have reduced token supply by over 1.2 million HYPE since January 10.

Co-founder Jeff Yan stated that Hyperliquid aims to become “the most liquid venue for on-chain price discovery,” noting that expansion into metals gives it an edge over crypto-only competitors. Analysts are watching for regulatory commentary as Hyperliquid’s synthetic silver and gold markets attract non-crypto traders.

Pepe Holds $0.000000499 as Cup and Handle Forms, Retail Flows Return

Pepe (PEPE) is priced at $0.000000500, with a market cap of $2.06 billion and 24-hour volume at $364 million. The coin is consolidating just above its $0.000000494 support, with a developing Cup and Handle formation visible on the daily chart.

Technical traders are watching $0.000000547 as the breakout level, with a target of $0.000000600 on confirmation. On-chain flows show retail re-entry, with 1,300 new wallets holding PEPE added since January 20.

Google Trends data also shows a 17% rise in meme coin search traffic, aligning with minor DOGE and FLOKI rallies. RSI for PEPE remains neutral near 47, but price structure is firm. Whales have not exited, and no major exchange delistings are expected.

In the short term, failure to hold $0.000000494 would invalidate the pattern for the Pepe price prediction. If structure holds and flows continue rising, PEPE may enter a new trend phase as February begins.