Key Notes

JPMorgan says the US dollar drop is being driven by short-term flows and sentiment, not a shift in US growth or monetary policy.

Unlike the gold rally, Bitcoin price has remained range-bound, indicating it’s behaving more like a liquidity-sensitive risk asset than a store of value.

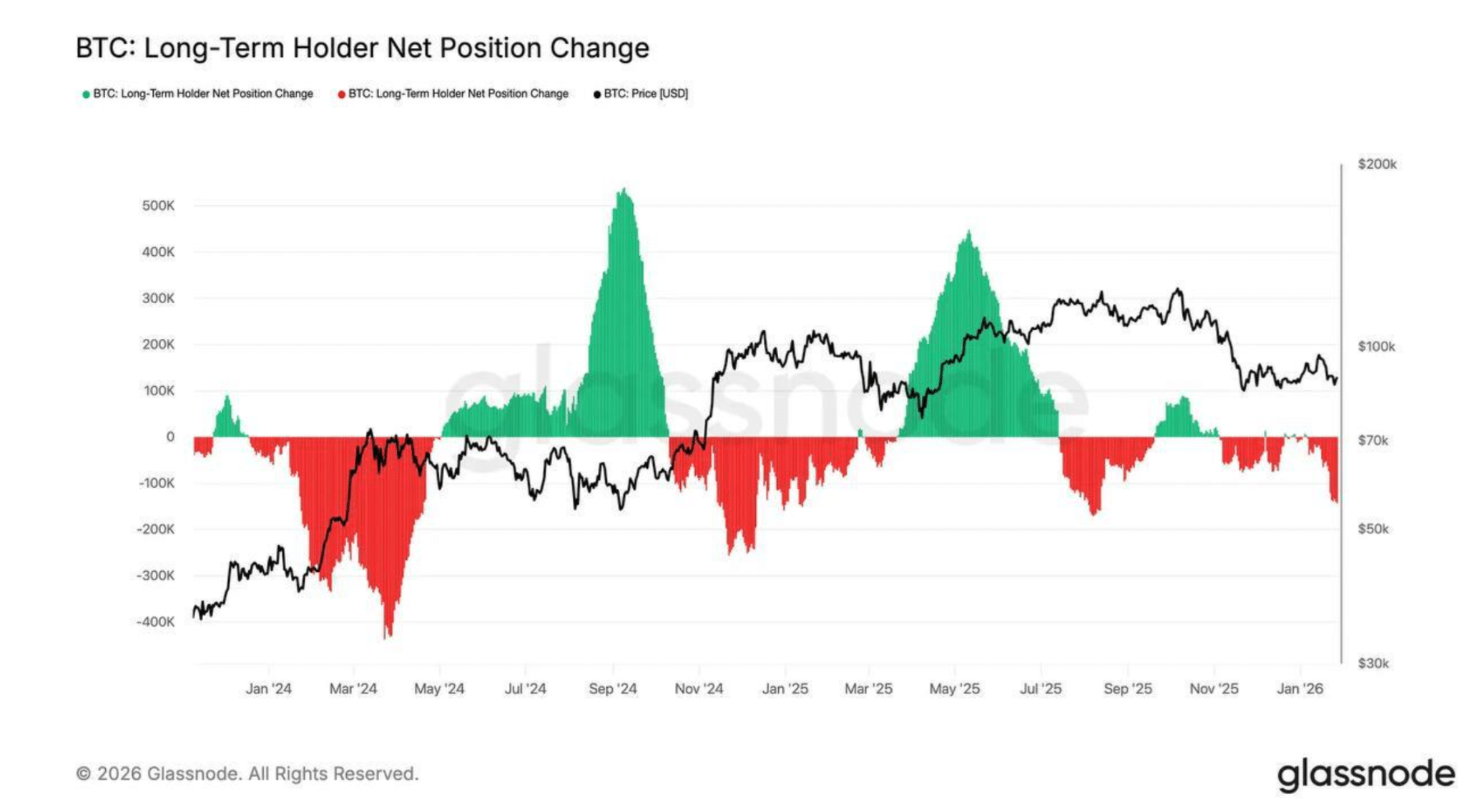

Glassnode reports muted BTC trading volumes, bearish options positioning, and ~143,000 BTC sold by long-term holders in 30 days.

Despite the US Dollar Index falling more than 10% over the past year, Bitcoin price has failed to show strength, leaving investors confused. On the other hand, a weakening dollar is pushing precious metals like gold and silver to fresh highs. JPMorgan strategists explain the reason why BTC is failing to catch up despite the USD weakness.

Why Bitcoin Price Underperformed Despite US Dollar Index Drop

Historically, BTC price usually moves in the opposite direction to the USD.

Explaining the linearity between USD and BTC over the past year, JPMorgan strategists noted that the weakness in USD is being driven largely by short-term flows and market sentiment, rather than a fundamental shift in US growth or monetary policy expectations.

They noted that US rate differentials continue to favor the dollar, suggesting the move may not be structural.

Related article: Dollar Is Weak, but Why Is Bitcoin Lagging?

Furthermore, the bank noted that the US dollar weakness could be temporary, and any recovery in the US economy could lead to a surge in the dollar index. This is the reason why BTC hasn’t acted as a traditional hedge to the US dollar. Yuxuan Tang, JPMorgan Private Bank’s head of macro strategy in Asia, explained:

“It’s crucial to note that the recent dollar slide isn’t about shifts in growth or monetary policy expectations. If anything, interest rate differentials have actually moved in the USD’s favor since the start of the year. What we’re seeing now, much like last April, is a USD selloff driven primarily by flows and sentiment.”

Gold Dominating BTC as Store of Value

With the gold price hitting $5,500 historic high amid the USD weakness, Bitcoin price has remained rangebound. This shows that BTC is trading more like a liquidity-sensitive risk asset instead of being a store of value.

Until currency markets are driven by growth and rate dynamics rather than by flows and sentiment, JPMorgan believes Bitcoin may continue to lag traditional macro hedges. The $1.8 billion outflows from US Bitcoin ETFs over the past week also show waning institutional confidence in BTC.

? Bitcoin ETF's have seen significant money moving out leading up to today's FOMC decision. Since January 15th, the last 7 full trading days have had a total of -$1.86B in net outflows.

? Bitcoin, Ethereum, and Solana money flows and trading volume. https://t.co/QJvmafU9xX pic.twitter.com/Eed0rLmTRb

— Santiment (@santimentfeed) January 28, 2026

Bitcoin critic Peter Schiff said that digital gold Bitcoin is losing its shine over the yellow metal.

Bitcoin is melting down in terms of real money. Priced in gold, Bitcoin is down 56% from its November 2021 peak. This slow melt is about to turn into a fast burn. Before the fire ignites, trade your Bitcoin in for gold right now. Schiff Gold makes it easy. https://t.co/GGNU9tT9EQ

— Peter Schiff (@PeterSchiff) January 29, 2026

The latest Glassnode report said Bitcoin is consolidating amid subdued trading volumes. It added that the spot demand is showing little signs of recovery, while options are positioned on the bearish side.

Bitcoin long-term holder net position | Source: Glassnode

The on-chain analytics firm added that long-term holders have sold roughly 143,000 BTC over the past 30 days. This marks the fastest distribution since August 2025.