What began as a temporary correction in the last quarter of 2025 has morphed into a full-blown bear cycle. Bitcoin plunged below $75,000 on Monday, erasing over $1 trillion in market value since its all time high last October. The overall crypto market has dipped to $2.53 trillion, the lowest level since April 2025.

Multiple factors converged to trigger a sharp downturn in the crypto market. Even leading cryptos like Bitcoin and Ethereum have failed to respond to geopolitical stress, inflation, dollar weakness, forced liquidations, and thinning liquidity.

The fear of a larger global market correction pushed investors toward traditional assets like Gold and Silver, which reached record highs in 2026. Now, the main question investors are asking is when this madness will end.

In this guide, we explain what ChatGPT predicts about when the crypto crash will end. The advanced AI model analyzes various factors and approaches the question objectively. Read on as we unpack why the crypto market crashed and ChatGPT’s market prediction for 2026.

What Caused the Crypto Crash?

The crypto crash was triggered by a convergence of macro tightening, liquidity stress, and risk-off sentiment. The major trade wars initiated by U.S. President Donald Trump weakened the bull market’s momentum, and they have continued to date, shifting investors towards low-risk assets.

Source: CoinMarketCap

Middle-East geopolitical tension between Israel and Palestine, and revolt in Iran, also raised the risk of full-blown wars. In times of war, investors typically hold traditional assets such as gold or remain in cash in U.S. dollars. Because bitcoin is still seen as a 24/7 speculative market, it often experiences the first wave of liquidation crises during global panics.

Weak institutional interest in spot ETFs also contributed to the recent drop. In the last two sessions, the U.S. spot Bitcoin ETFs faced more than $1 billion in losses. Big institutional buyers, including digital-asset treasury firms, have also pulled back. After their own stock prices crashed last year, many slowed or stopped buying altogether. This retreat has reduced demand at the upper end of the market and removed a key source of support.

ChatGPT Prediction for End of Crypto Crash

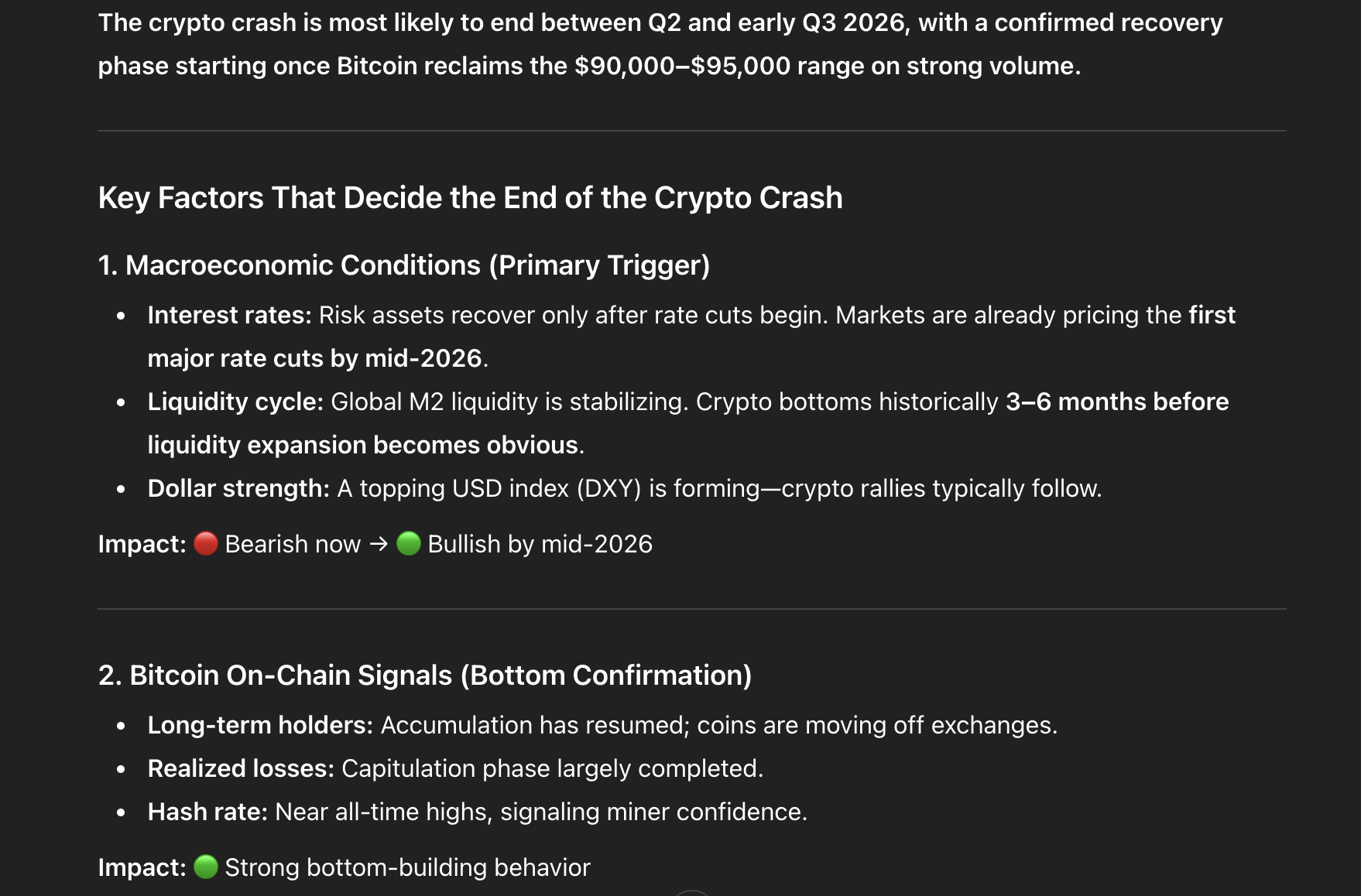

According to ChatGPT’s analysis, the crypto crash is most likely to end between Q2 and early Q3 2026, with a confirmed recovery phase starting once Bitcoin reclaims the $90,000–$95,000 range on strong volume.

ChatGPT notes the high likelihood that the Fed will cut interest rates and that Global M2 liquidity is stabilizing. Risk assets like cryptocurrencies recover only after rate cuts begin. When interest rates are lowered, borrowing becomes easier, which leads capital to flow towards high-return assets like Bitcoin.

Historical price action also supports the theory. In every major drawdown, 2014–15, 2018–19, and 2022, Bitcoin first completed a deep capitulation, then spent 4–8 months moving sideways in a narrow range while sentiment stayed negative. During this phase, long-term holders accumulated, exchange balances fell, and volatility compressed.

Importantly, price recovery always began before macro conditions visibly improved, with Bitcoin rallying 3–6 months ahead of rate cuts and liquidity expansion. Once Bitcoin reclaimed a prior macro resistance zone and held it for several weeks, the bear market was considered officially ended, and capital rotated into altcoins shortly after.

Why Bitcoin and Ethereum Failed to Act as Safe Havens

Despite rising adoption and confidence in the crypto market, Bitcoin and Ethereum failed to absorb macroeconomic shocks due to thin liquidity and institutional risk aversion.

The recent sharp decline wasn’t a normal pullback; it triggered one of the largest liquidation cascades in the crypto market. This resulted in the liquidation of over $2.56 billion in overleveraged positions within 24 hours. Market observers were closely watching both digital assets as volatility escalated.

Source: CoinMarketCap

Currently, Bitcoin is trading at around $76,600 while Ethereum is hovering above the $2,200 support level. The altcoin market is also facing intense bearish pressure, with major altcoins including Solana, XRP, and Cardano struggling to hold their support levels. Market-wide weakness and institutions’ slowing accumulation lead to capital diversion to traditional safe-haven assets.

Is This the End or Just Another Phase?

ChatGPT predicts the current crash as a late-stage bear cycle rather than a structural collapse of crypto. Bitcoin is down over 40% with multiple bearish legs, and the sharp downturn this time could prompt dip buyers and long-term believers to step in.

ChatGPT indicates that the current crypto downturn reflects a late-stage bear cycle driven by macro and liquidity stress, not a fundamental breakdown of the crypto market. If macroeconomic conditions stabilize and liquidity improves in 2026, the crypto market could transition from prolonged consolidation to a gradual recovery.