Frax price predictions attract many beginners because the project connects two important ideas in crypto. It links stablecoins and investment tokens in one system. Many new users see Frax and ask a simple question. Can this project grow in the long term?

The market data looks interesting and also confusing. The current price is $1.15. At the same time, recent monthly moves show strong volatility. The monthly low reached $0.61 on December 21, 2025. The monthly high touched $1.47 on January 19. This wide range shows how fast sentiment can change in crypto. It also shows why people search for clear and simple analysis.

In this guide, you will learn what Frax is and how it works. You will also discover who created it and why it exists. We will review its past price behavior in simple words. Then we will move to clear Frax price predictions for 2026, 2030, and beyond. Step by step, you will see what can move the price up or down. So, let’s get started!

| Current FRAX Price | FRAX Price Prediction 2026 | FRAX Price Prediction 2030 |

| $1.15 | $1.7 | $7 |

Frax (FRAX) Overview

Frax (prev. FXS) is a cryptocurrency project that focuses on stable digital money. The token FRAX works as part of a larger system called the Frax Protocol. The main goal of this system is simple. It wants to create a stablecoin that stays close to one US dollar. At the same time, it wants to stay decentralized.

The project started in 2020. Sam Kazemian created it with a clear vision. He wanted to build a stablecoin that does not depend only on cash reserves. Instead, Frax uses a smart mix of collateral and algorithms. This is why people often call it a hybrid stablecoin.

Here is how it works in simple words. Part of each FRAX token is backed by other crypto assets. The rest of the value comes from the system’s own mechanisms. These mechanisms control supply and demand. When demand rises, the system can create more tokens. When demand falls, it can reduce supply. This helps keep the price close to one dollar.

The Frax ecosystem has more than one token. FRAX is the stablecoin that users spend and hold. There is also a governance and utility token, often known as FXS in the past. Today, the project uses the Frax name for its main token system. This second token helps absorb risk and keeps the system balanced.

People use Frax in many ways. They trade it, lend it, and use it in DeFi apps. Many platforms accept it as a stable unit of account. This makes it useful for saving value during market stress. It also helps traders move funds fast between different protocols.

The big idea behind Frax is trust through code. The system does not rely on one company or one bank. It relies on smart contracts and open rules. This makes Frax an important experiment in the future of digital money.

FRAX Price Statistics

| Current Price | $1.15 |

| Market Cap | $106,099,493 |

| Volume (24h) | $63,487,061 |

| Market Rank | #261 |

| Circulating Supply | 91,180,083 FRAX |

| Total Supply | 99,681,495 FRAX |

| 1 Month High / Low | $1.47 / $0.61 |

| All-Time High | $42.8 Jan 12, 2022 |

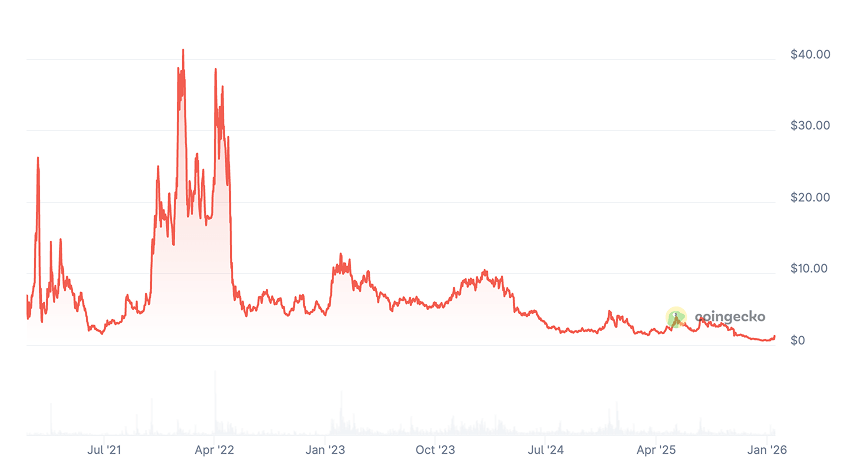

FRAX Price Chart

CoinGecko, January 20, 202

Frax (FRAX) Price History Highlights

2020: Launch And The First Market Test

Frax Finance launched on Ethereum on December 20, 2020. The protocol introduced a new idea. It mixed collateral and algorithms in one stablecoin system. At that time, FXS worked as the governance and value-capture token. It started trading near $3.95 on December 27, 2020. The legacy FRAX stablecoin stayed close to $1. The market treated the project as an experiment, but interest grew fast.

2021: Explosion, Volatility, And The First Halving

In January 2021, speculation pushed FXS to $25.77 in less than three weeks. Then came a sharp crash to $3.08. The market calmed down for several months. Prices moved sideways between $5 and $8. In October, the Tokemak partnership gave FXS real utility. In December, the first halving cut emissions by 50%. This created scarcity and changed the long-term narrative.

2022: All-Time High And A Brutal Collapse

On January 12, 2022, FXS reached its all-time high near $42.8. The rally came from the halving and strong DeFi partnerships. Then everything changed. In May, the Terra UST collapse shocked the entire stablecoin sector. Legacy FRAX lost part of its peg for short periods. Capital left DeFi. FXS crashed to the $5–$8 range. The FTX collapse in November added more fear. By the end of the year, FXS had lost around 80–85% from the top.

2023: Slow Recovery And Confidence Issues

March 2023 marked a painful moment. Legacy FRAX hit its all-time low near $0.8745. This scared many investors. Still, the system survived. Over the year, FXS recovered and closed 2023 near $8.59. The team focused on Frax v2 and better system controls.

2024: Quiet Bear Market And Weak Demand

2024 brought no strong catalysts. FXS started the year near $8.58 and ended near $3.51. This meant a drop of almost 60%. Legacy FRAX stayed close to $1. The market focused on other sectors, especially Layer 2 networks.

2025–2026: Capitulation, Rebound, And Rebranding

In December 2025, FXS hit a new all-time low near $0.61. This marked full capitulation. Then sentiment flipped. In weeks, the token rebounded above $1.1. In January 2026, FXS rebranded to FRAX at a 1:1 ratio. The new FRAX now trades near $1.15, with rising volume and renewed interest.

FRAX (prev. FXS) Price Prediction: 2026, 2027, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2026 | $1.52 | $1.95 | $1.7 | +50% |

| 2027 | $2.13 | $2.76 | $2.5 | +115% |

| 2030 | $5.19 | $8.84 | $7 | +510% |

| 2040 | $902.4 | $1,110 | $1,000 | +87,000% |

| 2050 | $1,367 | $1,562 | $1,400 | +122,000% |

Frax (FRAX) Price Prediction 2026

DigitalCoinPrice analysts estimate that in 2026, Frax may trade between $1.52 (+35%) at the lower end and $1.95 (+70%) at peak valuation. This scenario assumes steady protocol adoption and a gradual recovery of demand across the DeFi sector.

PricePrediction presents a similar but slightly more conservative outlook. According to their models, FRAX could trade as low as $1.54 (+35%) and climb to $1.85 (+60%), with the average price hovering near $1.59. This suggests a year of stabilization rather than explosive growth.

Frax (FRAX) Price Prediction 2027

DigitalCoinPrice expects Frax to accelerate its growth in 2027, with prices ranging from $2.13 (+90%) to $2.76 (+140%). This forecast reflects rising confidence in the protocol’s long-term positioning and expanding real use cases.

PricePrediction closely aligns with this view. Their projections place FRAX between $2.27 (+100%) and $2.70 (+140%), with an average trading price near $2.35. This suggests that 2027 could mark a clear transition into a stronger growth phase.

Frax (FRAX) Price Prediction 2030

By 2030, DigitalCoinPrice believes FRAX could trade between $5.19 (+360%) and $6.48 (+475%), supported by wider DeFi adoption and a more mature crypto market structure.

PricePrediction is even more optimistic. Their long-term models forecast a minimum price of $7.35 (+550%) and a potential high of $8.84 (+680%), assuming Frax becomes a key piece of DeFi infrastructure.

If these scenarios play out, FRAX would be among the stronger long-term performers in the sector, with returns measured in several multiples of today’s price.

Frax (FRAX) Price Prediction 2040

PricePrediction’s ultra-long-term outlook for 2040 is extremely bullish. According to their estimates, FRAX could trade between $902.4 (+80,500%) and $1,109.5 (+99,000%), with an average price near $965.5.

This scenario assumes massive global adoption of blockchain finance, a dominant role for mature DeFi protocols, and a long-term shift of traditional financial infrastructure onto crypto rails.

While such numbers should be treated with caution, they illustrate the theoretical upside if Frax becomes a core financial primitive.

Frax (FRAX) Price Prediction 2050

Looking even further ahead, PricePrediction forecasts that in 2050 FRAX could reach between $1,367.06 (+122,000%) and $1,561.94 (+139,000%), with an average price around $1,438.55.

This projection reflects an extremely optimistic future in which blockchain-based systems dominate global finance and Frax secures a lasting, strategic role in that ecosystem.

Naturally, such long-term forecasts come with enormous uncertainty. Still, they highlight the asymmetric upside potential that long-horizon investors often look for in foundational crypto protocols.

FRAX Price Prediction: What Do Experts Say?

Expert opinions on Frax have changed a lot in recent years. Today, the discussion focuses less on speculation and more on long-term infrastructure. One of the strongest voices comes from Kyle, a well-known crypto analyst and KOL on AICoin. In May 2025, he described FRAX as “the best liquidity token to bet on the stablecoin narrative.” He also called it an asymmetric opportunity.

Kyle points to simple numbers. At a market value below $500 million, FRAX looked small compared to Ethena at $6.1 billion. He also compared it to USDT and USDC. These giants do not even have governance tokens. His core idea is clear. Stablecoins today make up only about 1% of global M1 money. That share could grow to trillions of dollars. New laws, such as the GENIUS Act, may allow stablecoins to take roles once held by banks.

His thesis focuses on one key point. Issuers capture the most value in the stablecoin system. They control supply. They also control distribution. This gives them a strong economic position. In his view, this makes FRAX more interesting than exchanges or lending platforms.

Another important voice is Sam Kazemian, the founder of Frax. In late 2025, he shared a new direction for the project. On the Stabled Up podcast, he explained a shift toward institutional finance. The new frxUSD now uses 1:1 backing with U.S. Treasuries and cash equivalents. BlackRock and Superstate handle custody. This marks a clear break from the old algorithmic model.

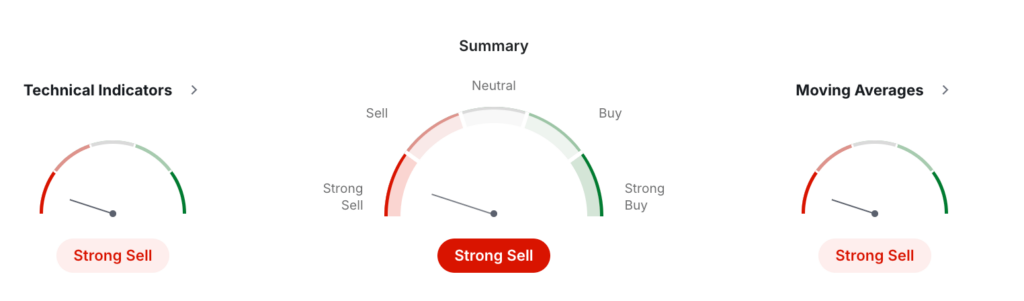

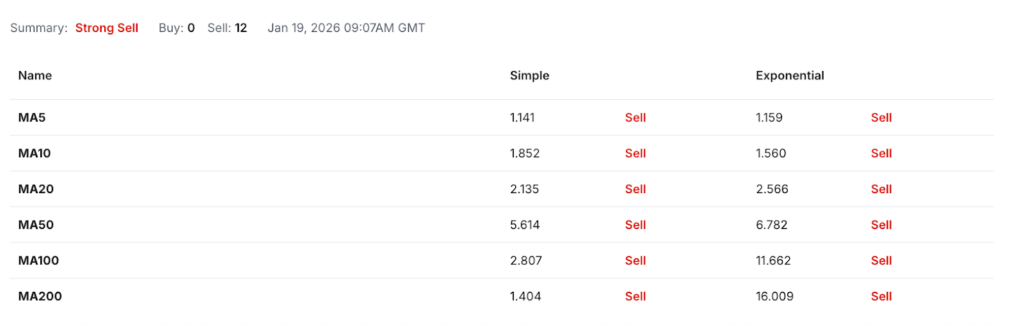

FRAX USDT Price Technical Analysis

This technical analysis uses monthly data from Investing.com and reflects the market situation as of January, 2026. On the higher time frame, the picture looks clearly bearish. The overall summary shows Strong Sell across both technical indicators and moving averages. This means the long-term trend still points down.

Investing, January 20, 2026

Let us start with momentum indicators. The RSI at 34.21 sits near the oversold zone and signals sell pressure. The Stochastic and StochRSI also stay low, with StochRSI already in oversold territory. This shows weak demand and limited buying interest. The MACD at -1.317 confirms negative momentum and a dominant downtrend. At the same time, ADX at 16.43 suggests the trend is weak, not strong. This means price is falling, but without heavy trend acceleration.

Other indicators support this view. Williams %R at -91.33 and CCI at -130.7 both signal oversold conditions. However, oversold does not mean a reversal must happen. It only shows that sellers have controlled the market for a long time. ROC at -75.71 highlights how deep and fast the long-term decline was.

Moving averages paint an even clearer picture. All 12 tracked averages show Sell signals. Price trades far below the 20, 50, and 100-month averages. This confirms that FRAX remains in a long-term downtrend on the monthly chart.

Pivot points now define key zones. The main pivot sits near 0.70. Resistance levels appear near 0.80, 0.95, and 1.05. Support zones start near 0.54 and 0.45.

In short, the monthly structure still favors sellers. The market first needs time to build a base before any sustainable trend change.

What Does the Frax Price Depend On?

The price of Frax does not move by accident. Like every crypto asset, it reacts to several connected factors. Some come from inside the project. Others come from the wider market. When you understand these drivers, you can better judge future Frax price predictions.

First, the health of the Frax ecosystem matters the most. If more users adopt frxUSD and other Frax products, demand for the system grows. Higher usage usually supports the value of the governance token. On the other hand, when activity drops, interest in the token also falls.

Second, the stablecoin market environment plays a key role. Frax competes with giants like USDT, USDC, and DAI. When regulators favor some models over others, capital flows can change fast. New laws can help or hurt the entire sector at once.

Third, confidence in the peg and reserves strongly affects sentiment. Even small depeg events in the past caused fear. When users trust that the system is safe and fully backed, they stay. When trust breaks, they leave quickly.

Some of the most important factors include:

Adoption of frxUSD in DeFi and real-world finance.

Regulatory decisions about stablecoins in the US and EU.

Growth or decline of the overall DeFi market.

Revenue and fees generated by the Frax protocol.

Changes in token supply, incentives, or tokenomics.

Another big driver is the broader crypto market cycle. In bull markets, almost all assets rise. In bear markets, even strong projects fall. Frax is no exception. Bitcoin and Ethereum trends still influence most altcoins.

Finally, narrative and positioning matter more than many beginners think. The recent shift toward institutional backing and U.S. Treasuries changed how investors see Frax. If the market accepts this story, long-term demand can grow.

Frax Features

Frax is no longer just a simple stablecoin project. Today, it works as a full on-chain financial system with many connected parts. Each feature aims to improve stability, efficiency, and real-world use.

At the core sits the dynamic collateral ratio mechanism. The protocol adjusts its collateral level based on the FRAX price. When FRAX trades above one dollar, the system slowly reduces collateral. This increases capital efficiency. When FRAX trades below one dollar, the system raises collateral to restore trust. This creates a flexible balance instead of a fixed rule.

Another key part is Algorithmic Market Operations (AMOs). These are smart contracts that move collateral into yield strategies without breaking the peg. AMOs work in four modes. They can reduce collateral, stay neutral, rebuild collateral, or send profits to token burns through the FXS1559 model. This turns the protocol into an active balance sheet manager.

Frax also uses a PID controller. This replaced simple step-by-step changes. The new system reacts to market conditions and liquidity growth. It allows more precise and smoother control over the collateral ratio.

In Ethereum staking, Frax offers frxETH and sfrxETH. frxETH tracks ETH with a small tolerance range. sfrxETH collects about 90% of staking rewards for holders. The rest goes to protocol fees and an insurance fund. frxETH also plays a role inside the Fraxtal network.

For lending, Frax built BAMM, an oracle-less borrowing system. It allows leveraged positions without using external price feeds. This reduces risk from oracle attacks and keeps the system simpler.

Cross-chain transfers run through Fraxferry. It uses capped batches and delayed settlement to prevent abuse. The newer version adds zero-knowledge proofs and stronger verification.

The ecosystem also includes Fraxtal, an EVM-compatible chain. It uses OP Stack technology. Blocks target about two seconds. Fees stay very low, often below a few cents.

On top of this base layer, Frax runs several DeFi products:

Fraxswap, a native AMM with TWAMM orders for large trades.

Fraxlend, a permissionless lending market with real demand for frxUSD.

sfrxUSD, a yield vault that mixes DeFi strategies and U.S. Treasury yields.

frxUSD, a fully backed stablecoin using regulated custodians like BlackRock.

FraxNet, a banking-style interface for payments and treasury yield access.

Together, these tools turn Frax into a full financial stack. It connects DeFi, stablecoins, and real-world assets in one system.