Dogecoin (DOGE) is currently trading near $0.092, attempting to stabilize after dropping more than 11% over the previous week. While the recent price action has been bearish, on-chain metrics indicate that large-volume investors used the decline to accumulate DOGE at discounted rates. This buying activity, combined with cooling selling pressure, suggests a potential trend shift could be forming for the leading meme coin.

What Does Whale Accumulation Signal for DOGE?

According to Santiment’s Supply Distribution data, a significant divergence in investor behavior has emerged during Dogecoin’s recent corrective phase. Wallets holding between 10 million and 100 million tokens, along with the cohort holding 100,000 to 1 million tokens, have collectively added 250 million DOGE to their balances since Thursday. This accumulation pattern typically signals that well-capitalized investors—often referred to as “whales”—believe the asset is undervalued at current levels.

Source: Santiment

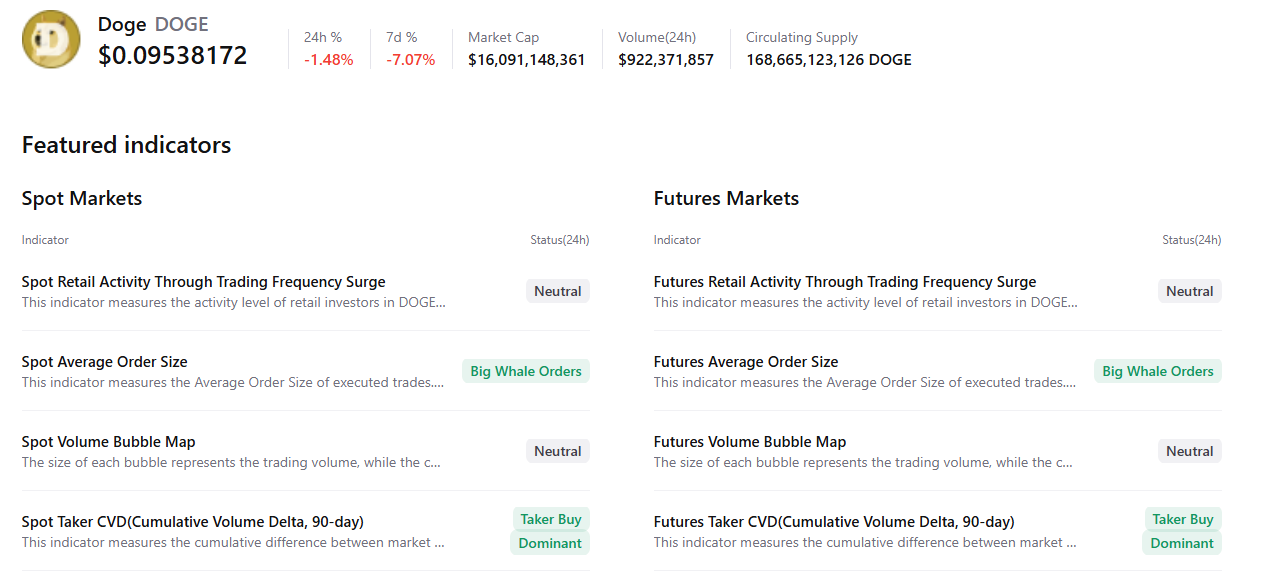

While a separate group of holders (those with 1 million to 10 million tokens) offloaded approximately 110 million coins in the same period, the aggregate activity leans bullish. When larger entities absorb supply during price dips, it often creates a floor that prevents further downside. Data from CryptoQuant reinforces this view, showing buy dominance in spot and futures markets, indicating that institutional or high-net-worth players are positioning for a recovery.

Technical Indicators Align with On-Chain Signals

The technical structure for Dogecoin is beginning to mirror the optimism seen on-chain. After bottoming at $0.080—just above the critical weekly support of $0.078—DOGE rebounded to retest a previously broken trendline. Momentum indicators suggest that the prevailing bearish sentiment is losing steam.

Source: TradingView

The Relative Strength Index (RSI) is currently reading 32, recovering from oversold territory. While this does not guarantee an immediate rally, it often precedes a relief bounce or a period of consolidation. Additionally, the Moving Average Convergence Divergence (MACD) histogram is showing fading red bars, signaling that bearish strength is waning.

Traders watching for a breakout need to see a decisive daily close above the current trendline resistance. Recent analysis regarding DOGE’s stabilization efforts suggests that reclaiming the $0.10 level is crucial. If bulls can push the price past this psychological barrier, the next major target is likely the liquidity cluster around $0.110.

What Could Invalidate the Bullish Setup?

Despite the accumulating evidence for a reversal, the primary trend remains downward. Investors should remain cautious of a “dead-cat bounce,” where the price briefly recovers before resuming its slide. The RSI must break above the neutral 50 level to confirm a genuine trend reversal; failure to do so implies bears are still in control.

If DOGE faces rejection at current resistance levels, it could revisit the recent low of $0.080. A breakdown below this support would open the door to $0.078, potentially triggering further sell-offs. Market sentiment is notably fragile, as highlighted in reports covering recent altcoin crashes. Furthermore, some capital appears to be rotating, with indications that investors are exploring alternatives to hedge against Dogecoin’s current stagnation.

Maxi Doge ($MAXI): An Alternative for DOGE?

Maxi Doge ($MAXI) takes the iconic Doge meme and spins it into a community-centered meme coin built for risk-takers.

Although the market is not favoring towards meme coins, who knows if altcoin season will start soon? $MAXI is ready to fly, and early investors will be positioned favorably to reap the highest returns.

To buy $MAXI at its presale price, head to the official Maxi Doge official website, and link your wallet (e.g. Best Wallet).

You can either swap USDT or ETH for this token or use a bank card to invest.