Bitcoin’s latest pullback is being driven less by headline price moves and more by a quiet but important shift in capital flows.

Key Takeaways

New investor inflows into Bitcoin have turned negative, leaving sell-offs largely unabsorbed.

Current behavior aligns more with early bear-market conditions than healthy bull-market dips.

Sentiment data shows dip-buying is fragile, with rebounds losing momentum quickly.

Heavy selling pressure has neutralized the usual multiplier effect of new capital.

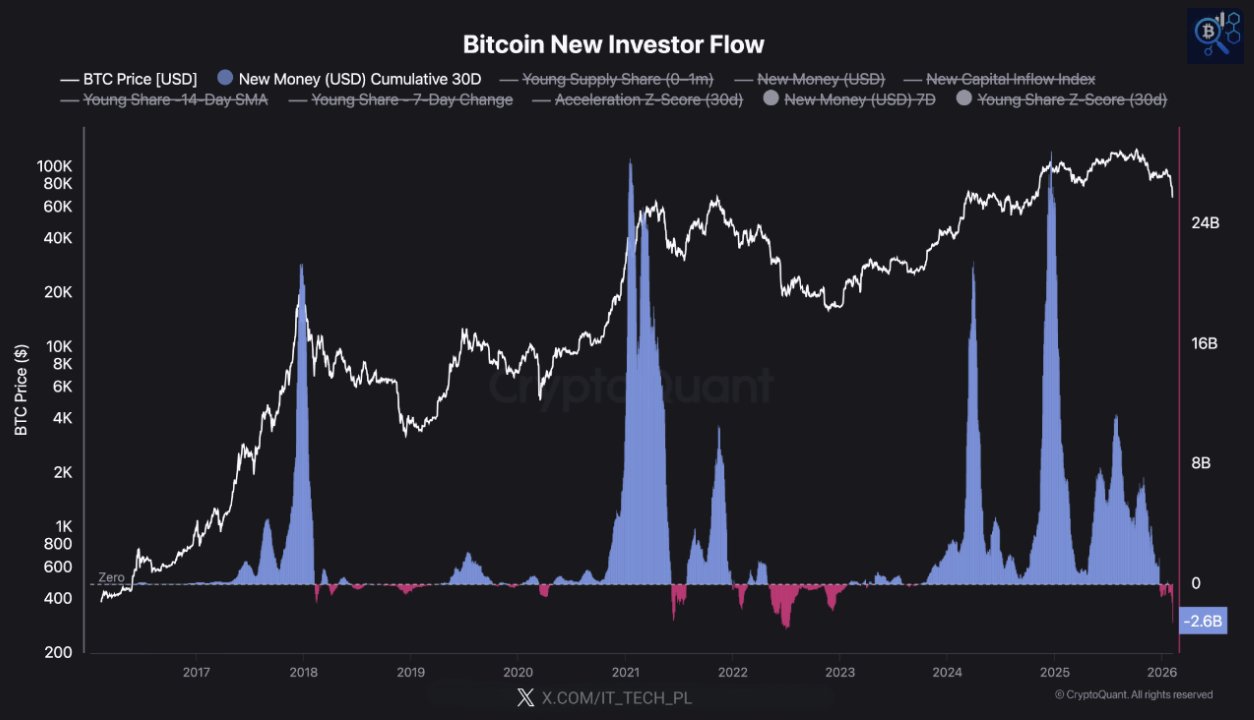

New on-chain data from CryptoQuant shows that new investor inflows have flipped negative, meaning fresh money is no longer stepping in to absorb selling pressure. Instead of buyers viewing declines as opportunities, capital is leaving the market, reinforcing downside momentum.

Historically, this type of behavior tends to appear when a cycle is losing strength rather than during routine bull-market pauses. In past bull phases, even sharp drops were met with renewed demand. The absence of that response is what makes the current environment stand out.

Why this looks different from a normal bull-market dip

CryptoQuant analysts highlight that bull-market corrections usually act as magnets for new capital. Drawdowns create urgency, pulling sidelined money back into the market and helping prices stabilize quickly. That mechanism is currently missing.

Instead, each wave of weakness is met with hesitation. Investors appear more focused on preserving capital than chasing rebounds, which limits follow-through on the upside. As a result, rallies struggle to extend beyond short-term relief moves before running into renewed selling.

Sentiment data confirms fragile dip-buying behavior

This cautious tone is echoed in sentiment and behavioral data from Santiment. Its latest insights suggest that 2026’s volatility has eroded confidence in dip-buying strategies. Social chatter and trading patterns show that optimism tends to spike only after extreme fear, and even then, it fades quickly.

Rather than signaling conviction, these rebounds often reflect short covering or tactical trades. Once that demand is exhausted, prices lose momentum again, reinforcing the view that the market lacks a solid liquidity base.

? It's not easy to figure out which dip to buy when markets have been as volatile as they in 2026. Our latest insight guides you through several easy-to-read signals that you can rely upon to dip buy when prices go down. Enjoy our latest deep dive! ?https://t.co/fx2kzLWWbA pic.twitter.com/8aMhuDzNcd

— Santiment (@santimentfeed) February 10, 2026

Bitcoin is not “pumpable” under current conditions

Ki Young Ju describes the current setup bluntly: Bitcoin is not pumpable right now. He points to the contrast between recent years to explain why. In 2024, relatively modest inflows had an outsized impact on Bitcoin’s valuation, creating a strong multiplier effect.

That dynamic broke down in 2025. Despite substantial capital moving through the ecosystem, Bitcoin’s market capitalization declined, showing that selling pressure overwhelmed incoming demand. Until that imbalance eases, attempts to force upside momentum are likely to fail.

Liquidity is now the key constraint

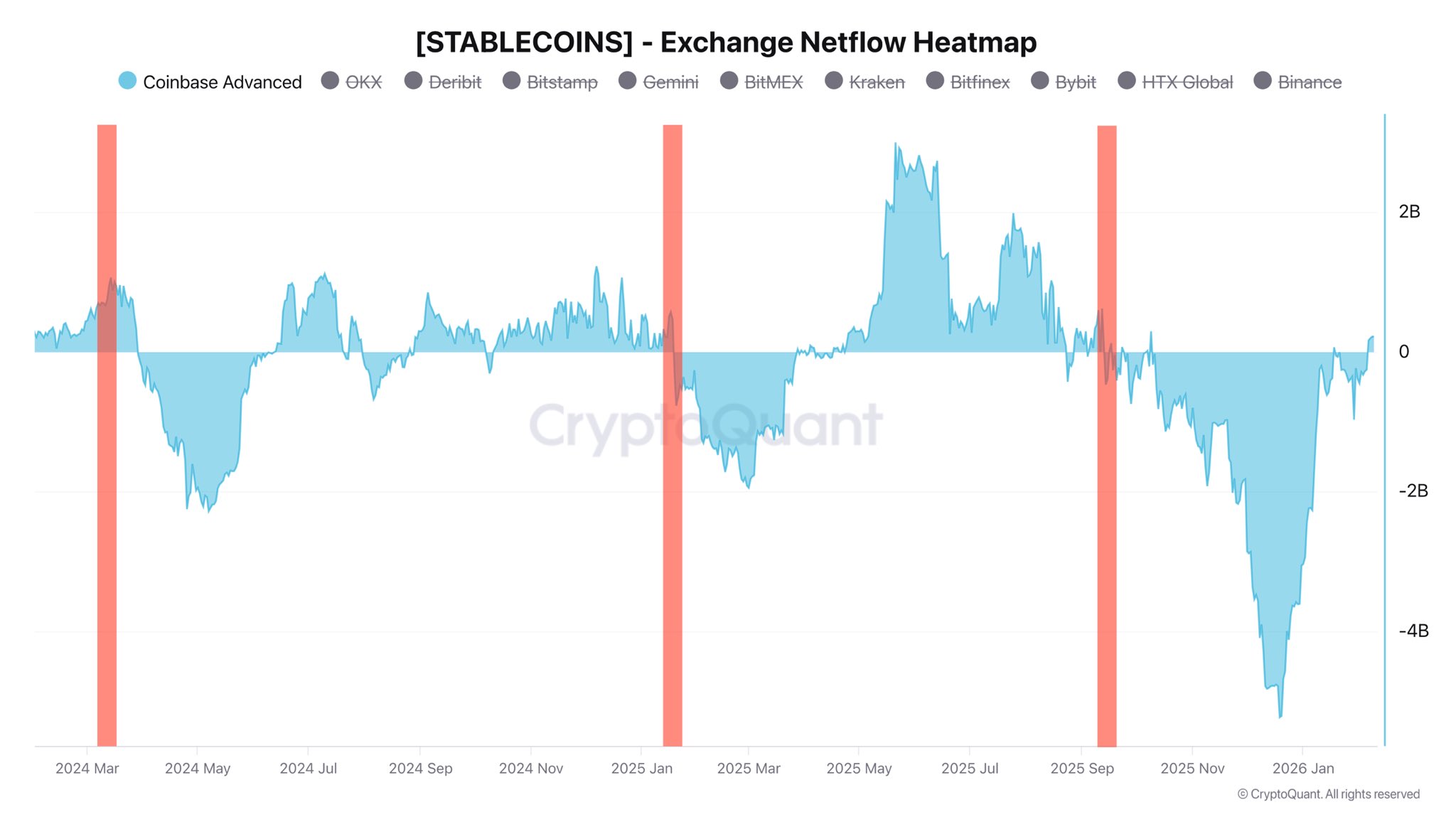

Bitcoin’s significantly larger market cap has changed the rules of the game. Higher valuations require a steady level of circulating liquidity just to be maintained. Analysts warn that ongoing stablecoin outflows and a shrinking stablecoin market cap are clear signals that this liquidity is not currently available.

As long as that trend persists, any recovery in BTC is likely to be temporary. Sustainable upside would require not just buyers, but a broader expansion in available capital across the crypto ecosystem.

Macro data could decide the next move

The outlook is not fixed. Liquidity conditions can shift quickly if the broader environment improves and investors regain the ability to look past short-term uncertainty. This week’s inflation and unemployment data are therefore in focus, as they could influence expectations around monetary policy and risk appetite.

If macro signals turn supportive, capital could flow back into stablecoins and risk assets, giving Bitcoin a firmer foundation. Until then, analysts caution that rallies may continue to fade, reflecting a market still waiting for liquidity to return.