Hyperlane (HYPER) is a permissionless, modular interoperability protocol that enables seamless cross-chain communication between blockchains, allowing developers to send messages, transfer assets, and trigger smart contract calls across different networks without the need for centralized intermediaries. Over the past month, HYPER coin experienced a substantial surge in price, skyrocketing from $0.11 to an all-time high of $0.69 (+530%), driven by listings on South Korean exchanges (Upbit, Bithumb) and record trading volume. In this article, we’ll discover the latest Hyperlane price prediction and dissect the key factors behind its price surge.

| Current HYPER Price | HYPER Prediction 2025 | HYPER Price Prediction 2030 |

| $0.4 | $0.9 | $7 |

Hyperlane (HYPER) Overview

Hyperlane is a permissionless, modular interoperability protocol that enables seamless cross-chain communication between blockchains, allowing developers to send messages, transfer assets, and trigger smart contract calls across different networks without centralized intermediaries. Hyperlane supports 140+ chains and 5 virtual machines (EVM, SVM, CosmWasm, etc.), including cross-VM interactions like EVM-to-Solana transfers. Its core innovation lies in Interchain Security Modules (ISMs), which let developers customize security for their applications, and Warp Routes, which facilitate no-slippage token bridging with optional yield generation.

The platform’s native HYPER token powers staking, validator incentives, and governance. stHYPER is a liquid staking token users receive when they deposit $HYPER into the Symbiotic vault. It acts as a receipt token representing ownership of staked HYPER.

HYPER Price Statistics

| Current Price | $0.4 |

| Market Cap | $70,810,955 |

| Volume (24h) | $31,716,100 |

| Market Rank | #460 |

| Circulating Supply | 175,200,000 HYPER |

| Total Supply | 802,666,667 HYPER |

| 1 Month High / Low | $0.6898 / $0.1102 |

| All-Time High | $0.6898 Jul 25, 2025 |

Launched in 2022 and backed by investors like Variant and CoinFund, Hyperlane was founded by Jon Kol, Asa Oines, and Nam Chu Hoai. The coin launched on April 22, 2025.

Hyperlane Features

Hyperlane offers several features within the crypto space:

Permissionless interoperability: Hyperlane enables any blockchain to self-deploy its protocol without requiring approvals or centralized intermediaries.

Modular security with ISMs: Hyperlane’s Interchain Security Modules (ISMs) allow developers to customize security for their applications, from pre-configured options (multi-sig, optimistic checks) to fully bespoke models. This flexibility ensures apps balance security and cost-efficiency.

Multi-VM support & cross-VM transfers: The protocol supports EVM, SVM (Solana), and CosmWasm virtual machines, enabling interactions like EVM-to-Solana asset transfers. This breaks down ecosystem silos, allowing developers to build applications that span heterogeneous blockchain environments.

HYPER Price Chart

CoinGecko, August 7, 2025

Hyperlane Price History Highlights

Hyperlane’s native token, HYPER, was introduced in April 2025. It went to its all-time high of $0.6898 shortly after its launch. At the moment, its price hovers around $0.4.

Hyperlane Price Prediction: 2025, 2026, 2030

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.36 | $1.38 | $0.9 | +125% |

| 2026 | $0.86 | $2.14 | $1.5 | +275% |

| 2030 | $1.89 | $12.3 | $7 | +1,650% |

Hyperlane Price Prediction 2025

DigitalCoinPrice crypto experts think that in 2025 HYPER coin could reach a maximum of $0.88 (+120%), with a potential low of $0.36 (-10%).

Meanwhile, Telegaon analysts project a more positive scenario, estimating a minimum price of $0.65 (+65%) and a peak of $1.38 (+245%).

HYPER Coin Price Prediction 2026

Analysts at DigitalCoinPrice forecast that HYPER could reach $1.03 (+155%) by 2026, with a conservative floor of $0.86 (+115%). This bullish outlook is underpinned by Hyperlane’s expanding interoperability solutions; the protocol’s Warp Routes are expected to drive further adoption as demand for seamless cross-chain transfers grows.

Telegaon’s more aggressive projection of a minimum of $1.39 (+250%) and a potential high of $2.14 (+435%) hinges on several catalysts: mainnet upgrades, strategic partnerships with major chains like Injective and Eclipse, and Korean exchange dominance.

Hyperlane Price Prediction 2030

By 2030, DigitalCoinPrice estimates $HYPER could climb to $2.13 (+430%), with a conservative low of $1.89 (+370%).

Telegaon’s ultra-bullish outlook of $12.35 (+3,000%) at HYPER’s peak and $8.82 (+2,100%) at its low hinges on mass adoption of Hyperlane’s interchain messaging protocol, potential integration with central bank digital currencies (CBDCs), and dominance in cross-VM interoperability.

Hyperlane Price Prediction: What Do Experts Say?

Market analysts remain cautiously optimistic about Hyperlane’s price trajectory, with projections varying based on adoption of its cross-chain interoperability solutions. While short-term forecasts for 2025 suggest moderate growth potential, long-term predictions paint a more ambitious picture should Hyperlane establish itself as a leader in blockchain connectivity. The token’s future value will largely depend on the protocol’s ability to onboard major chains, maintain its technological edge in modular security, and expand use cases beyond current DeFi applications.

Experts note that HYPER’s price potential is closely tied to the broader adoption of cross-chain infrastructure across the blockchain industry. More bullish scenarios assume Hyperlane will capture significant market share from competitors like LayerZero and Wormhole, while conservative estimates anticipate steady, organic growth. Analysts at Gate.com believe that in 2030, $HYPER will hit a maximum of $0.9 per coin.

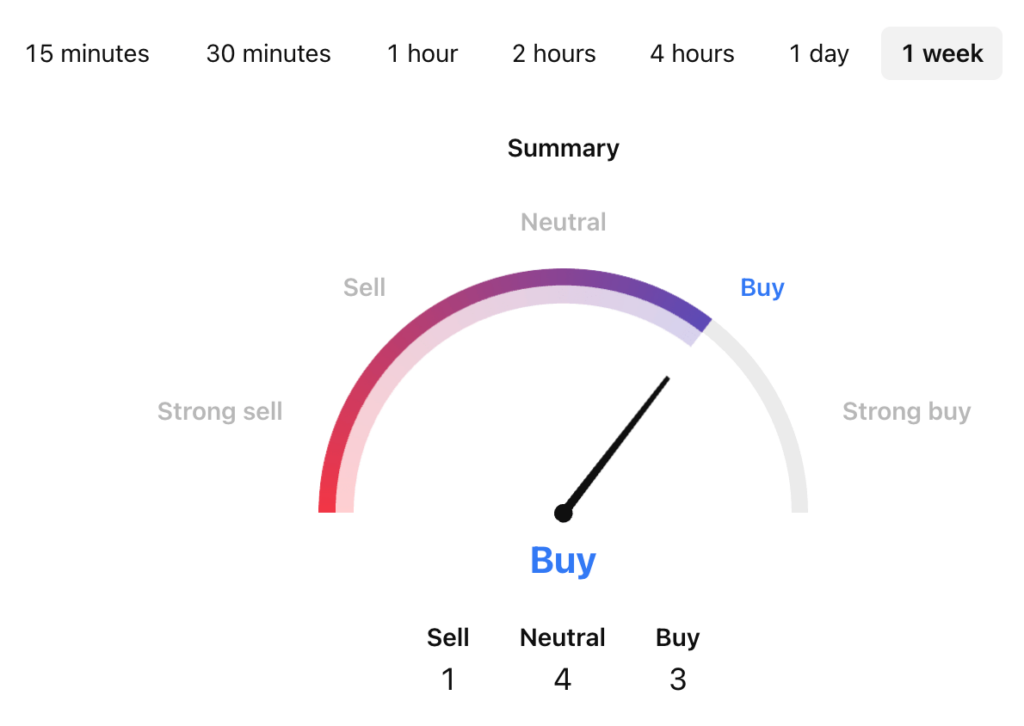

HYPER USDT Price Technical Analysis

Tradingview, August 7, 2025

Now that we’ve seen possible price predictions for Hyperlane, let’s find out a bit more about the factors that can influence its price.

What Does the HYPER Price Depend On?

The price of Hyperlane’s HYPER token depends primarily on adoption of its interoperability solutions and market sentiment toward cross-chain infrastructure. As a permissionless protocol connecting over 100 blockchains, HYPER’s value is tied to developer activity, including deployment of its Interchain Security Modules (ISMs) and usage of Warp Routes for asset transfers.

Secondary factors include tokenomics and ecosystem growth. HYPER’s fixed supply and staking incentives via Symbiotic Vaults may create scarcity, while its role in governance and gas fees sustains utility. Listing on major exchanges like Binance and Upbit has improved liquidity, but competition from rivals like LayerZero and macroeconomic risks (e.g., crypto market downturns) could pressure prices.

Risks and Opportunities

Hyperlane presents significant growth potential as a permissionless interoperability protocol, enabling seamless cross-chain communication. Its modular ISMs allow developers to customize security, making it attractive for DeFi and institutional use cases like real-world asset (RWA) tokenization. Strategic partnerships and exchange listings could further boost adoption.

Hyperlane faces volatility risks, as seen in its sharp corrections after rallies. Competition from established interoperability protocols like LayerZero and Wormhole could limit market share, while reliance on Korean exchanges exposes HYPER to regional liquidity fluctuations.

Is Hyperlane a Good Investment?

Hyperlane shows potential as an investment due to its strong backing from major investors like Galaxy Ventures and Variant, along with its innovative interoperability solutions that address cross-chain communication challenges. However, its price is highly influenced by regional trading activity and market sentiment, with some analysts predicting short-term declines before potential long-term gains. All in all, Hyperlane is a speculative but high-reward opportunity for risk-tolerant investors.

How Much Is Hyperlane Coin Worth Now?

At the moment, the HYPER coin costs around $0.4.

What Is the Total Supply of Hyperlane?

The total supply of Hyperlane is 802,666,667 HYPER.

Will Hyper Coin Go Up?

The coin’s volatility and neutral market sentiment indicate uncertainty, but its strong backing and interoperability solutions, along with bullish tendencies on the market, could drive adoption over time.

What Is the Price Prediction for HYPER Coin in 2025?

According to DigitalCoinPrice, in 2025 $HYPER can go as high as $0.9.

What Is the Price Prediction for Hyperlane in 2030?

According to Telegaon, in 2030 the maximum price level Hyperlane can reach is going to be $12.

Can Hyperlane Reach $1?

Hyperlane has the potential to reach $1, but its path depends on market adoption, developer activity, and broader crypto trends. Currently trading around $0.4, HYPER would need a relatively small increase in price to go to $1. It’s a feasible target if its interoperability solutions gain traction and major exchange listings boost liquidity.

Will HYPER Coin Reach $10?

Yes, it’s possible. Hyperlane has the potential to reach $10, but this would require significant adoption of its interoperability technology and sustained bullish market conditions.

Can HYPER Reach $100?

HYPER reaching $100 is highly speculative and would require extraordinary growth. While some long-term predictions suggest HYPER could hit $1.9 by 2030, reaching $100 would demand massive adoption of its interoperability solutions, major exchange listings, and sustained bullish market conditions.

Conclusion

Hyperlane has emerged as a groundbreaking force in blockchain interoperability, offering a permissionless, modular, and secure framework for cross-chain communication. The success of this blockchain will hinge on continued adoption, security resilience, and market dynamics, but its technological advancements and open architecture make it a pivotal player in the multi-chain era. The road ahead seems to be promising: if Hyperlane can maintain its momentum, it may well become the standard for blockchain interoperability.