Pi Coin has faced sustained selling pressure over recent weeks, pushing its price to a multi-week low. The altcoin has declined sharply alongside broader market weakness, with Bitcoin acting as a key drag.

Waning investor support and rising withdrawals have intensified downside pressure, limiting any meaningful recovery attempts.

Pi Coin Follows Bitcoin

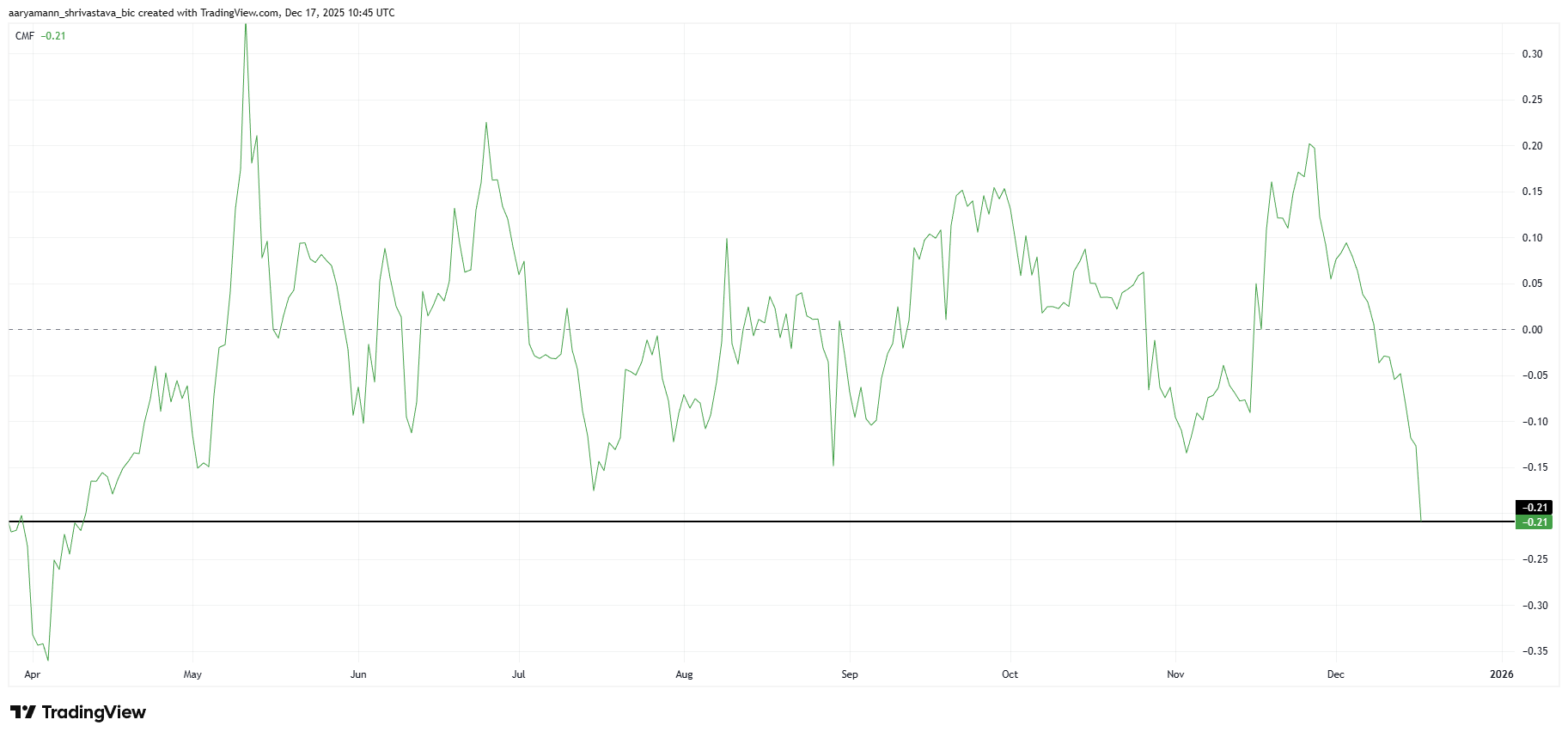

On-chain indicators reflect deteriorating sentiment among Pi Coin holders. The Chaikin Money Flow shows heavy withdrawals, with the indicator dropping to an eight-month low. This reading signals strong capital outflows, suggesting investors are reducing exposure amid continued price weakness.

The sustained selling reflects fading confidence following repeated failed recovery attempts. Many holders appear unwilling to wait for a rebound, choosing instead to exit positions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin CMF. Source: TradingView

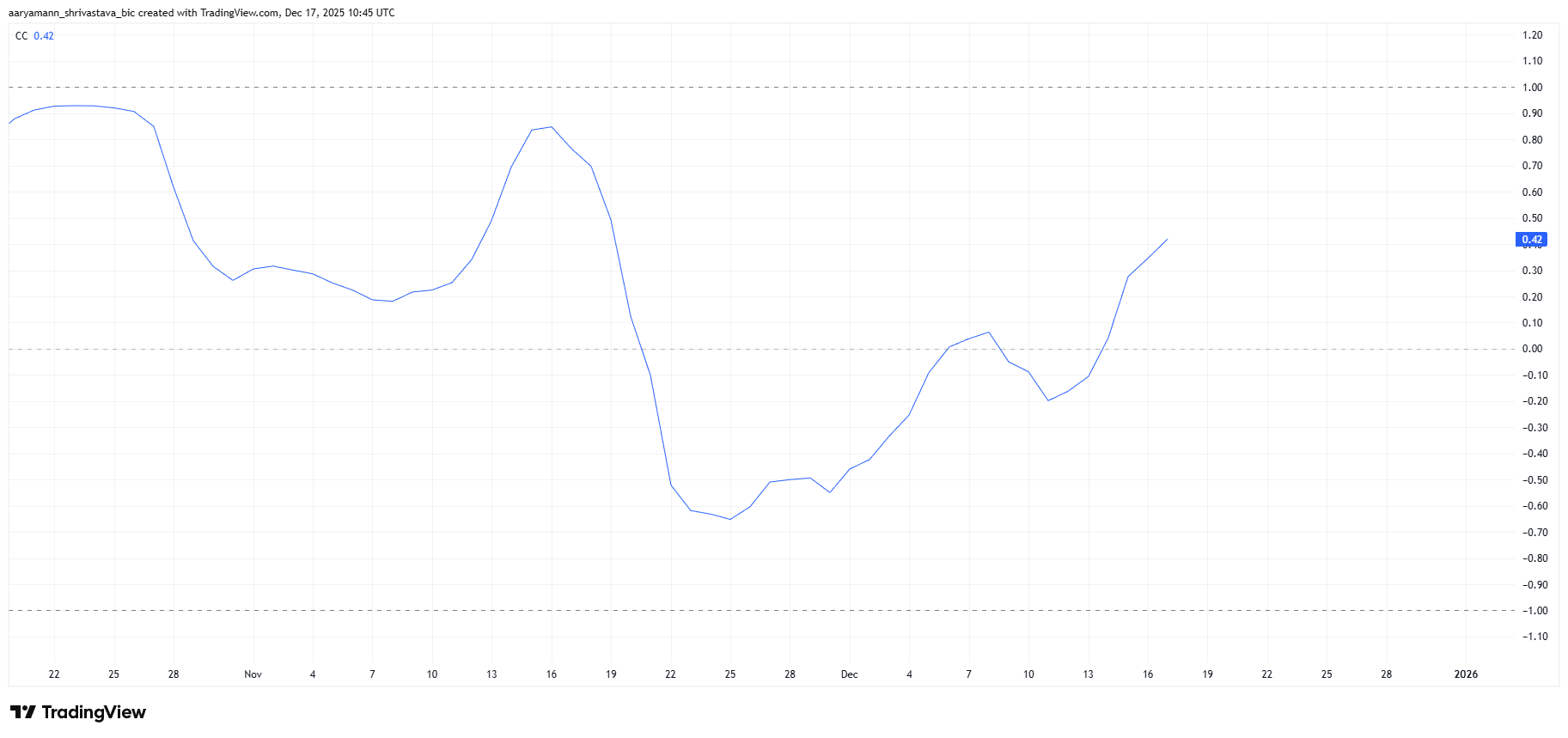

Pi Coin’s macro momentum remains closely tied to Bitcoin’s performance. The correlation between PI and Bitcoin currently stands at 0.42. This relationship turned positive after steadily improving over nearly three weeks, mirroring the period of Pi Coin’s recent price decline.

This alignment has worked against PI. As Bitcoin corrected, Pi Coin followed lower, magnifying losses. A rising correlation during a downtrend often increases vulnerability, as independent recovery becomes less likely without broader market stabilization or asset-specific catalysts.

Pi Coin Correlation To Bitcoin. Source: TradingView

PI Price Falls To Its Critical Support

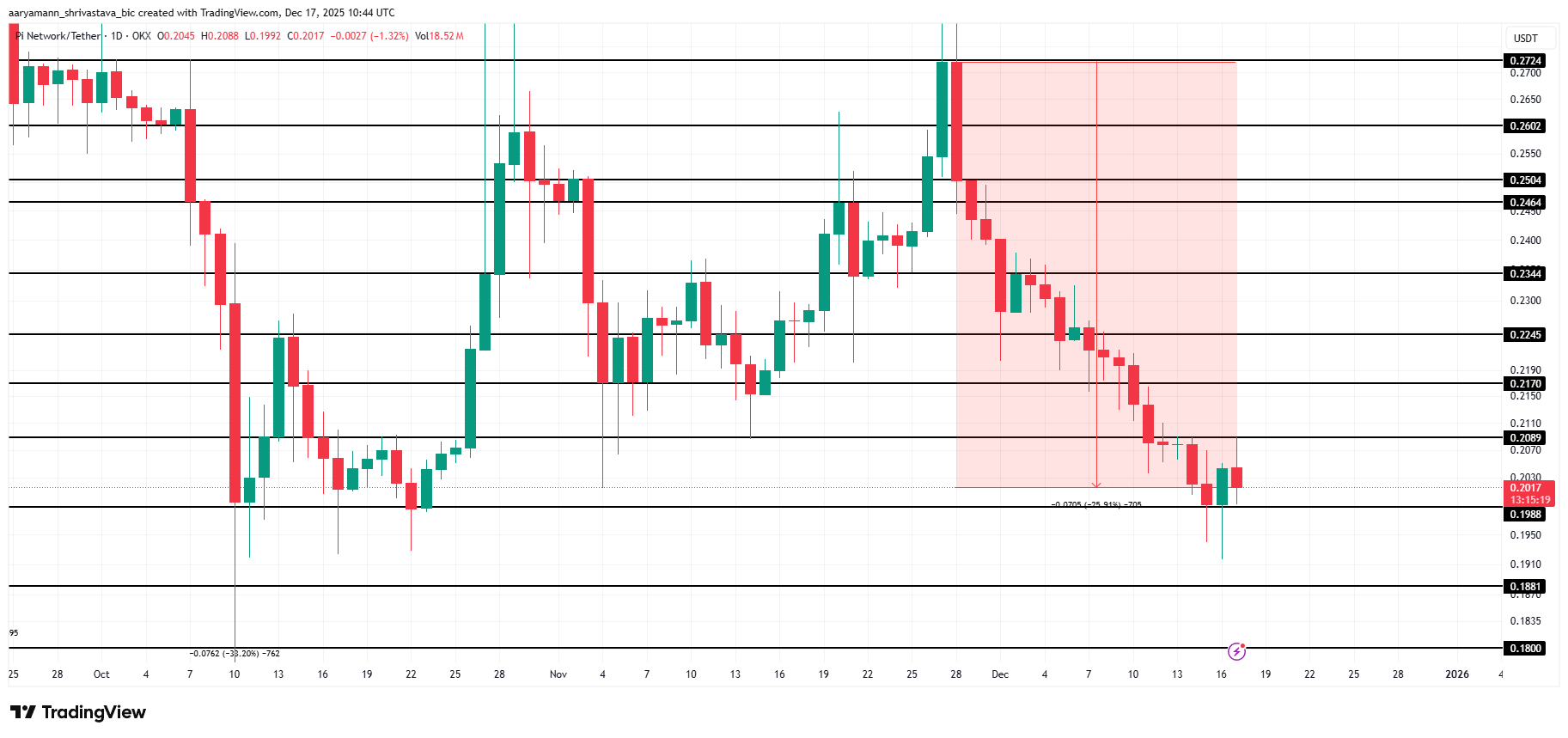

At the time of writing, Pi Coin trades at $0.201, reflecting a 25% decline over the past 20 days. The drop followed a failed attempt to break above the $0.272 resistance. Rejection at that level marked a clear shift toward sustained bearish momentum.

Pi Coin is now testing the $0.198 support, an eight-week low that has previously acted as a floor. This level remains critical. However, bearish signals persist, and a breakdown could push PI toward $0.188 or even $0.180, extending the downtrend.

Pi Coin Price Analysis. Source: TradingView

A recovery scenario remains possible if historical patterns repeat. A successful bounce from $0.198 could restore short-term confidence. If Pi Coin reclaims $0.208 as support, the bearish thesis would weaken. Such a move may allow PI to rise toward $0.217, signaling temporary relief.