Riot Platforms (RIOT) shares have caught the attention of investors lately, especially with crypto-related stocks seeing renewed volatility. As market sentiment shifts, the company's recent stock movements offer an interesting case for those following the digital assets sector.

After an impressive start to the year, Riot Platforms has seen a sharp pullback, with a 1-month share price return of -35.2%, while still maintaining a strong year-to-date gain of 32.7%. However, the long-term story remains notable, as the 3-year total shareholder return of 226.6% highlights the momentum that has developed for investors willing to withstand volatility.

If you’re curious about other stocks with standout track records, this is the perfect moment to broaden your toolkit and discover fast growing stocks with high insider ownership

With shares recently pulling back despite strong long-term returns, the key question for investors is whether Riot Platforms is trading at a bargain today or if the market has already factored in expectations for future growth.

Most Popular Narrative: 49.2% Undervalued

Compared to the latest closing price, the most widely followed narrative suggests Riot Platforms might be trading well below what forward-looking assumptions imply. The narrative’s valuation points to a substantial potential upside if its underlying expectations play out.

Riot's aggressive build-out of a scalable data center business leverages its extensive, readily available power capacity in high-demand regions. This well-positions the company to benefit from surging demand for AI and cloud computing infrastructure, which is likely to drive higher revenue growth and improved valuation multiples over time.

Curious to see what’s fueling this optimism? This narrative hinges on a surprising set of growth forecasts and profit margin assumptions that could radically reshape Riot’s earning power. The secret? A bold belief in Riot’s transformation timeline. Ready to find out how these expectations stack up against reality?

However, significant delays in securing high-quality data center tenants or a meaningful drop in Bitcoin prices could quickly challenge this positive outlook.

Another View: High Multiple Sparks Caution

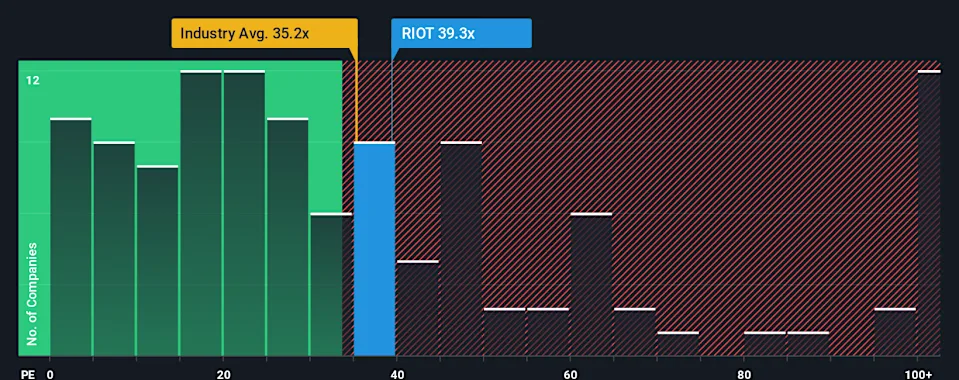

Taking a different approach, using the commonly watched price-to-earnings ratio shows Riot Platforms trading at 31.5x. This is noticeably higher than the industry average of 28.8x, the peer group at 21.1x, and especially distant from a fair ratio of just 6.6x. Such a premium suggests investors are banking on extreme growth or are overlooking valuation risks. What would it take for the market to justify these high expectations?

Build Your Own Riot Platforms Narrative

Keep in mind, if you’ve got a different perspective or want to dive into the numbers on your own terms, it only takes a few minutes to build your own view. Do it your way

A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t let today’s opportunities slip by. Your next smart move could be just a click away. Simply Wall Street’s handpicked screeners make it easy to spot exciting companies across emerging sectors.

Explore fresh AI breakthroughs and see which companies stand out among these 26 AI penny stocks as machine learning transforms entire industries.

Find undervalued stocks with solid growth prospects by tapping into these 924 undervalued stocks based on cash flows before the broader market takes notice.

Discover the world of digital finance and find companies thriving in blockchain innovation with these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.