KEY TAKEAWAYS

Riot Platforms ended 2024 on a strong note.

The Bitcoin mining company started in 2025 with high production.

Analysts remain bullish on RIOT stock and predict strong growth ahead.

Despite a 19% decline in its stock price over the past six months, Riot (RIOT) reported better-than-expected earnings, continued to scale its Corsicana Facility, and increased its Bitcoin (BTC) holdings.

Analysts remain optimistic, forecasting a potential 140% surge in Riot’s stock over the next year.

As Riot enters 2025 with solid production numbers and a shift toward AI and high-performance computing, investors are weighing whether the recent stock dip is a short-term setback or a buying opportunity ahead of the next rally.

Riot 2024 Earnings Beat Market Estimates

Riot Platforms reported quarterly earnings of $0.44 per share, surpassing the market estimate of a $0.27 per-share loss. In comparison, the company had recorded earnings of $0.48 per share in the same quarter last year. These results are adjusted for non-recurring items.

This quarter’s earnings reflect a significant surprise of 263%. In the previous quarter, analysts had anticipated a loss of $0.22 per share, but Riot ultimately reported a larger-than-expected loss of $0.54, resulting in a negative surprise of 145%.

Over the past four quarters, Riot has exceeded consensus EPS estimates twice.

The Bitcoin miner generated $142.56 million in revenue for the quarter ending December 2024, surpassing analyst expectations by 10.26%. This marks an increase from the $78.83 million reported in the same period the previous year. However, the company has outperformed revenue forecasts only once, in the last four quarters.

The future trajectory of Riot’s stock will largely depend on management’s insights during the earnings call, as investors assess the company’s outlook and future earnings potential.

2025 Started With Strong Production

Riot Platforms maintained its growth in Bitcoin mining, producing 527 BTC in January despite fluctuating network conditions. The company’s total Bitcoin holdings increased to 18,221 BTC, reflecting a 3% rise from December, 2024.

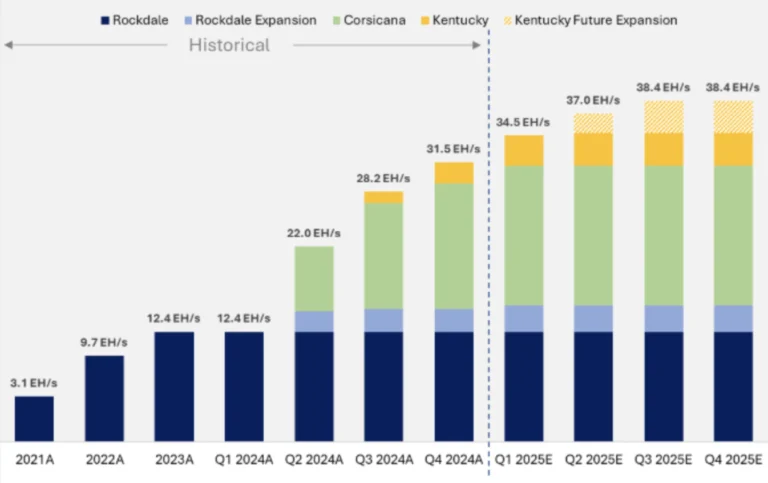

Riot’s deployed hash rate reached 33.5 EH/s, with significant expansion at its Corsicana Facility, which achieved 15.7 EH/s by the end of the month. Additionally, the company earned $3.6 million in power credits—a 250% monthly surge—by optimizing energy consumption across key mining sites.

Riot has also launched an AI and high-performance computing (HPC) evaluation for Corsicana’s remaining 600 MW power capacity, enlisting Altman Solon to assess its potential. In light of this, the company revised its 2025 hash rate target from 46.7 EH/s to 38.4 EH/s to align with evolving business priorities.

RIOT Stock in 5 Years

Riot Platforms (RIOT) has faced a tough six months, dipping 19%, while the broader crypto-mining industry surged by 47%. Despite this, Riot’s growth prospects suggest that the recent pullback could be a strategic buying opportunity.

With industry peers, like Cipher Mining (CIFR) and Marathon Digital (MARA), down 37% and 54%, respectively, investors may wonder if it’s the right time to bet on Riot’s future.

Despite short-term struggles, projections for Riot remain bullish. Forecasts indicate that Riot’s stock price could climb to $9 by mid-2025 and reach $12 by mid-2026, marking a 78% increase from current levels.

By 2027, Riot could trade at $16.53, more than double its current price. Looking even further, the stock is projected to hit $25 by 2033 and $30 by 2036, representing a 283% gain, over the next decade.

Some analysts predict that in the coming months, Riot is expected to experience a gradual price recovery:

March – $7.96

April – $8.30

June – $9.13

August – $9.41

This steady climb suggests confidence in Riot’s ability to weather market fluctuations. Its Corsicana expansion, strategic energy credits and operational efficiency will play a crucial role in stabilizing revenue.

Wall Street Remains Bullish on RIOT

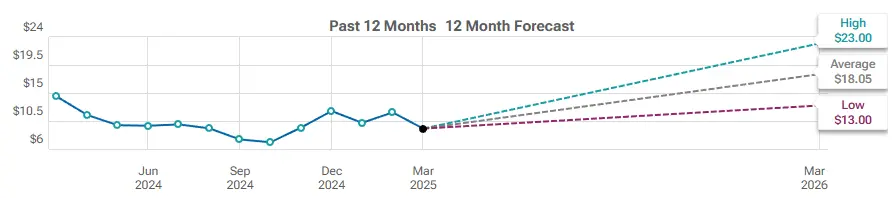

Analysts are eyeing a major rebound for Riot. The average 12-month price target is $18.55, with some estimates reaching as high as $23, a 140% surge from current levels.

Revenue projections also point toward solid growth. Next quarter, Riot’s sales are expected to hit $159.25 million, an increase from the previous $142.56 million.

While the company has beaten its EPS estimates half the time in the past year, it has outperformed its industry overall in revenue performance.

While RIOT stock has underperformed in the short term, its long-term trajectory remains promising. As Bitcoin mining dynamics evolve, Riot is well-positioned to capitalize on strategic investments and infrastructure expansion, potentially making today’s price levels a rare buying opportunity.

For those with a long-term perspective, Riot Platforms presents a case for strong returns in the years ahead, with projections pointing toward significant upside.